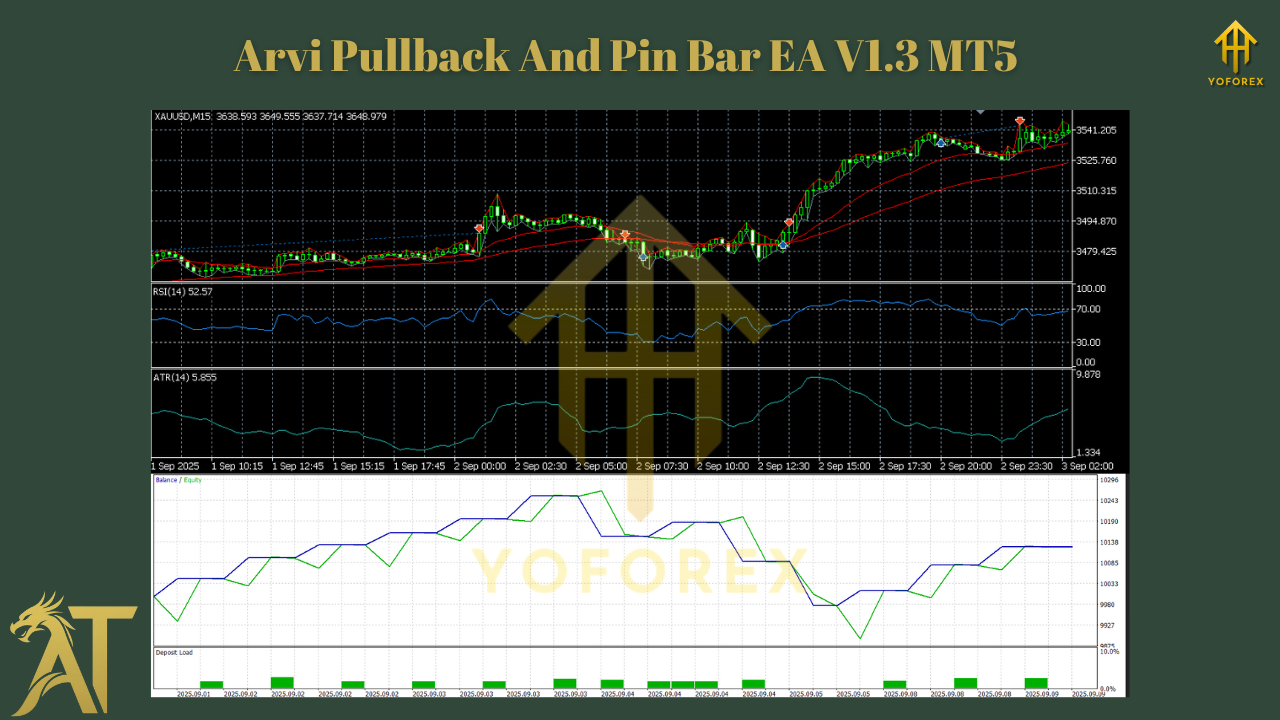

Arvi Pullback And Pin Bar EA V1.3 MT5 — Dual-Engine Precision on M15

Platform: MT5

Timeframe: M15 (primary chart)

Markets: Precious metals / CFDs (best behavior observed on XAUUSD)

Minimum Deposit: Small-account friendly (start on demo to validate)

Broker Note: Works on standard MT5 brokers; developer tested on Exness (3-digit quotes on XAUUSD). Always confirm digits, tick size, contract size, margin with your broker.

Arvi Pullback And Pin Bar EA V1.3 is a disciplined, intraday Expert Advisor that fuses two complementary engines—Pullback and Pin Bar—to harvest mean-reversion and rejection setups on metals (especially gold). It runs internally on multiple timeframes for context, so one EA instance per symbol is enough. Risk is front-and-center: volatility-aware SL/TP, daily P&L pause, and hard limits on spread, slippage, and trades per day.

Why Arvi?

- Two brains, one bot. Flip Pullback and Pin Bar engines on/off independently to match market regime.

- MTF awareness under the hood. The EA references higher-timeframe context internally while you operate from a clean M15 chart.

- Gold-first design. Tuned on metals/CFDs (best results during development on XAUUSD), but extensible to similar instruments.

