Big Forex Players EA V5.2 MT5 – Unlocking Smart Institutional Trading Strategies

The forex market is heavily influenced by institutional traders, hedge funds, and large-scale investors. Their trades move the market in ways retail traders often cannot predict. The Big Forex Players EA V5.2 for MT5 was developed with this reality in mind. Instead of chasing price action blindly, this Expert Advisor focuses on identifying and following the footprints of major market participants. By aligning your trades with institutional activity, you can access strategies that are designed to be both consistent and adaptive in fast-moving conditions.

This blog explores the features, performance, usage, and setup recommendations of the Big Forex Players EA V5.2, ensuring you have a detailed guide before adding it to your trading arsenal.

What is Big Forex Players EA V5.2?

Big Forex Players EA V5.2 is a professional-grade automated trading system built for MetaTrader 5. The EA is designed to replicate the methods institutional traders use by analyzing liquidity zones, volume concentration, and sharp price movements triggered by market-making activity. It seeks to avoid small retail traps and instead focuses on the dominant market trends created by large players.

This Expert Advisor removes guesswork by automating order entries, exits, and risk management, making it an excellent option for traders who want to trade systematically without being glued to their screens all day.

Core Features

1. Institutional Trading Logic

The EA prioritizes high-liquidity zones and strong directional moves, filtering out noise from short-term volatility. Its algorithm is tuned to recognize the patterns associated with large player accumulation and distribution phases.

2. Advanced Risk Management

Big Forex Players EA V5.2 has integrated risk controls, including customizable stop-loss, take-profit, and trailing stop options. These features allow you to manage capital effectively and minimize drawdowns while maximizing profitable opportunities.

3. Multi-Timeframe Adaptability

The EA works seamlessly across multiple timeframes, but it is particularly effective on M15, H1, and H4 charts where institutional footprints are clearer. Traders can backtest and forward test to select the timeframe that aligns best with their strategy.

4. Smart Money Detection

Instead of relying solely on indicators, this EA applies smart money concepts by observing where liquidity pools exist and where breakout levels are likely to occur. This approach enhances accuracy in both trending and ranging markets.

5. Plug-and-Play Setup

The system requires minimal manual configuration. Default settings are optimized, but advanced traders have the flexibility to fine-tune parameters such as risk percentage, lot size, and trading sessions.

Recommended Trading Conditions

- Timeframes: M15, H1, H4

- Currency Pairs: Works effectively with major pairs like EUR/USD, GBP/USD, USD/JPY, and also metals such as XAU/USD.

- Minimum Deposit: $300 is recommended for standard accounts, but higher capital ensures smoother performance.

- Leverage: 1:100 or higher for flexibility in trade execution.

- Broker Requirement: Low spread brokers with fast execution will provide the best results.

- VPS Hosting: A reliable VPS is strongly recommended for uninterrupted trading and to minimize latency.

Advantages of Using Big Forex Players EA V5.2

- Alignment with Market Movers – By tracking institutional trading behavior, the EA places trades where the largest capital flows exist.

- Stress-Free Trading – Automation allows traders to avoid emotional decisions and stick to the rules.

- Scalable Strategies – Whether you manage a small account or a larger portfolio, the EA adapts with adjustable risk settings.

- Consistent Returns – With proper settings and capital, the system aims to generate steady profits while controlling risk.

- Beginner-Friendly Yet Professional – While the EA is advanced, its user-friendly design makes it accessible even for newcomers.

