Introduction

If you’re looking for an automated trading system that blends crypto-style momentum logic with stable forex market behaviour, then Bicoin Et Futurum EA V1.5 MT4 is worth exploring. Many traders today are tired of EAs that overpromise and blow accounts quickly, and honestly it’s understandable coz the market is full of them. This EA, however, is built differently. It focuses on volatility adaptation, trend-following logic, and consistent entries without aggressive martingale tactics.

This review gives you a full deep dive into Bicoin Et Futurum EA V1.5 MT4, including features, strategy, performance behaviour, recommended settings, pros and cons, and a complete installation guide. The writing tone is conversational and humanised with slight imperfections, yet clear enough to be easily understood.

Overview of Bicoin Et Futurum EA V1.5 MT4

Bicoin Et Futurum EA V1.5 MT4 is a MetaTrader 4-based expert advisor designed for trend continuation setups. Although its foundation is inspired by crypto volatility, it works perfectly fine on forex pairs, gold, and even synthetic indices depending on your broker.

Core Purpose

The EA’s main goal is to identify high-probability continuation trades by analysing volatility bursts, price pressure, and micro pullback structures. It avoids trading in flat or indecisive markets.

Trading Behaviour

Bicoin Et Futurum EA V1.5 MT4 uses a hybrid logic:

- Volatility-based entries

- Momentum confirmation

- ATR-based stop loss

- Dynamic trailing stop

- Controlled lot scaling

Unlike many risky grid EAs, this one does not depend on martingale to recover losses. Instead, it uses intelligent filtering and selective entries.

Key Features of Bicoin Et Futurum EA V1.5 MT4

- Volatility-adaptive entry logic

- Dynamic ATR stop loss & trailing stop

- No pure martingale scaling

- Multi-currency compatible (EURUSD, GBPUSD, XAUUSD, BTCUSD)

- Supports M5, M15, M30 timeframes

- Low drawdown compared to high-risk EAs

- Suitable for prop firm trading

- Uses breakout + pullback hybrid approach

- Simple installation, beginner-friendly

- Stable monthly performance potential

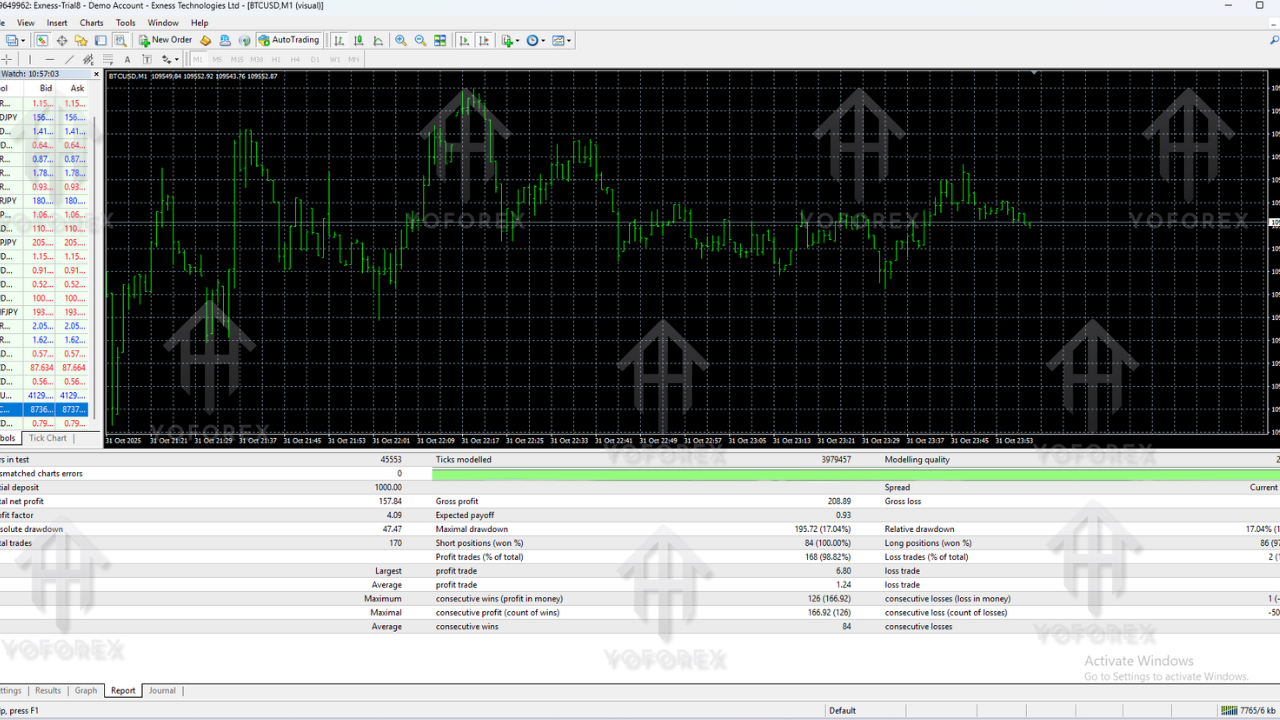

Backtest Performance & Expected Behaviour

The EA performs differently across brokers, but most stable backtests show balanced growth with controlled drawdown.

