AsistenteExperto EA V1.0 MT5 — Versatile, Risk-First Automation for Any Market

Supported timeframes: M1, M5, M15, M30, H1, H4, D1

Instruments: Any symbol (forex, metals, indices, crypto CFDs—broker permitting)

Risk management: ATR-based (or similar) stop-loss, 3-stage trailing, MaxLossPercent (automatic equity stop)

Operation modes: Buy Only / Sell Only / Both

If you’ve ever wished for a single EA you can deploy across multiple markets without juggling different robots for every symbol, AsistenteExperto EA V1.0 (MT5) is your “one brain, many charts” solution. It’s deliberately flexible—timeframe-agnostic in design, symbol-agnostic in scope—yet strict where it matters: risk. Using volatility-aware stops, up to three trailing stages, and a portfolio-level MaxLossPercent circuit breaker, it aims to keep you in control whether you’re trend-riding EURUSD on H1, range-fading XAUUSD on M15, or swing-trading indices on D1.

What Makes AsistenteExperto EA Different

1) Truly Multi-Market, Multi-TF

Most bots are picky: they “need” a specific pair or timeframe. AsistenteExperto instead leans on first principles—trend/momentum confirmation with volatility-scaled risk, so the same framework remains coherent from M1 scalps to D1 swings. You decide the canvas; the EA adapts.

2) Volatility-Scaled Stop-Loss (ATR or Equivalent)

A stop that breathes with the market. ATR-anchored (or comparable) distances aim to avoid random noise yet cut fast when the thesis breaks. No arbitrary 20-point stops slapped on every symbol—Gold ≠ EURUSD ≠ NASDAQ.

3) Three-Stage Trailing

Locking in profits is a process, not a toggle. AsistenteExperto supports up to three trail stages—e.g.,

- Stage 1: shift to break-even once price advances ~0.8–1.0R

- Stage 2: tighten to a faster ATR multiple if momentum persists

- Stage 3: trend-ride with a slower ATR or structural swing trail to capture extended moves

You can keep it simple (one trail) or let winners breathe (two or three).

4) MaxLossPercent — Your Equity Seatbelt

No more “just one more trade” spirals. Set a MaxLossPercent (e.g., –5% for the day or week), and the EA auto-stops trading when that drawdown is reached. Portfolio-level discipline beats post-loss tinkering.

5) Mode Control: Buy Only / Sell Only / Both

Trade with the wind (e.g., Buy Only in strong uptrends), fight the tide (Sell Only during bear phases), or allow Both when your edge is symmetric. This simple switch is surprisingly powerful for aligning with macro bias or your system tests.

Practical Ways to Use It (Examples)

- EURUSD M15 — Momentum Pullbacks: Use Both mode, ATR stops ~1.5–2.0×, 2-stage trail.

- XAUUSD H1 — Trend Continuation: Consider Buy Only or Sell Only depending on bias; slightly wider ATR multiple, 3-stage trail to capture runners.

- US100 (Nasdaq) D1 — Swing: Small % risk per trade (0.25–0.5%), Both mode, slower trail to avoid over-tightening.

- Range Days (GBPUSD M5): Tight ATR stops, conservative trail; consider Both but add a session/time filter if your broker spikes spreads in off-hours.

Tip: Keep per-trade risk consistent across charts (e.g., 0.5% each), then let MaxLossPercent act as your circuit breaker.

Installation & First-Run (MT5)

- Copy the EA → MT5 → File → Open Data Folder →

MQL5/Experts→ paste file → restart MT5. - Open a Chart for your symbol (any TF: M1–D1).

- Attach the EA → Navigator → Experts → drag AsistenteExperto EA V1.0 to the chart.

- Enable Algo Trading (toolbar green) and tick Allow Algo Trading in the EA settings.

- Core Inputs to Review:

- Risk % / Lot mode (start conservative: 0.25–1.0% per trade)

- ATR length & multiplier (baseline distance of the SL)

- Trailing stages (on/off, increments, ATR/source)

- MaxLossPercent (e.g., –5% daily stop; define timeframe of enforcement if available)

- Mode: Buy Only, Sell Only, or Both

- Spread/Slippage filters (adapt to your broker)

- Confirm Logs (Experts/Journal) show clean initialization and no routing issues.

