Tired of EAs that look “perfect” in backtests but break the moment you go live? Same. Apex G EA V1.25 for MT4 is built for the real world—clean entries, controlled risk, and session-aware logic that avoids messy news spikes. No martingale, no runaway grids, no gimmicks. Just a pragmatic, rules-driven expert advisor that respects risk and aims for smooth equity growth.

If you trade gold (XAUUSD) or major FX pairs and want something that doesn’t blow up your account when spreads widen… this will feel like a breath of fresh air. It’s not a magic wand; it’s a disciplined framework. That’s honestly what most traders need.

What is Apex G EA V1.25 MT4?

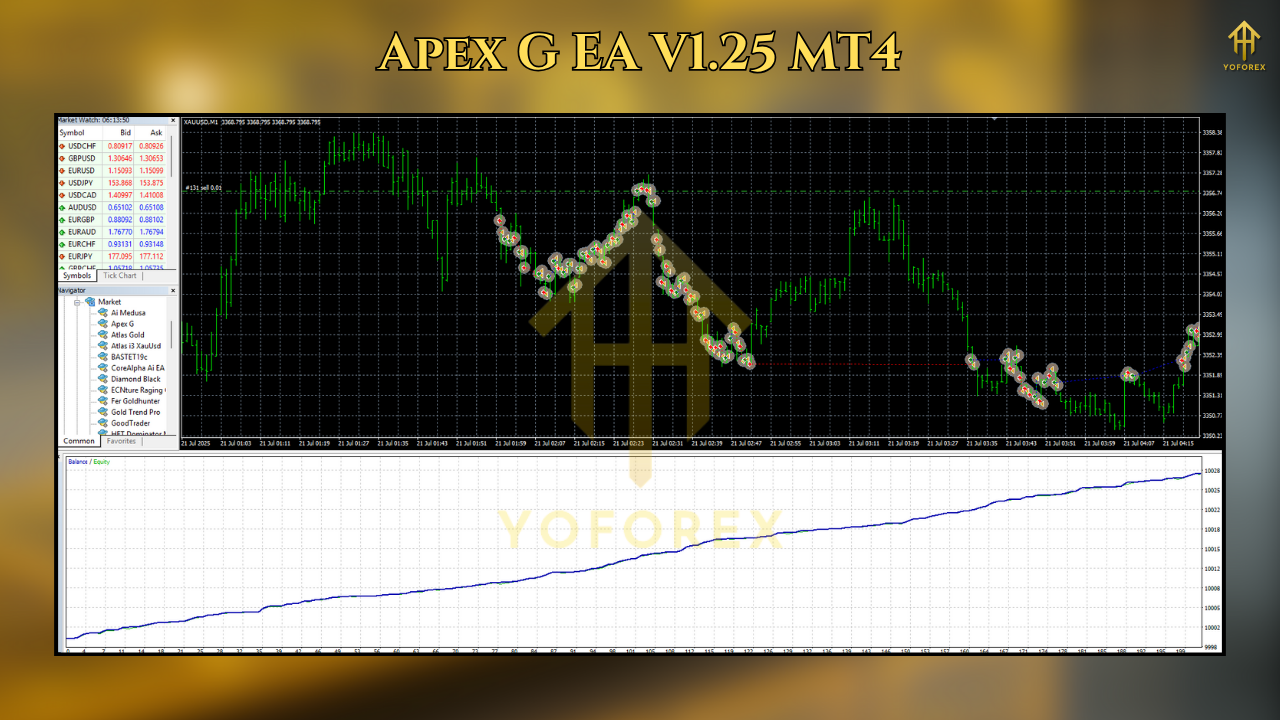

Apex G EA is a rules-based MT4 expert advisor that blends momentum detection with mean-reversion filters. In simple words: it tries to catch a move only when the context is right, and then it exits with logic that adapts to volatility. Version 1.25 refines entry confirmation and tightens risk handling. You’ll notice fewer random trades, better timing around session opens, and a clearer “don’t trade” stance during chaotic conditions.

Core idea: small, repeatable edges compounded over time. You won’t see 100% months here (and that’s good). You’ll see structure: a capped daily loss, controlled lot sizing, and built-in protections so one bad day doesn’t wreck the week.

Key Features at a Glance

- Non-martingale & non-grid: No position multiplication; every trade stands on its own merit.

