The landscape of forex and commodity trading has shifted dramatically in recent years. With the growing dominance of automated systems, traders are now relying less on manual chart-watching and more on sophisticated Expert Advisors (EAs). Among the new generation of trading robots, Argos Fury EA V1.0 MT5 has emerged as a serious contender for gold traders who want precision, adaptability, and consistent performance.

Designed for MetaTrader 5, this EA takes a specialized approach to XAUUSD (Gold) trading by blending artificial intelligence with structured risk management. Instead of following rigid technical signals, it evaluates the market dynamically, analyzing liquidity zones, candle structures, and price momentum. This makes it one of the more advanced trading tools currently available for MT5 users.

What Sets Argos Fury EA Apart?

Many EAs focus on simple moving average crossovers or generic breakout strategies. Argos Fury takes a different path. It incorporates multiple analytical layers that allow it to trade under various conditions:

- Market Strength Analysis: The EA measures whether momentum supports continuation or reversal.

- Reversal Zone Mapping: Identifies areas of price exhaustion where liquidity is likely to shift.

- Adaptive Candle Reading: Recognizes price behavior in real time instead of relying solely on historical averages.

- Volatility Filters: Keeps trades out of erratic conditions where spreads and slippage may be costly.

This multi-faceted approach gives Argos Fury EA the flexibility to perform in both trending and ranging markets.

