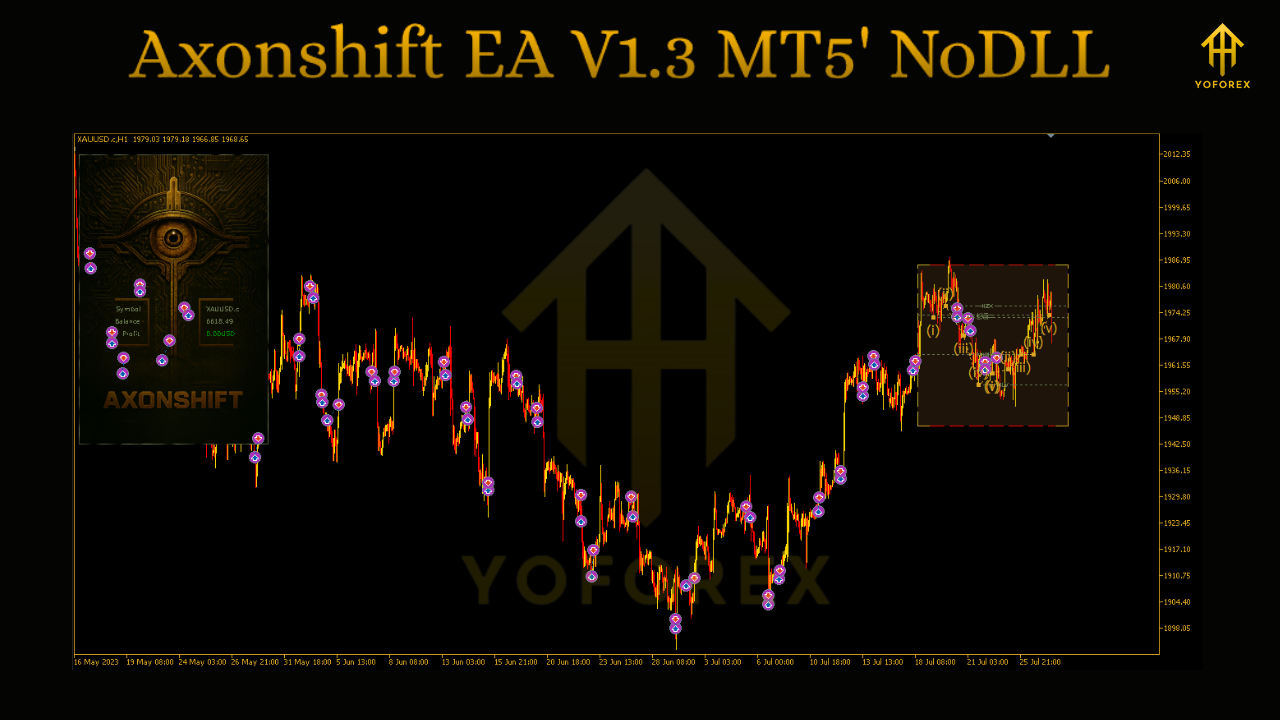

The market for automated trading systems is expanding rapidly, and gold remains one of the most attractive instruments for traders. Among the recent releases in the MT5 marketplace, the Axonshift EA V1.3 has caught the attention of traders who prefer structured, risk-controlled strategies. Designed for XAUUSD on the H1 timeframe, this Expert Advisor aims to deliver consistency without relying on aggressive or high-risk methods. In this detailed review, we explore what makes Axonshift EA unique, how it works, and the considerations traders should keep in mind before using it.

What is Axonshift EA V1.3?