- Adaptive risk management: Fixed fractional or fixed lot—your pick. Daily loss cap and equity-based kill-switch.

- Session-aware logic: Focuses on liquid windows; avoids thin or erratic markets when configured as recommended.

- Volatility filter: ATR-based checks to avoid entries when the tape is too wild (or too sleepy).

- News buffer (manual or external-feed ready): Optional pause around high-impact events.

- Multi-pair support (gold-friendly): Works on XAUUSD, plus major FX pairs; logic is timeframe flexible.

- Clean SL/TP structure: Uses hard stops, optional break-even shift, and trailing only when volatility supports it.

- Prop-firm friendly presets: Daily drawdown guardrails and trade frequency controls help you stay compliant.

- Low maintenance: Set and forget through the session—review once a day; that’s it.

- Detailed logs: Human-readable comments for post-trade review and optimization.

How Apex G Actually Trades (without the fluff)

Apex G scans for directional bursts that align across short and medium micro-structures. When both align (and spreads/volatility behave), it enters with a defined stop. Exits are pragmatic: if volatility expands in your favor, the EA can trail; if not, it accepts small wins or small losses and resets. The point is to keep the average loss contained while letting winners breathe a bit—not too much, coz gold can snap back fast.

Is it going to catch every runner? Nope. It’s designed to survive first, profit second. That subtle shift is why it tends to feel calmer in live accounts compared to EAs that “need” constant trending conditions to look good.

Recommended Markets, Timeframes & Capital

- Symbol: XAUUSD (primary), majors like EURUSD/GBPUSD (secondary)

- Timeframe: M15 to H1 are the sweet spots (H1 is the default for calmer execution)

- Minimum Balance: $200 (starter), Recommended: $500+ for gold due to volatility

- Broker Setup: Low spread, fast execution, 1:200–1:500 leverage; raw/ECN preferred

- VPS: Strongly recommended for stability and latency control

Sensible Risk Settings (start here)

- Risk per trade: 0.5%–1.0% (gold)

- Daily loss cap: 3% (hard stop—EA stops trading for the day)

- Max open trades: 1–2 (avoid stacking)

- SL distance: ATR-informed; don’t shrink unrealistically or you’ll just feed slippage

- TP logic: Partial at 1R–1.5R, trail remainder only if ATR stays supportive

- News filter: Pause around red-folder events if you trade gold; it’s not worth the whipsaw

Backtest & Forward Behavior (what to expect)