Recommended Starter Profiles

Intraday (M5–M15) Forex Majors

- Risk: 0.5% per trade

- ATR SL: 1.5–2.0× ATR

- Trail: 2 stages; BE at +1.0R, then 1.0× ATR fast trail

- Mode: Both unless your bias says otherwise

Gold / Indices (H1)

- Risk: 0.5% (or 0.25% on volatile days)

- ATR SL: 2.0–2.5× ATR (give it air)

- Trail: 3 stages; BE at +1.0R, step-tighten, then slow ATR to ride trends

- Mode: Align with macro bias (Buy Only or Sell Only) during clear cycles

Swing (H4–D1)

- Risk: 0.25–0.5%

- ATR SL: 2.0–3.0× ATR

- Trail: 2–3 stages; slower measures to avoid whip

- Mode: Both; optionally disable during major event risk

Don’t rush to optimize. Forward-test defaults first for 2–4 weeks per symbol, then adjust one variable at a time.

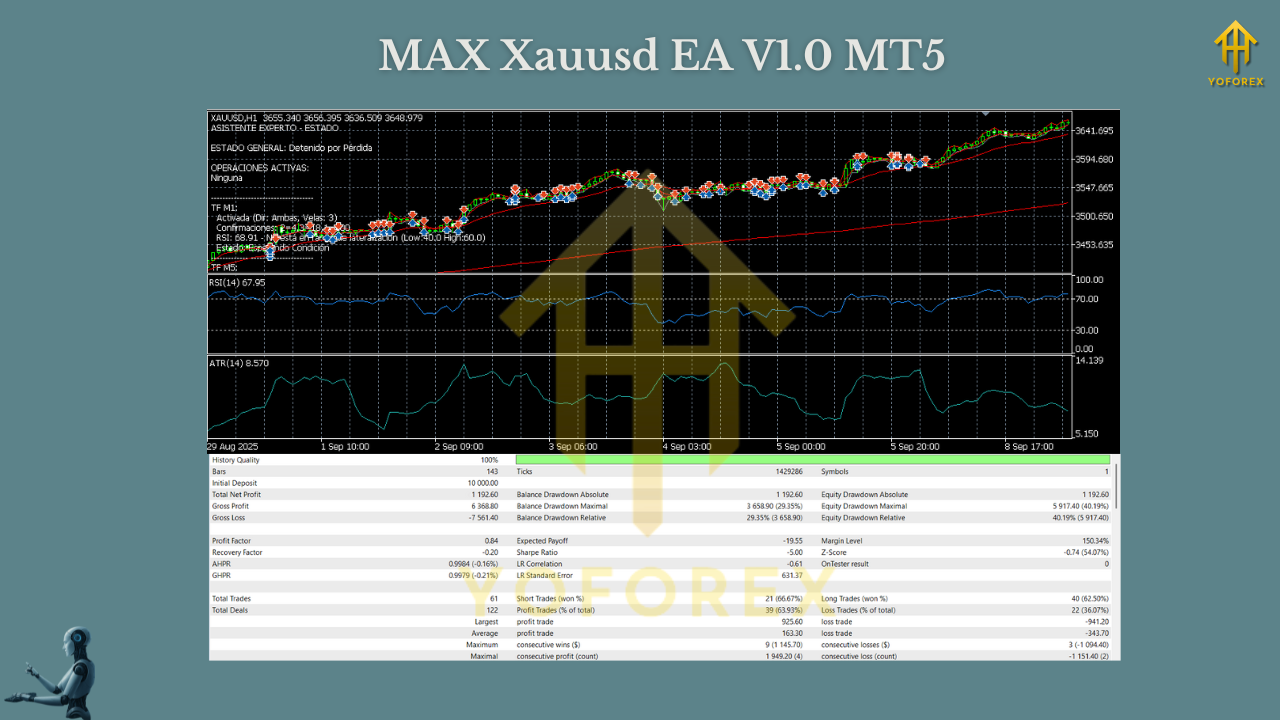

Backtesting & Validation Tips

- Use quality tick data for spread/slippage realism—particularly on Gold & indices.

- Cover multiple regimes (calm, volatile, tightening/loosening cycles).

- Walk-Forward any optimizations; confirm out-of-sample robustness.

- Track: max drawdown, win rate vs. R-multiple, profit factor, average trade length, session performance.

Portfolio & Correlation Playbook

Running multiple charts is the point—but manage the basket:

- Cap total concurrent risk (e.g., no more than 2–3% across all open positions).

- Stagger entry windows (or symbols) to avoid synchronized losses on shock events.

- Let MaxLossPercent stop trading for the day/week to protect your mental capital too.

Join our Telegram for the latest updates and support

Comments

Leave a Comment