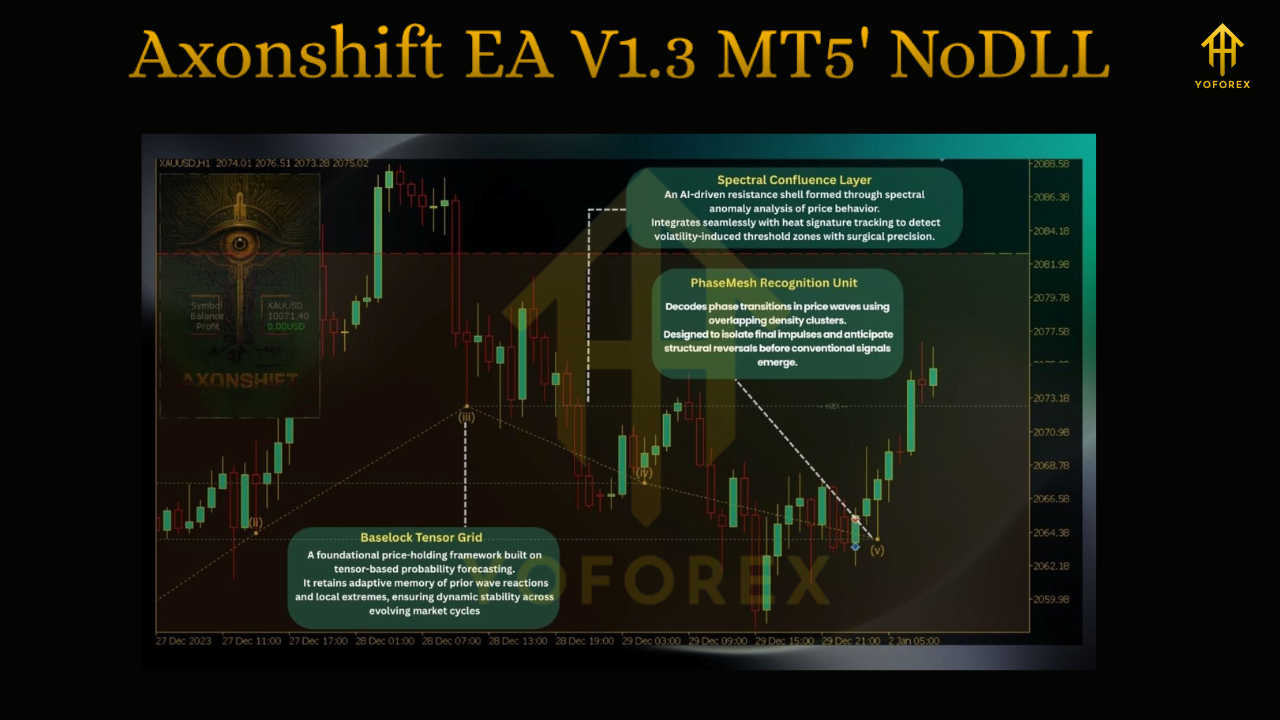

Axonshift EA V1.3 is an algorithmic trading tool tailored exclusively for MetaTrader 5 users. It is optimized to trade gold, focusing on the one-hour chart, where liquidity, volatility, and price structures often present significant opportunities. Unlike many Expert Advisors that use grid trading, hedging, or martingale recovery systems, Axonshift EA sticks to a conservative philosophy. Every position is managed with a predefined Stop Loss and Take Profit, making risk exposure clearer from the start of each trade.

Why Traders Are Talking About It

Gold is a highly liquid market with distinct trading behavior, and many EAs fail to adapt well to its sharp moves. Axonshift EA V1.3 is different because it doesn’t attempt to trade every market tick. Instead, it identifies specific structural conditions and triggers trades when short-term impulses align with intermediate price direction. This deliberate style means fewer trades, but with an emphasis on quality over quantity.

Key Strengths of Axonshift EA V1.3

One of the main strengths of this EA is its specialization. By narrowing its focus to gold on the H1 chart, it avoids the pitfalls of over-generalized systems that claim to work across multiple pairs and timeframes but often underperform. This specialization improves its ability to capture meaningful movements in XAUUSD.

