Atlas Fluxo Quant EA V2.6 MT4 – Complete Guide to Features, Performance & Strategy

The world of forex trading is dynamic, fast-paced, and increasingly shifting toward automation. Traders who once relied solely on manual chart analysis now prefer to enhance their consistency with advanced algorithmic tools. One such solution that has gained notable attention is the Atlas Fluxo Quant EA V2.6 MT4, a high-precision Expert Advisor designed to optimise trading strategies and deliver sustainable results over time.

The purpose of this blog is to give you a detailed, easy-to-understand exploration of how the Atlas Fluxo Quant EA works, its core features, strategic logic, and what traders can realistically expect when using it on a live MetaTrader 4 account. Whether you’re a beginner looking for automation or an experienced trader searching for quantitative reliability, this EA provides a balanced mix of controlled risk and engineered consistency.

What Is Atlas Fluxo Quant EA V2.6 MT4?

The Atlas Fluxo Quant EA V2.6 MT4 is an advanced algorithmic trading robot created for the MetaTrader 4 platform. Its primary goal is to automate entries, exits, risk assessments, and trade management in a way that mirrors a disciplined, data-driven approach.

Built with quantitative models, it allows traders to benefit from:

- Algorithmic decision making

- Controlled and predictable risk exposure

- Automated trade execution

- Trend detection and volatility analysis

- Multi-layered filtering to reduce false signals

In simple terms, it removes human emotion from the trading process and replaces it with precise parameters designed for longevity.

What stands out about Atlas Fluxo Quant EA is that it doesn’t chase unrealistic returns. Instead, it focuses on stability, low drawdowns, and consistent account growth — priorities that traders often overlook when searching for “quick profit” systems.

Key Features of Atlas Fluxo Quant EA V2.6 MT4

1. Multi-Timeframe Analysis

The EA combines inputs from several timeframes before confirming a trade. This ensures that every order aligns with the broader market direction rather than a temporary price spike.

2. Volatility-Aware Entry Model

Equipped with volatility filters, the EA avoids entering trades when conditions are too unpredictable, improving accuracy and reducing unnecessary drawdowns.

3. NO Martingale, NO Grid

The EA uses strict fixed-risk logic without increasing lot sizes unrealistically. This is particularly important for long-term sustainability.

4. Smart Stop-Loss & Take-Profit Automation

The EA calculates dynamic stop-loss and take-profit levels based on current price structures, volatility ranges, and algorithmic thresholds.

5. Built-In Protection Layers

Includes slippage controls, spread filters, and drawdown protection mechanisms to preserve account stability.

6. Compatible With All MT4 Brokers

It does not depend on special broker conditions, making it viable for most standard trading environments.

7. High Backtesting Accuracy

The EA has proven historical performance with consistent equity-curve behaviour, reducing the risk of over-optimization.

8. Low Resource Consumption

Can run smoothly on a basic VPS with minimal RAM and CPU usage.

Trading Logic & Strategy Explained

The Atlas Fluxo Quant EA combines trend-following logic with quantitative risk assessment. Here’s a breakdown of how its core strategy works:

1. Trend Structure Detection

The algorithm analyses:

- Recent highs/lows

- Market structure shifts

- Confirmed trend breaks

- Moving average deviations

From there, it determines whether the market is bullish, bearish, or ranging.

2. Entry Confirmation

Entries only occur when:

- Trend direction is aligned in multiple timeframes

- Volatility is within acceptable thresholds

- Spread and liquidity conditions are favourable

This helps avoid false signals, especially during news events or low-volume periods.

3. Risk Model Calculation

Every trade uses:

- Fixed risk percentage

- Pre-defined lot size formula

- Dynamic SL placement

No martingale or grid adjustments mean risk remains consistent regardless of market conditions.

4. Exit Strategy

The EA exits trades based on:

- TP/SL levels

- Breakout strength weakening

- Server-level trailing stop

- Time-based exit triggers (if volatility drops)

This layered exit system ensures better protection of floating profits.