- Risk done right. Volatility-scaled stops/targets, P&L circuit-breakers, and execution filters to avoid trading in junk conditions.

- Backtest-friendly. No external DLLs; quick to iterate in the MT5 Strategy Tester.

Key Features (Concise)

- Dual Engines:

- Pullback Engine – Buys dips / sells rallies into structure when trend and volatility agree.

- Pin Bar Engine – Seeks rejection candles at key levels for precision entries.

(Enable/disable each engine independently.) - Isolated Execution IDs: Each engine manages only its own orders—no cross-talk.

- Volatility-Aware SL/TP: ATR-scaled options, plus fixed-value alternatives for tighter control.

- Lot Modes:

- Fixed lot

- % of equity

- Engine-driven dynamic sizing

- Trade Hygiene: Daily P&L pause, max trades/day, spread & slippage checks, session/time-of-day filters.

- News Stub: Lightweight news filter (extendable in your environment).

- Backtesting: No DLLs; straightforward model for historical evaluation.

Recommended First-Run Profile (XAUUSD)

- Chart: XAUUSD M15

- Engines: Start with Pullback = ON, Pin Bar = ON (balanced).

- Risk: 0.25–0.5% per trade while you learn the rhythm.

- Stops/Targets: ATR × 1.5–2.0 SL; TP at 1.2–1.8R (or ATR-scaled TP).

- Max Trades/Day: 3 (across both engines) to curb overtrading.

- Spread Cap: Based on your broker’s typical XAUUSD spread in liquid hours; reject entries if above cap.

- Slippage Limit: Conservative during news; slightly looser in normal flows.

- Daily P&L Guard: Pause trading at –2R daily loss; optional daily profit lock at +2–3R.

- Session Filter: Focus on London → NY overlap; optional Asia session off.

- VPS: Recommended (low-latency, 24/5 uptime).

Broker specifics: If using Exness (3-digit XAUUSD), confirm contract size and volume step. For other brokers, align digits/lot step and ensure margin calcs are consistent with your account type.

Installation (MT5)

- Copy EA to

MQL5/Experts→ Restart MT5. - Open XAUUSD M15 chart (or your chosen metal/CFD).

- Attach EA → tick Allow Algo Trading.

- Configure:

- Engines ON/OFF per your plan

- Lot mode (fixed / % equity / dynamic)

- ATR settings (length, multiplier) or fixed SL/TP

- Spread/slippage caps, max trades/day, daily P&L pause

- Time-of-day and session filters

- Watch Experts/Journal for clean initialization and rule rejections (super helpful during tuning).

Parameter Tips

- ATR Length: 14 is a solid baseline; shorten if you want more reactive stops.

- Pullback Depth: Start moderate; too shallow = noise, too deep = missed moves.

- Pin Bar Qualifier: Require decent tail/body ratio and close back within range; skip micro pin bars.

- Dynamic Sizing: Cap max lot to avoid oversizing during volatility spikes.

- Engine Mix:

- Choppy conditions → keep Pin Bar ON, consider Pullback OFF.

- Clean trends → keep Pullback ON, throttle Pin Bar to higher quality filters.

