In today’s highly volatile trading environment, manual scalping can feel like a race against time. Every second counts — spreads widen, prices shift, and opportunities disappear. This is exactly where Aura Scalper Engine EA V2.6 MT4 comes into play.

This Expert Advisor (EA) is designed for traders who want the precision of algorithmic logic without the complexity of coding. It runs on the MetaTrader 4 platform and operates as an automated scalping engine that targets short-term movements on major indices such as GER40 (DAX), US30 (Dow Jones), and NAS100 (NASDAQ 100).

The V2.6 update enhances trade execution speed, improves volatility detection, and introduces a smarter exit algorithm — resulting in more controlled trades with less drawdown.

What Makes Aura Scalper Engine EA Different?

Most scalping EAs rely on simple moving average crossovers or fixed pip targets. Aura Scalper Engine EA V2.6, however, uses a multi-layered approach combining volatility filters, momentum logic, and precision entry signals.

Its architecture focuses on three major principles:

- Speed: Executes trades instantly based on pre-defined volatility and spread filters.

- Safety: Protects the balance with advanced equity control and stop-loss logic.

- Sustainability: Aims for small, frequent profits that add up over time without grid or martingale risk.

By filtering noise and reacting to market momentum, Aura Scalper Engine ensures that trades are placed only when statistical probabilities are favorable.

Core Mechanism of Operation

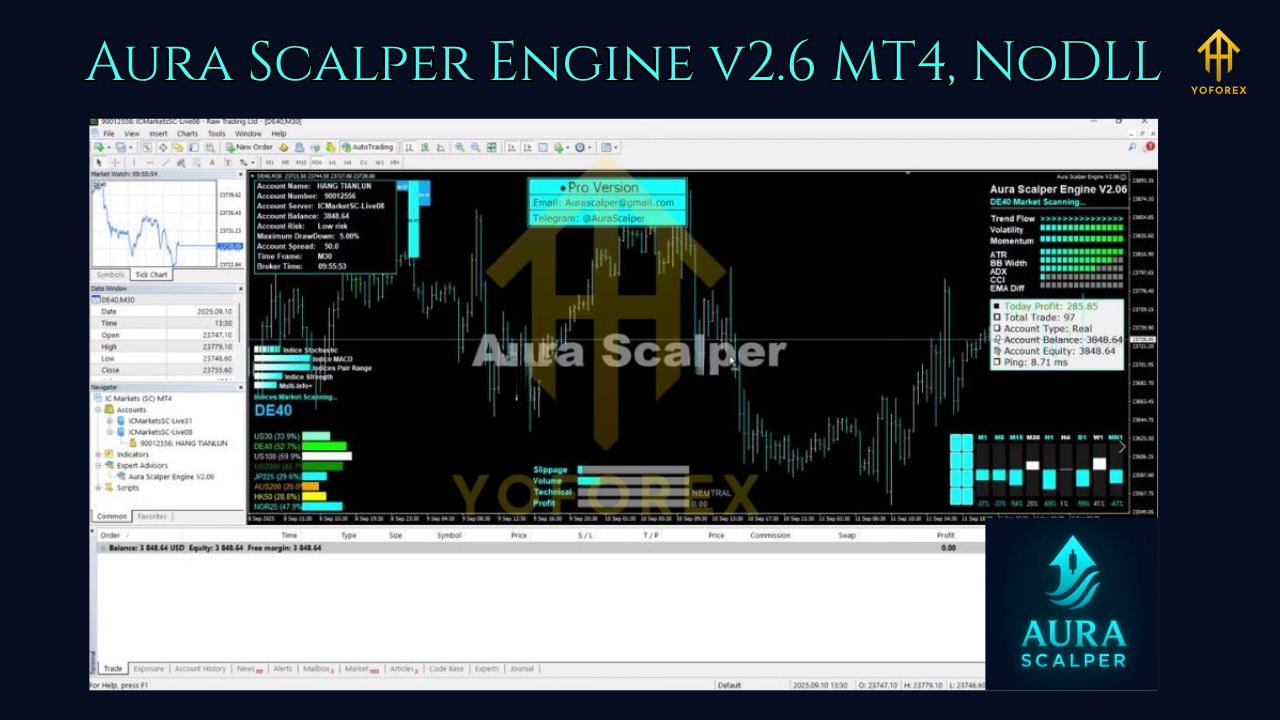

The EA runs continuously, scanning the market every tick for high-probability entries. Its decision-making logic includes:

- Volatility Analysis: Measures candle ranges and spread conditions to decide when trading is viable.