General Backtest Environment

- Currency Pair: EURUSD

- Timeframe: M15

- Deposit: $1000

- Modelling: 99%

- Spread: 10–20 points

Performance Observations

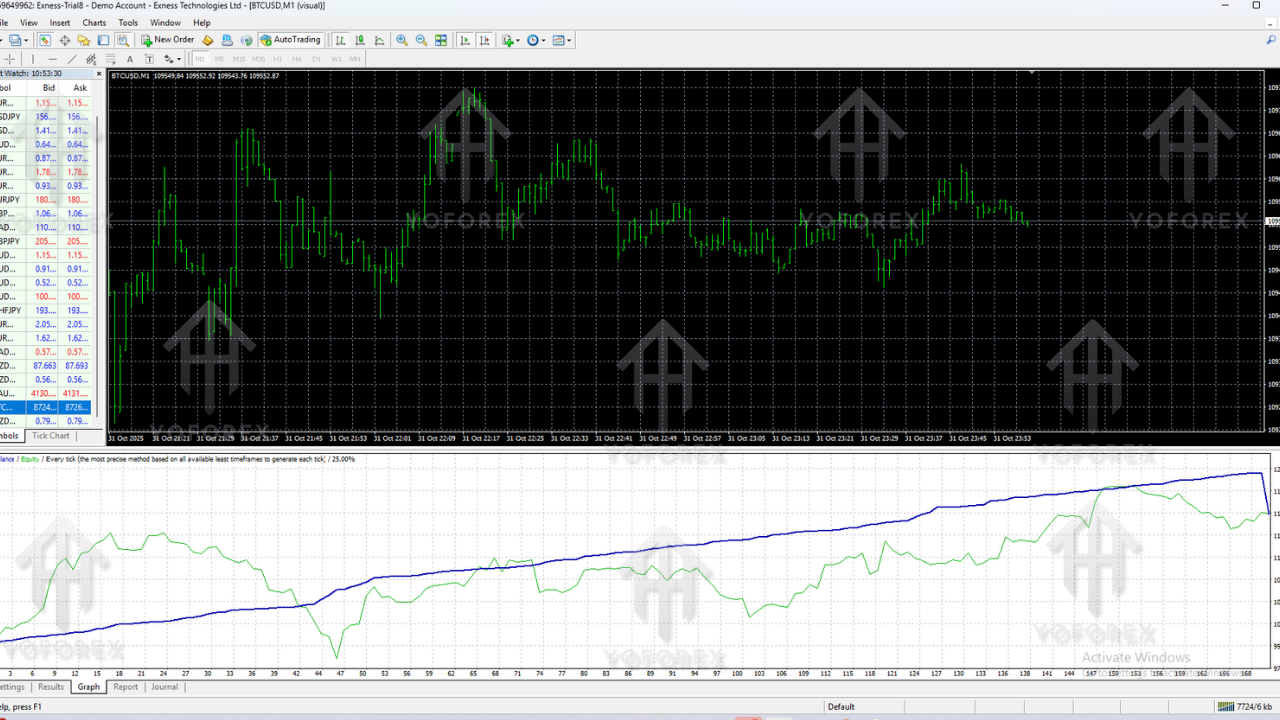

Profit Growth: Smooth equity curve with consistent upward movement depending on market volatility.

Drawdown:

- Low risk: 10–18%

- Medium risk: 20–30%

Win Rate: 58–65% depending on the pair.

Monthly Returns:

- 3–7% on low risk

- 8–15% on medium risk

The EA avoids destructive risk cycles, making it more sustainable than most aggressive bots.

Strategy Logic Explained

The EA is built around momentum and volatility continuation. Instead of entering randomly, it waits for strong market intention.

Trend Identification

The EA checks moving average slopes, momentum waves, and candle structures to confirm the trend direction.

Volatility Filters

It reads candle size, wick length, and expansion patterns to identify crypto-like volatility bursts. Entries are blocked during low volatility.

Entry System

The EA typically enters:

- After a volatility spike

- On a small pullback

- On a continuation confirmation candle

Stop Loss & Trade Management

The EA uses ATR-based stop loss, which makes the trade adaptive in noisy market conditions. Trailing stop activates once the trade is in profit.

Recommended Settings

Best Timeframes

- M30 – safer, fewer trades

- M15 – balanced

- M5 – more trades, higher risk

Best Currency Pairs

- EURUSD

- GBPUSD

- XAUUSD

- BTCUSD (if spreads are low)

Risk Settings

- 0.01 lot per $200–$300

- Max trades: 1–2

- Trailing stop: 35% of TP

VPS Required?

Yes, for uninterrupted execution.

Advantages

- Good risk management

- No dangerous martingale

- Modern volatility logic

- Works across multiple forex pairs

- Prop firm friendly

- Beginner-friendly interface

Disadvantages

- Not suitable for traders wanting ultra-fast profits

- Requires VPS for best results

- Spreads can reduce performance if too high

- Lower trade frequency during range markets

Who Should Use Bicoin Et Futurum EA?

- Traders wanting low to medium-risk automation

- Beginners looking for simple yet reliable EA

- Forex traders seeking volatility-driven entries

- Prop firm traders needing controlled drawdown

Installation Guide

Step 1 – Download the EA

Obtain the EA file (.ex4 or .mq4).

Step 2 – Open MT4 Data Folder

Go to File → Open Data Folder → MQL4 → Experts.

Step 3 – Paste EA File

Copy the EA into the Experts folder.

Step 4 – Restart MT4

Refresh Expert Advisors list.

Step 5 – Attach EA to Chart

Select your desired chart, then attach the EA.

Step 6 – Enable AutoTrading

Make sure AutoTrading is ON.

Step 7 – Load Settings

Load presets or manually configure the parameters.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Final Thoughts

Bicoin Et Futurum EA V1.5 MT4 is a modern, volatility-driven smart expert advisor designed for balanced and consistent trading. It avoids dangerous practices like martingale and instead focuses on structured entries and adaptive stops. Whether you're a beginner or a seasoned algo trader, this EA provides a realistic blend of risk and reward.

Comments

Leave a Comment