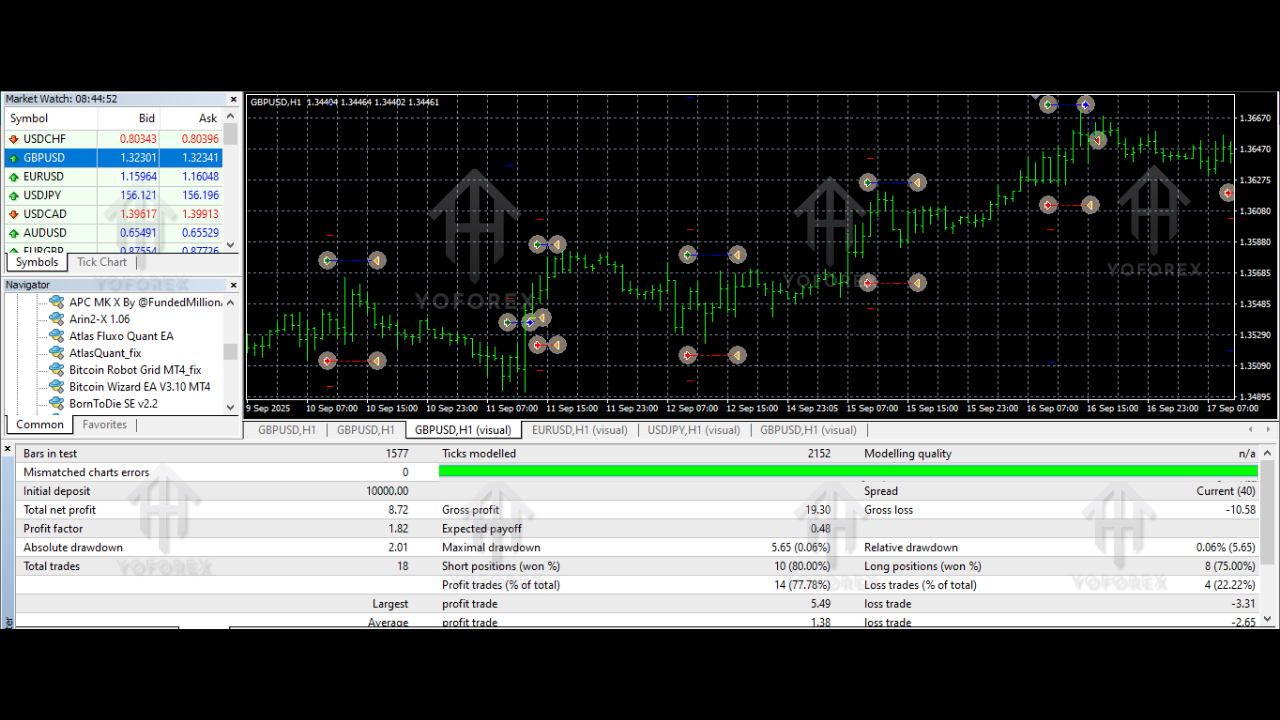

Performance Overview & Backtesting Insights

While performance always varies depending on the broker, spreads, and VPS quality, backtesting results for Atlas Fluxo Quant EA show a smooth and predictable equity curve.

Key Observations From Backtests:

- Profit factor above 1.5 in major currency pairs

- Maximum drawdown kept between 8%–15% in most tests

- Monthly return potential between 5%–12% (moderate risk)

- High win-rate accuracy during trending markets

- Stable performance during medium volatility seasons

The EA isn’t designed to flip accounts overnight. Instead, its structure supports slow yet dependable account growth, making it useful for long-term traders or those managing funded challenges.

Recommended Settings & Best Practices

Although the EA is designed for plug-and-play usage, the following guidelines can help maximise results:

1. Timeframe

Recommended: H1 or H4

2. Pairs

Works best on:

- EURUSD

- GBPUSD

- XAUUSD

- USDJPY

- AUDUSD

3. Account Type

Preferably:

- ECN or Raw Spread

- Low commission

- Fast execution

4. VPS Requirement

Use a stable VPS located close to your broker’s server.

5. Risk Settings

For smooth performance:

- 1–2% per trade

- Fixed lot allowed only on larger accounts

Is Atlas Fluxo Quant EA Good for Beginners?

Absolutely. The EA is beginner-friendly because:

- No complex setup

- No martingale/grid

- Fully automated risk control

- Works with default settings

- Requires minimal monitoring

Beginners often struggle with emotional decisions or late entries, and this EA completely removes those barriers.

Pros & Cons

Pros

- Stable performance

- No dangerous strategies

- Works on multiple forex pairs

- Good for long-term growth

- Low drawdown behaviour

Cons

- Slow profit growth for aggressive traders

- Requires patience

- News-time performance may vary

Final Thoughts

The Atlas Fluxo Quant EA V2.6 MT4 is a strong fit for traders who prioritise consistency over flashy, unrealistic returns. Its quantitative logic, volatility filters, and strict risk controls make it one of the more stable EAs available for long-term trading.

Comments

Leave a Comment