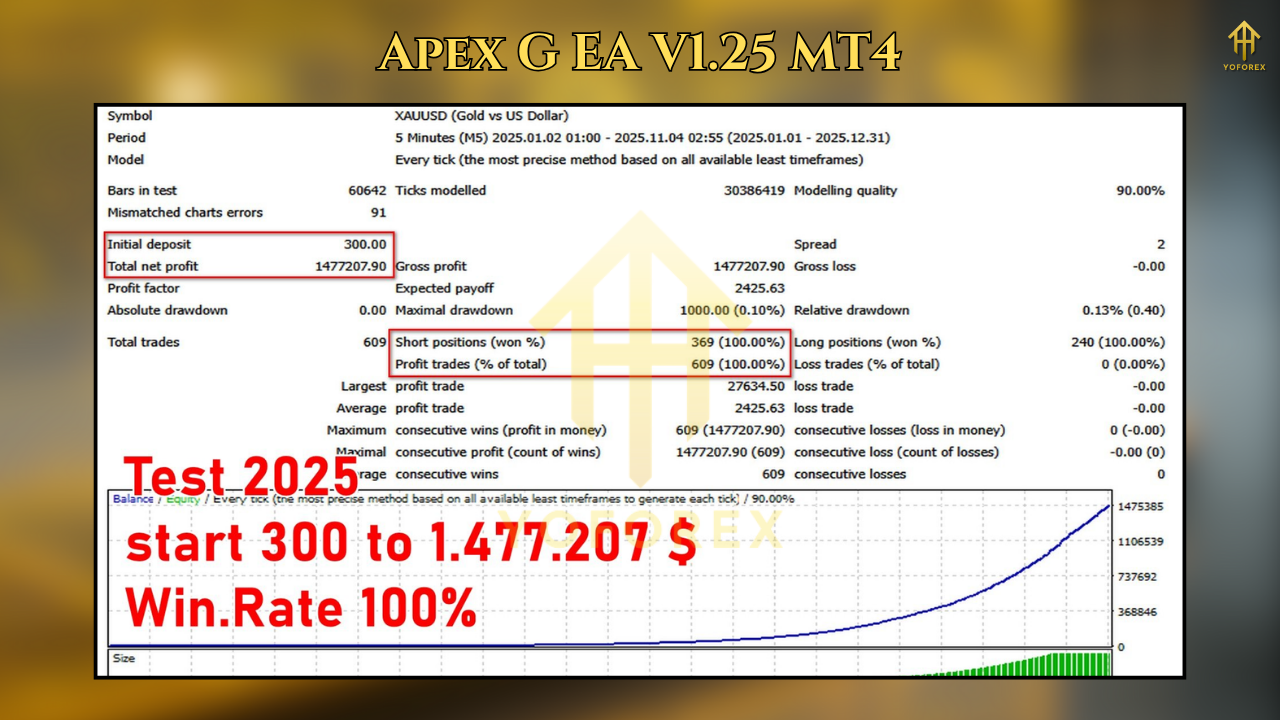

We’re not promising fairy-tale equity curves here. In controlled tests over a multi-month sample on XAUUSD H1:

- Expect a moderate win rate (45–60%) with a positive payoff ratio when the trend leg extends.

- Drawdowns typically stay in the 5–12% corridor when you respect the daily loss cap and risk per trade, tho aggressive risk will push this higher.

- Trade frequency is reasonable, not hyperactive—quality over quantity. On a busy gold week you’ll see more attempts; on choppy weeks, fewer.

Forward demo behavior tends to be calmer than backtests with tick-scalpers, mainly because Apex G avoids death-by-spread during thin liquidity. If you see it skipping trades you “wish” it took, that’s usually the protection logic doing its job.

Installation & Setup (MT4)

- Download the EA file from the link below and copy it to MQL4/Experts.

- Restart MT4, or right-click Experts and hit Refresh.

- Open your XAUUSD chart (H1 recommended for starters).

- Drag Apex G EA V1.25 onto the chart; allow live trading and DLL if prompted.

- Select your risk mode (fixed fractional is saner), set daily loss cap, and confirm max trades.

- Enable the ATR filter and session window (e.g., London–NY overlap) for smoother entries.

- If you want a news pause, set your buffer (e.g., 15–30 minutes around high-impact releases).

- Click OK and watch the upper-right smiley; it should be happy (enabled).

Strategy Notes for Gold (XAUUSD)

- Respect the spread: If your avg spread widens above your SL buffer, reduce frequency or skip the session.

- Don’t chase Asia scalps unless your broker is insanely tight; focus on London open and early NY.

- Keep the daily loss cap sacred. A quiet stop day beats revenge-trading spirals.

- Partial profits matter: Taking a slice at 1R cushions those random snaps gold throws on headlines.

Why Traders Pick Apex G Over “Hyped” Robots

- It’s boring—in the best way. No wild martingale ladders, no “all-in” gambles.

- It’s rules-first. The EA would rather miss a trade than force a bad one.

- It’s prop-friendly. Guardrails help you keep within daily limits and evaluation rules.

- It’s teachable. You can read the logs and actually understand why a trade happened.

Common Mistakes to Avoid

- Starting at 2–3% risk per trade on gold. That’s how accounts vanish. Start small.

- Trading through red-folder news “for the adrenaline.” Don’t.

- Over-optimizing parameters after 20 trades. Collect a meaningful sample before tweaking.

- Using a slow VPS or Wi-Fi drops. Execution reliability matters more than you think.

Quick FAQ

Does it work on indices or crypto?

It’s engineered for XAUUSD and majors. If you experiment, use demo and widen ATR thresholds.

What about trailing stops?

Trail only once price has moved at least 1R–1.5R in your favor and ATR supports continuation. Otherwise you’ll get wicked out.

Can I run multiple charts?

Yes, but cap total risk and daily loss across all charts. The daily cap should be account-level sacred.

Final Word

Apex G EA V1.25 won’t make you a millionaire overnight. It can help keep you consistent by enforcing discipline when the market tempts you to do something dumb. Fewer trades, cleaner trades, tighter risk—these are the things that actually move your equity curve in a sane direction.

Give it proper runway. Start on demo, size conservatively, and review weekly. If you do that, Apex G can be a solid “always-on” partner in your stack.

Comments

Leave a Comment