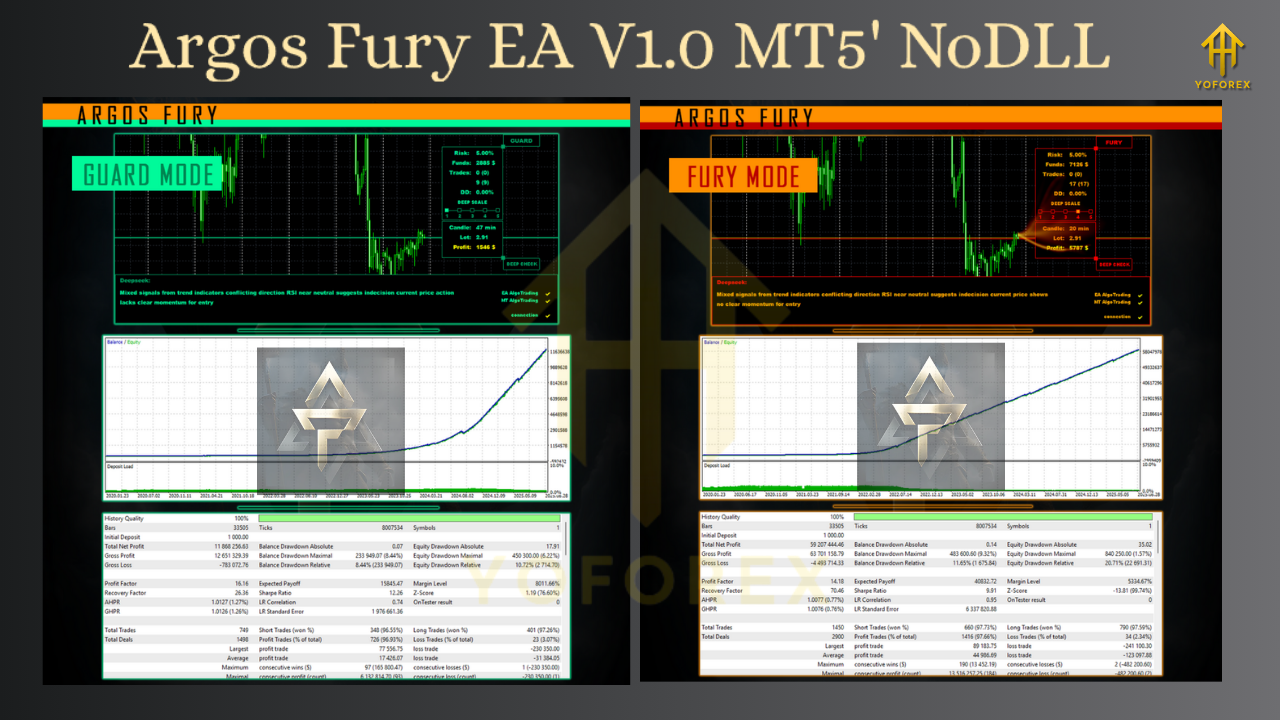

Trading Modes for Different Styles

One of the most appealing features of Argos Fury EA is its customizable trading modes. Instead of a one-size-fits-all strategy, it lets traders decide how aggressively they want to participate:

- Fury Mode: Built for traders who want fast and aggressive growth, accepting higher risks.

- Guard Mode: A balanced option with a mix of caution and opportunity.

- Steady Mode: Conservative and slower-paced, designed for long-term capital growth.

This flexibility means a beginner can choose a lower-risk approach while an advanced trader may opt for a more aggressive setting.

Technical Requirements and Setup

To achieve optimal results with Argos Fury EA V1.0 MT5, traders should meet a few basic requirements:

- Trading Platform: MetaTrader 5

- Primary Pair: XAUUSD (Gold)

- Recommended Timeframe: H1

- Minimum Starting Deposit: $200

- Broker Type: ECN with low spreads for gold

- Leverage: 1:30 or higher

- VPS Hosting: Strongly advised for stability and reduced latency

With these conditions in place, the EA can run smoothly and execute trades at the right intervals.

Claimed Performance and Insights

According to available information, Argos Fury EA has shown strong results in both historical testing and live performance accounts. Reports highlight:

- Consistent profitability across long-term backtests (2000–2025).

- Low drawdowns even in aggressive modes.

- Strong profit factor and win rate, particularly in trending conditions.

Still, as every experienced trader knows, no EA can guarantee future profits. Market conditions change constantly, and past results should always be treated as reference points, not promises.

Advantages of Argos Fury EA

- Operates with AI-driven analysis rather than fixed indicators.

- Multiple trading modes suit both risk-takers and cautious traders.

- Optimized specifically for gold trading, one of the most liquid markets.

- Built for MetaTrader 5, a modern and efficient platform.

- Requires a relatively low starting deposit compared to other high-end EAs.

Limitations and Risks

Even with its advanced logic, Argos Fury EA is not without risk:

- Aggressive settings can expose traders to large swings in volatile conditions.

- Broker quality matters – high spreads or poor execution will impact results.

- Reliance on a single asset (gold) limits diversification.

- Backtests can sometimes overestimate profitability if real-world slippage is ignored.

Practical Tips for Traders

If you plan to deploy Argos Fury EA, consider these best practices:

- Start in Demo Mode – Test the EA thoroughly before going live.

- Scale Gradually – Begin with small capital and increase only after consistent results.

- Stay Aware of News – Gold reacts strongly to central bank policies and economic releases.

- Choose the Right Mode – Conservative traders should begin with “Steady” before moving to higher-risk modes.

- Use VPS Hosting – Prevents interruptions and ensures smooth execution.

Why Gold is the Perfect Market for Argos Fury

Gold’s volatility makes it attractive but also challenging. Unlike many forex pairs, gold often experiences large moves in short periods due to inflation data, interest rate speculation, or geopolitical shifts. Argos Fury EA’s ability to spot liquidity changes and reversal points makes it particularly well-suited for this environment.

Final Verdict – Is Argos Fury EA Worth It?

Argos Fury EA V1.0 MT5 represents a modern approach to automated gold trading. With its AI-based logic, flexible modes, and disciplined risk filters, it offers traders a practical tool for navigating one of the most dynamic assets in the market.

It’s not a “set and forget” solution for instant riches. Instead, it is best viewed as a serious trading assistant that enhances strategy, saves time, and adds discipline to trading decisions. For traders willing to test, adjust, and apply sound risk management, Argos Fury EA can be a powerful addition to their toolkit.

Comments

Leave a Comment