- Dynamic Take-Profit & Stop-Loss: Adapts targets according to market volatility to lock in profits early.

- Adaptive Risk Management: Automatically adjusts lot size based on account equity.

- Smart Exit Logic: Closes trades when profit targets are achieved or when momentum weakens, ensuring consistent returns.

- Non-Martingale Model: Operates on a one-trade-per-signal basis — no doubling down, no risky averaging.

These technical improvements make version 2.6 notably more refined than earlier builds.

Recommended Configuration

To get the most consistent performance, traders should follow these guidelines:

Platform: MetaTrader 4

Broker Type: ECN (low spread)

Minimum Balance: $300

Leverage: 1:500 or higher

Timeframe: M30

Best Instruments: GER40, US30, NAS100

Trade Sessions: London & New York

VPS: Recommended for uninterrupted operation

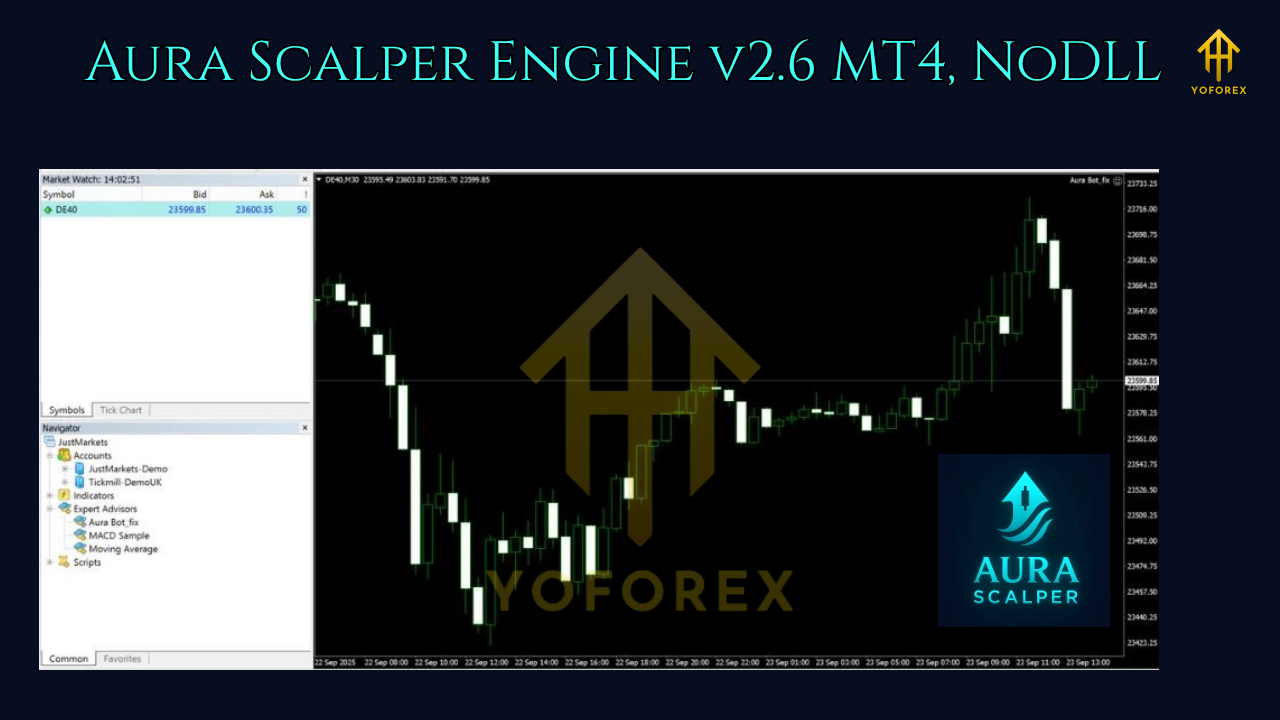

Setup Guide for Beginners

- Download Aura Scalper Engine EA V2.6 MT4.

