Angry Bird Xscalping EA V1.0 MT4 — The Fast Scalper Built for Today’s Market

If you’re tired of missing quick moves or babysitting charts all day, Angry Bird Xscalping EA V1.0 is designed to flip that script. This MT4 Expert Advisor focuses on high-probability micro-moves—breakouts and momentum bursts that often happen in seconds—so you can target consistent, bite-sized profits without the screen burn. It’s nimble, it’s selective, and it’s built around strict risk control so you’re not trading on pure hope. The aim is simple: fast entries, disciplined exits, and fewer surprises.

Unlike slow swing bots that wait for the “perfect” setup (and sometimes never get it), Angry Bird Xscalping leans into M1/M5 micro-structure. It watches volatility pulses, checks spread and slippage conditions, and only strikes when the reward-to-risk looks favorable. And yes, it avoids heavy grid/martingale by default—coz blowing up accounts isn’t a strategy. If you want an EA that can adapt to early London and NY momentum and keep risk transparent, this one’s worth your test run.

What Makes Angry Bird Xscalping Different?

Most scalpers claim speed; few combine speed with robust trade filters. Angry Bird Xscalping runs a layered checklist before placing an order:

- Momentum + Micro-Breakout Logic: Confirms short-term trend bias using fast EMAs and price acceleration. It doesn’t chase every flicker; it looks for quick continuation after liquidity sweeps.

- Smart Spread & Slippage Gate: Orders are blocked if spread exceeds your defined threshold or if recent slippage spikes. That alone saves a ton of bad fills.

- Session-Aware Behavior: Performs best during the first 2–4 hours of London and NY sessions when liquidity is deeper and spreads are tighter.

- Fixed SL/TP With Optional Trailing: Default SL is tight (often 6–18 pips depending on pair/volatility), TP aims for 1.2–2.0R. Trailing kicks in after partial profit to reduce giveback.

- No Martingale (Default): Position sizing is linear. There’s an optional recovery mode, but it’s off by default and not advised for small accounts.

- News Guard (Manual or Filter Input): You can pause trading ahead of high-impact news; the EA respects your on-chart “do not trade” windows if you configure them.

- Capital-Aware Positioning: Simple, transparent lot sizing guidance (see below) keeps drawdown under control even on volatile gold.

Recommended Markets, Timeframes & Account Setup

Pairs:

- XAUUSD (Gold): Primary target for momentum bursts and micro breakouts.

- EURUSD: A liquid major that tends to behave well under tight spreads.

Timeframes:

- M1/M5 for execution, M15 for visual monitoring and context (don’t overfit settings to M15).

Broker/Account Style:

- ECN/Razor-style accounts with low spread and fast execution shine here.

- Leverage of 1:200–1:500 is fine, but remember leverage isn’t a license to oversize.

- VPS is strongly recommended to minimize latency and platform hiccups.

Minimum Deposit: $200

- For $200–$500 starting equity, keep lot sizes small, avoid recovery modes, and cap max concurrent trades (1–2 open positions).

Position Sizing & Risk Modes (Guidance)

- Conservative: 0.01 lot per $300–$400 equity on XAUUSD; risk ≤ 0.5% per trade.

- Balanced: 0.01 lot per $200–$250 equity; risk ≈ 1% per trade.

- Aggressive (not for beginners): 0.02 lot per $200–$300 equity; risk ≈ 1.5–2% per trade and tighter trade frequency.

Remember, these are guidelines. Volatility shifts—especially on gold—so always forward-test on demo and refine.

Core Features You’ll Actually Use

- • M1/M5 micro-scalping engine tuned for fast momentum bursts

- • Spread & slippage shield to avoid poor fills

- • Hard stop-loss per trade (no blind averaging-down)

- • Partial take-profit + trailing stop to lock in gains on runners

- • Session filter to focus on London/NY when conditions are best

- • News pause support (manual windows or external input)

- • Simple lot sizing tied to account balance, not luck

- • Log & alerts so you can audit every decision

- • Clean inputs—no 200-field maze to configure

- • Works on XAUUSD & EURUSD with preset profiles

Suggested Settings (Starter Presets)

XAUUSD (Gold) – M1/M5

- Max Spread: 30–40 points (broker-quoted on gold)

- SL: 6–18 pips equivalent (tighter in low vol, wider in spike conditions)

- TP: 10–24 pips or 1.2–2.0R; enable trailing after +8–12 pips

- Trade Window: London + NY opens; pause during major news (CPI, NFP, Fed)

- Lot Size: 0.01 per $250 equity (balanced)

EURUSD – M1/M5

- Max Spread: 10–15 points (1.0–1.5 pips)

- SL: 6–10 pips; TP: 8–16 pips; trailing after +6 pips

- Avoid random low-liquidity hours (late US session, rollover)

Installation & Setup (MT4)

- Open MT4 → File → Open Data Folder.