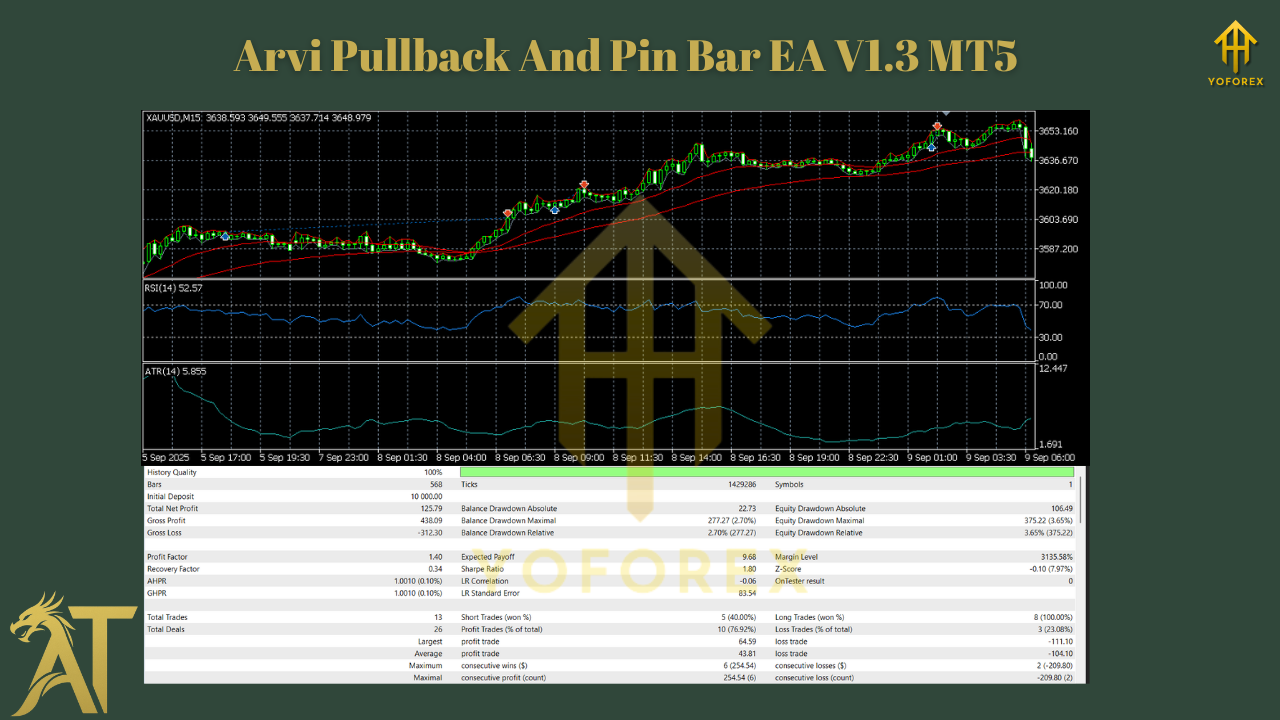

Backtesting & Forward Validation

- Tester Mode: Use Every tick based on real ticks if available.

- Data Coverage: Include both quiet weeks and high-volatility months (CPI/FOMC/NFP seasons).

- Walk-Forward: After any optimization, validate out-of-sample.

- Metrics to Track:

- Max drawdown (daily & overall)

- Profit factor & average R/trade

- Win rate vs. R multiple

- Engine-level stats (which engine adds edge in which regime?)

- Session performance (London, NY, overlap)

Operating Playbook

- Demo first (1–2 weeks) on your broker with your intended lot mode.

- Go small live with identical settings; don’t change mid-week.

- Weekly review:

- Engine breakdown (Pullback vs. Pin Bar)

- Spread/slippage violations

- P&L pause triggers (too tight or just right?)

- Iterate slowly: Adjust one variable at a time, evaluate over 30–50 trades.

FAQs

Does it hedge?

Yes—attach on a hedging MT5 account if you plan to run multiple symbols/instances.

Can I use it on pairs other than Gold?

Yes, the advisor is universal, but test and optimize for each new instrument.

Is martingale or grid used?

No. Single-signal entries with strict SL/TP and engine-specific sizing.

How many charts do I need?

One chart per symbol is sufficient—the EA handles internal MTF logic itself.

News filter included?

A lightweight news-filter stub is present; extend/configure as desired.

Pros & Cons

Pros

- Two independent engines; toggle per regime

- Volatility-aware risk with strong hygiene (P&L pause, caps, filters)

- Internal MTF context from a clean M15 chart

- Backtest-friendly (no DLLs) and small-account approachable

Cons

- Metals tuned; other assets require testing

- Pin bar quality heavily depends on broker feed and candle aggregation

- Requires VPS for best performance

Final Word

Arvi Pullback And Pin Bar EA V1.3 (MT5) gives you a dual-engine, risk-first framework to trade metals—especially XAUUSD—on the M15 timeframe. It stays nimble in chop with pin-bar precision, and it rides structural dips/rallies with the pullback engine—both under strict volatility-aware risk rules. Keep it simple: start conservative, let the data speak, and adjust one knob at a time.

Risk Disclaimer: Trading involves risk. Past performance is not indicative of future results. Always validate on demo before going live.

Join our Telegram for the latest updates and support

Comments

Leave a Comment