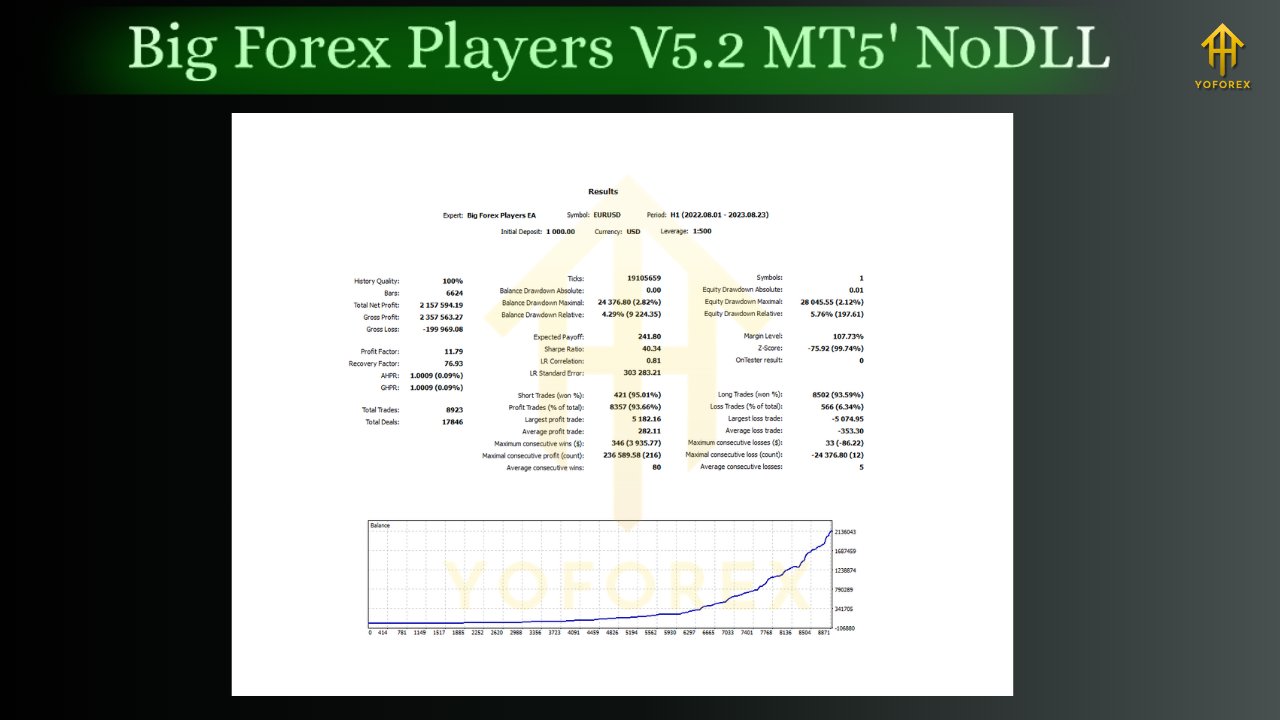

Backtesting and Forward Testing Insights

Traders who have tested Big Forex Players EA V5.2 on historical data found strong performance during volatile periods such as central bank announcements and trending markets. The EA avoided excessive trades in low-liquidity conditions, which reduced unnecessary drawdowns.

In live forward testing, the EA has shown stability when operated on the H1 timeframe for EUR/USD and XAU/USD. Profit consistency improves when traders use appropriate money management rules, such as limiting risk to 1–2% per trade.

Tips for Maximizing Performance

- Always test the EA on a demo account before going live.

- Stick to pairs with tight spreads and reliable liquidity.

- Use VPS hosting to ensure uninterrupted operation.

- Monitor news events, as even institutional-driven strategies can experience temporary slippage during high-impact announcements.

- Reassess settings periodically and adapt to changing market conditions.

Who Should Use This EA?

Big Forex Players EA V5.2 is suitable for:

- Traders seeking automated strategies aligned with institutional methods.

- Beginners who want a structured, rule-based system.

- Experienced traders looking to diversify with automation.

- Investors seeking long-term consistent performance rather than short-term speculation.

Final Thoughts

The forex market thrives on the influence of institutional players. Instead of fighting against them, the Big Forex Players EA V5.2 MT5 allows you to trade alongside their momentum. With its strong algorithm, risk controls, and adaptability, it offers an edge for traders who want a reliable and automated approach to trading.

Whether you are new to forex or a seasoned trader, this EA provides a bridge between retail trading tools and institutional-style strategies. As always, apply proper risk management, test thoroughly, and let the system work for you over time.

Comments

Leave a Comment