- Navigate to MQL4 → Experts and copy the EA file there.

- Restart MT4. In Navigator → Expert Advisors, find Angry Bird Xscalping EA.

- Drag it onto your chart (XAUUSD or EURUSD).

- In Common, enable Allow live trading (and DLL imports only if the EA requires; check docs).

- Load the provided .set file for your pair/timeframe or start with the presets above.

- Click AutoTrading to turn it green.

- Watch the first sessions live to confirm spread/slippage behavior matches your broker conditions.

Tip: Keep a journal. Note session times, spread ranges, and any rule breaks you observe, then tune the filters.

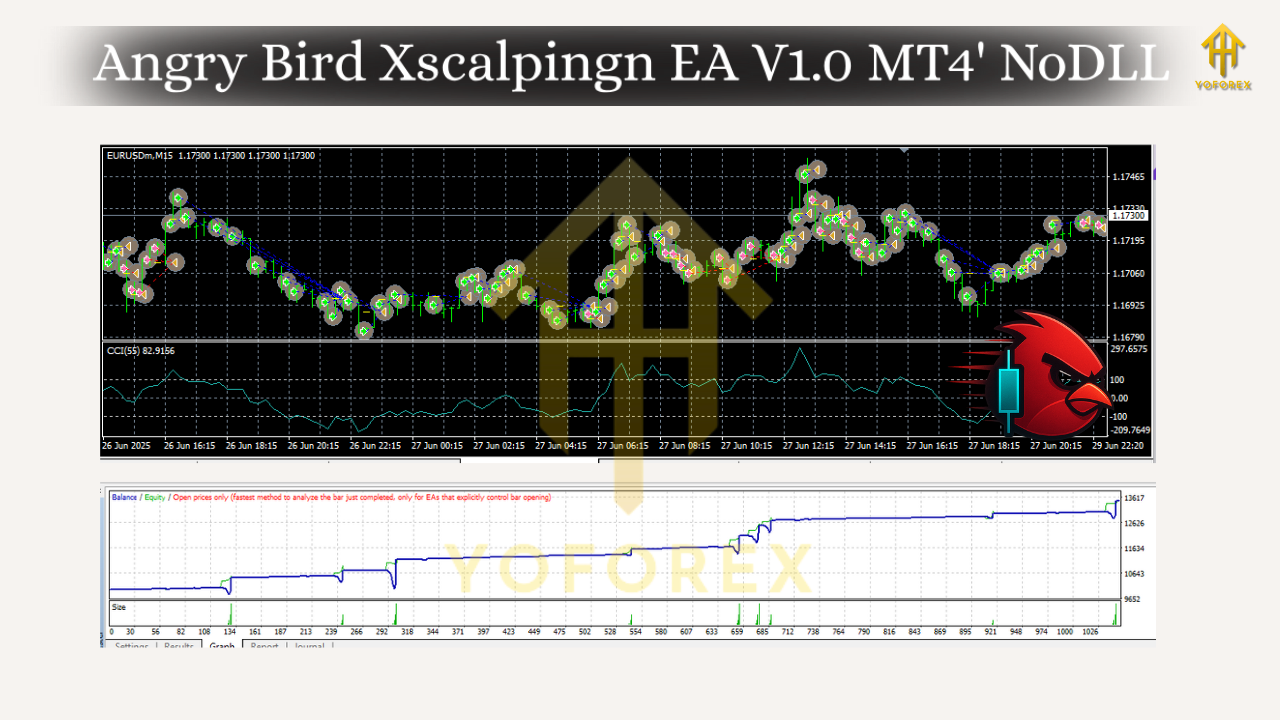

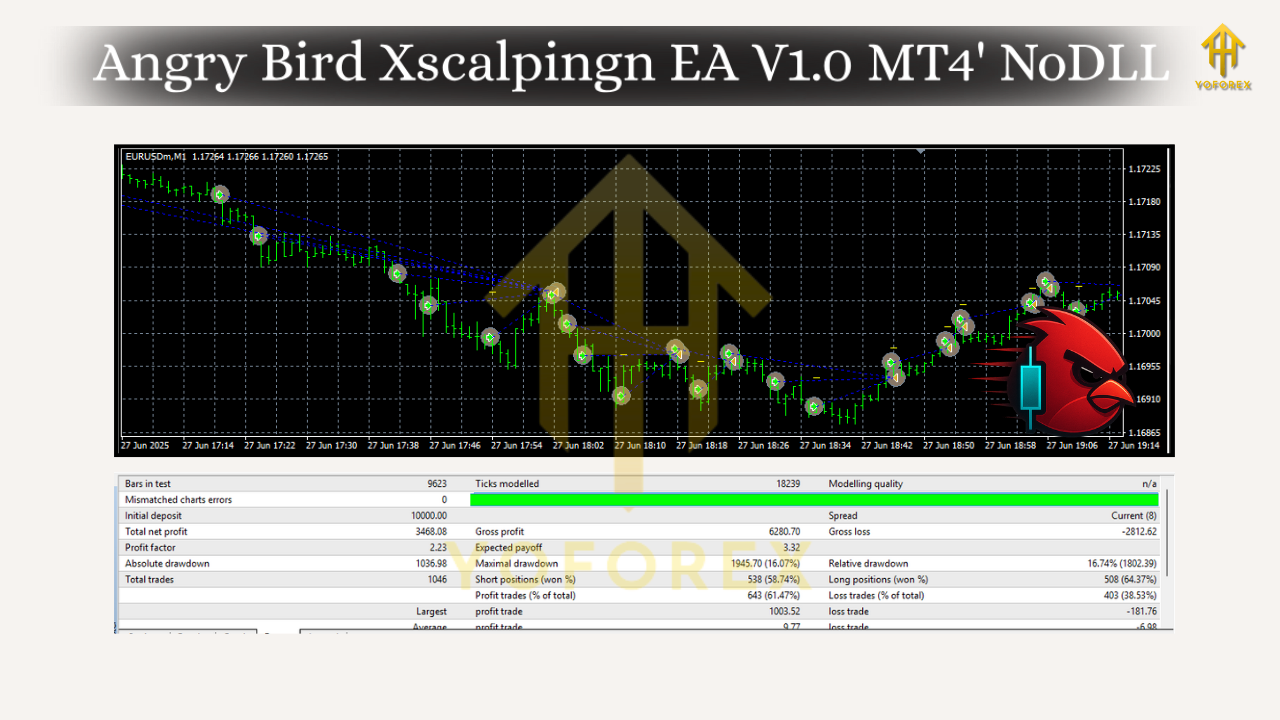

Backtesting & Forward-Testing Blueprint

- Backtest Model: “Every tick based on real ticks” (if available) for 2022–present to reflect modern gold behavior.

- Use variable spread and commission in tester; add 2–5 points of slippage to stay realistic.

- Key Metrics: Profit factor above 1.3, controlled max drawdown (ideally < 20% on balanced risk), steady equity curve without long stagnation.

- Walk-Forward: Split the data (train vs. unseen) to check robustness.

- Forward Demo (2–4 weeks): Run during London/NY opens with journal notes; only after that consider live with small size.

Who Is This For?

- Active day traders who like quick, rules-based scalps without manual entries.

- Part-time traders who can’t watch every tick but want a mechanical edge during liquid sessions.

- System builders who value clear inputs, no hidden martingale, and auditable logs.

If you prefer long holds, wide stops, or fully discretionary trading, this probably isn’t your cup of tea.

Risk Management & Good Habits

- Cap daily loss (e.g., 2–3% of equity). When reached, stop trading for the day.

- Limit concurrent trades to avoid correlated risk (especially on gold spikes).

- Pause for red-flag news or widen filters; no EA is a superhero during whipsaw minutes.

- Review weekly: prune bad hours, refine spread caps, and update trailing logic if needed.

Final Word

Angry Bird Xscalping EA V1.0 MT4 isn’t trying to catch the whole trend; it aims for frequent, controlled wins where micro-momentum gives you a measurable edge. Keep risk tight, respect the filters, and favor the best market hours. With disciplined execution and sensible lot sizing, this scalper can be a serious addition to your toolkit—especially if you love the fast lane on XAUUSD and EURUSD.

Comments

Leave a Comment