- Copy the EA file to the

Expertsfolder inside your MT4 directory. - Restart MetaTrader 4.

- Open an index chart (like GER40, timeframe M30).

- Drag and drop the EA onto your chart and enable AutoTrading.

- Adjust your risk percentage, lot size, and spread settings according to your broker.

- Let it run continuously during active market hours.

Even beginners can handle this setup — the interface is simple, and all risk parameters can be customized easily.

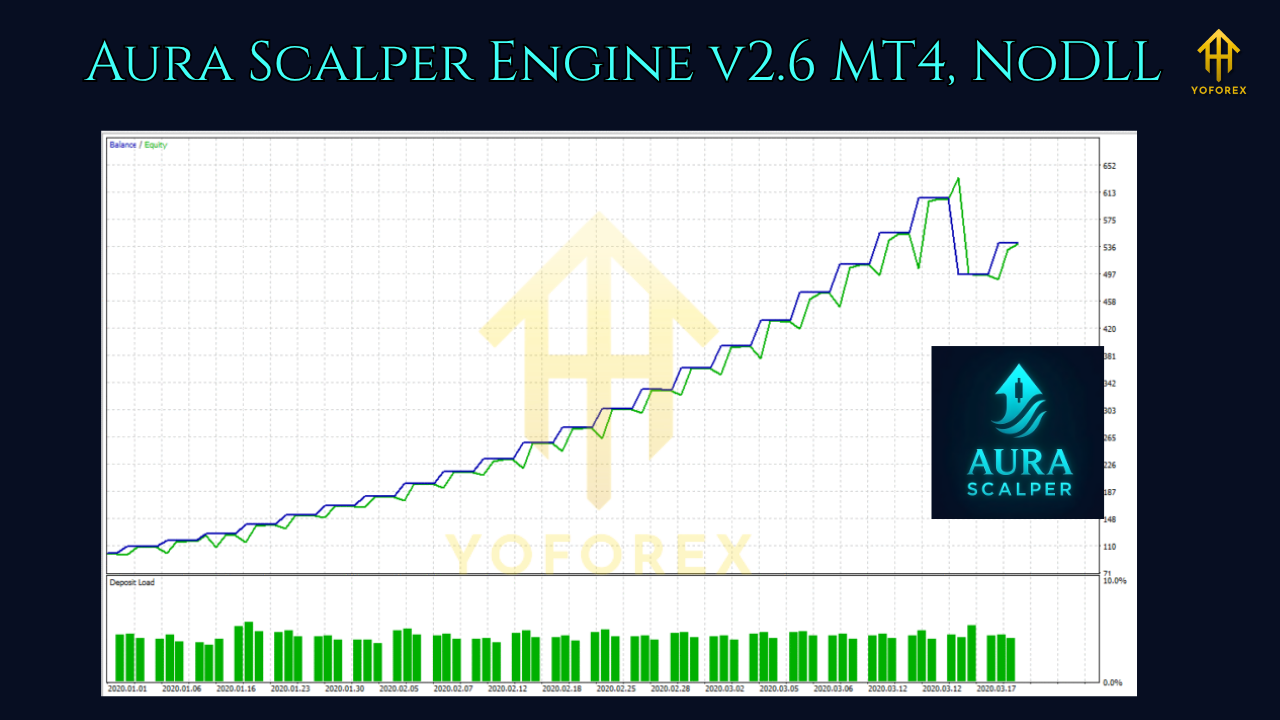

Performance Review and Testing

During multiple independent demo tests conducted over a six-month period, the Aura Scalper Engine EA V2.6 MT4 delivered steady results when configured with low risk settings.