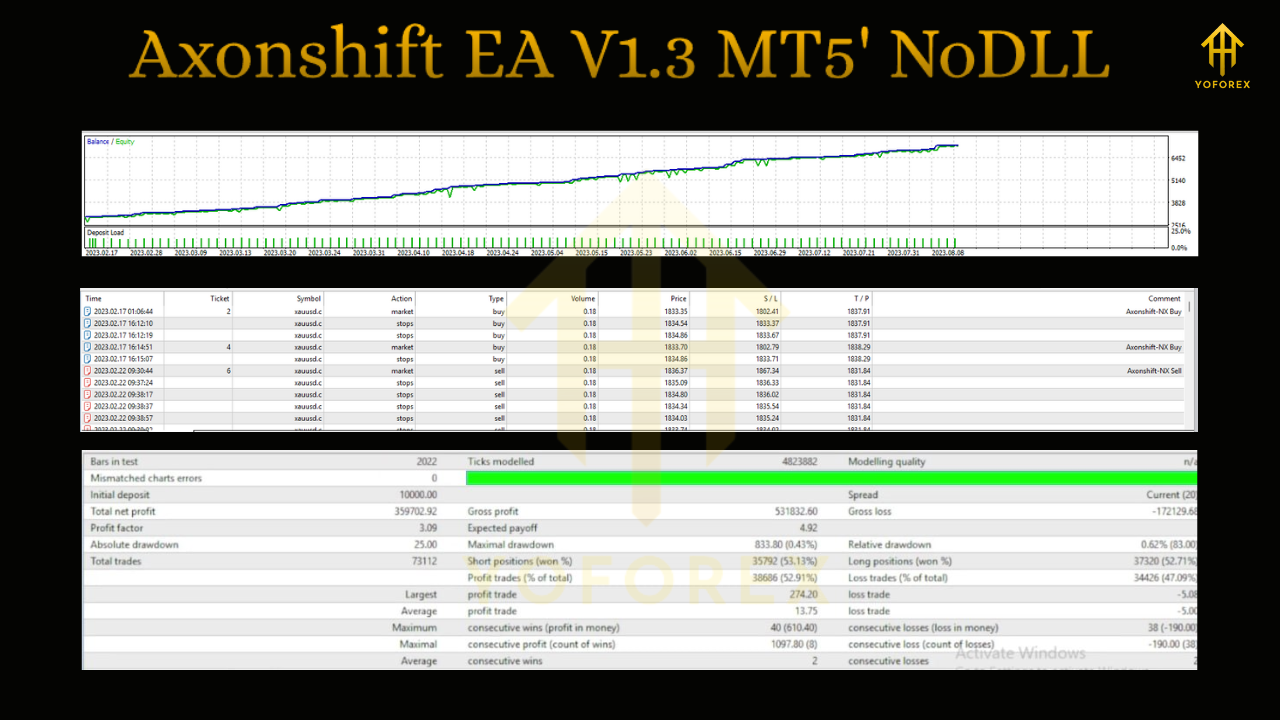

Another advantage is predictable risk management. With fixed SL and TP values, traders can calculate worst-case scenarios before entering positions. This transparency helps both retail traders and prop firm aspirants who must operate within strict drawdown limits.

Axonshift EA V1.3 also benefits from ongoing refinement. Earlier versions laid the foundation, while the latest update introduces improved risk settings and better alignment with current gold market conditions. Active updates from developers often translate into longer product lifespans, which is critical for traders who want stability.

Limitations and Considerations

Despite its positives, no trading system is perfect. Axonshift EA V1.3 comes with limitations that must be considered carefully.

First, it is designed only for XAUUSD on the H1 timeframe. Attempting to run it on other pairs or charts may produce inconsistent results. Traders who want a multi-pair or multi-timeframe solution will find this EA restrictive.

Second, while fixed SL and TP are excellent for transparency, they also mean the EA can face strings of small losses during unpredictable volatility spikes. Gold is known for sudden moves around major economic events, so traders should avoid running it blindly during news releases.

Third, broker conditions matter a great deal. High spreads or poor execution can cut into profitability. To get the best out of Axonshift EA, traders need accounts with tight spreads and reliable order processing.

Lastly, the cost is on the higher end of the spectrum. This raises the barrier to entry, making it more suitable for serious traders with adequate capital rather than beginners with very small accounts.

How to Use Axonshift EA V1.3 Effectively

The safest way to start with this EA is through demo testing. Running it on a practice account allows traders to observe its trade frequency, risk exposure, and profit potential without financial risk. Once confident, moving to a small live account can help gauge performance in real market conditions.

Traders should also stick to the recommended setup: gold on the H1 chart. Deviating from this optimized structure may dilute results.

Another smart move is to use a VPS for hosting. Automated systems require stable connectivity, and a VPS reduces downtime or disruptions caused by local computer issues.

Lastly, even though the EA handles trade entries and exits, traders should monitor performance periodically. Adjusting lot size according to account growth and maintaining realistic expectations are essential for long-term success.

Performance Expectations

Backtests and early results highlight steady performance when market conditions align with the EA’s logic. The system avoids high trade frequency and instead focuses on selective entries. This means returns might grow slower than aggressive EAs, but drawdowns are also more manageable.

It’s important to remember that past results never guarantee future outcomes. Gold markets can shift drastically, and strategies that work well today may need adjustments tomorrow. The advantage with Axonshift EA is its structured approach and ongoing updates, which aim to keep it relevant even as conditions evolve.

Who Should Consider Axonshift EA V1.3?

This EA is most suitable for traders who:

- Primarily focus on gold trading.

- Value controlled risk management over risky recovery methods.

- Prefer fewer, more calculated trades instead of high-frequency strategies.

- Are willing to invest both in the software and in proper testing before full deployment.

On the other hand, it may not suit traders looking for aggressive multi-pair EAs or those unwilling to accept periods of inactivity when conditions are not ideal.

Final Thoughts

Axonshift EA V1.3 MT5 brings a disciplined approach to trading gold, focusing on stability, transparency, and realistic risk control. It avoids the traps of martingale and grid systems, instead opting for a clean strategy that prioritizes capital protection. While it does not promise overnight wealth, its careful design offers traders a reliable framework for steady growth.

For those committed to trading XAUUSD and willing to pair the EA with strong risk management practices, Axonshift EA V1.3 can be a valuable addition to their trading arsenal. As with all EAs, success depends not just on the tool but on how wisely it is used.

Comments

Leave a Comment