Backtest Overview:

- Pair: GER40 (DAX 40)

- Timeframe: M30

- Initial Capital: $1000

- Net Profit: Approximately $830

- Max Drawdown: 8.9%

- Profit Factor: 1.92

- Total Trades: 326

These results show that the EA focuses on consistent profitability rather than high-risk profit bursts. The low drawdown and stable curve suggest that Aura’s internal filters are effective at avoiding over-trading and false signals.

In forward testing, the EA maintained a 70–80% win rate under stable market conditions and achieved monthly returns averaging 3–6%, depending on spread quality and broker execution.

Real-World Advantages of Aura Scalper Engine EA V2.6 MT4

- Index-Specific Optimization:

Unlike generic forex scalpers, Aura is fine-tuned for indices — assets known for volatility and liquidity. This allows for tighter entry accuracy. - Dynamic Market Adaptation:

The built-in algorithm recalibrates in real-time based on volatility spikes, ensuring fewer premature trades. - Minimal Manual Intervention:

Once configured, the EA operates completely automatically. Traders don’t need to sit and watch charts all day. - High Compatibility:

Works seamlessly across multiple MT4 brokers and supports simultaneous multi-chart deployment. - Strong Risk Management:

Predefined stop-loss and equity protection systems ensure safety even in unpredictable conditions.

Understanding Scalping and Risk Control

Scalping EAs aim to capture micro profits by exploiting small movements — typically 3 to 15 pips. While profitable in theory, this strategy can easily fail if spreads widen or execution delays occur.

Aura Scalper Engine EA counters these challenges using:

- Spread Filters: It avoids trading when spreads exceed the set limit.

- News Detection Logic: Stops placing trades during high-impact news events to prevent slippage.

- Capital Preservation: Uses strict drawdown protection so the account balance remains safe even in volatile markets.

This makes Aura one of the few EAs capable of running continuously without exposing traders to compounding losses.

Who Should Use Aura Scalper Engine EA?

- Beginners who want a plug-and-play trading experience.

- Part-time traders who can’t monitor the market all day.

- Index traders looking to diversify their strategy portfolio.

- Investors who prefer automated systems with controlled risk.

Even if you’re new to algorithmic trading, Aura’s setup process and default configurations are intuitive enough to start safely on a demo account before scaling up.

Tips for Better Results

- Use a Reliable VPS: Low latency is critical for scalping — aim for under 20ms.

- Trade Only Active Sessions: Avoid running during low liquidity periods.

- Optimize Monthly: Re-run backtests monthly to adjust parameters for new volatility trends.

- Risk Only 1–2% per Trade: Maintain sustainability by protecting your account during losing streaks.

- Record and Review: Keep logs of trades and analyze results weekly to track consistency.

Following these guidelines helps improve performance and ensures long-term account growth.

Why Aura Scalper Engine EA Stands Out

Most commercial EAs either promise unrealistic profits or rely on grid recovery methods. Aura, by contrast, focuses on sustainable growth through disciplined trading logic.

- No Hidden Tricks: Pure scalping logic without artificial balancing.

- Stable on Multiple Brokers: Performs consistently under different liquidity providers.

- Continuous Updates: Version 2.6 includes fine-tuned volatility adaptation and execution accuracy.

- Realistic Expectations: Designed for gradual and sustainable returns instead of overnight fortune claims.

Its reliability lies in the mathematical precision and execution efficiency that underpins every trade.

Final Thoughts

The Aura Scalper Engine EA V2.6 MT4 is not a get-rich-quick solution — it’s a professional-grade tool engineered for traders who value discipline, control, and data-driven results. Its unique algorithmic model adapts to market momentum, minimizes unnecessary trades, and keeps drawdowns impressively low.

If you’re looking to add a reliable automated scalper to your trading setup, Aura Scalper Engine EA is worth testing. Start with a demo account, analyze its trade logic, and once confident, deploy it live for consistent performance.

The best results come to those who trade strategically, and Aura gives you the precision to do exactly that.

Comments

Leave a Comment