AlphaAI EA V1.1 MT5 — Test Smart on EURUSD (H1)

Platform: MetaTrader 5 (MT5)

Recommended First Test: EUR/USD on the H1 timeframe

Style: AI-assisted trade selection with structured risk management

Approach: Clean one-chart setup → validate on EURUSD/H1 before scaling to other pairs

Why EURUSD on H1?

- Most liquid pair in the world → ultra-tight spreads, deep order book, stable behavior.

- Plenty of data → ideal for both backtesting and forward validation.

- H1 timeframe balance → filters out noisy intraday spikes while still generating a regular trade flow.

- Fair benchmark → results here give a realistic picture before expanding to more volatile pairs.

Core Features of AlphaAI EA V1.1

- AI-powered filtering → adapts entries to recent volatility and trend conditions.

- Strict risk controls → fixed or % equity risk, every trade protected by hard stop-loss & take-profit.

- Optional trailing & breakeven → configurable for more advanced trade management.

- No martingale, no grid → fully prop-firm compatible.

- Backtest friendly → quick to validate on EURUSD/H1 without curve-fit traps.

Quick Start Guide

- Install

- Copy EA into

MQL5/Expertsfolder → restart MT5. - Chart Setup

- Open EUR/USD on H1 timeframe.

- Drag AlphaAI EA V1.1 to the chart.

- Enable Algo Trading.

- Inputs (baseline)

- Risk: 0.5%–1% per trade.

- SL/TP: use defaults (ATR/structure-based).

- Spread filter: on (set close to your broker’s EURUSD average).

- Trailing stop: off for initial validation.

- Validation

- Check Experts/Journal tabs → confirm EA initialized, no errors.

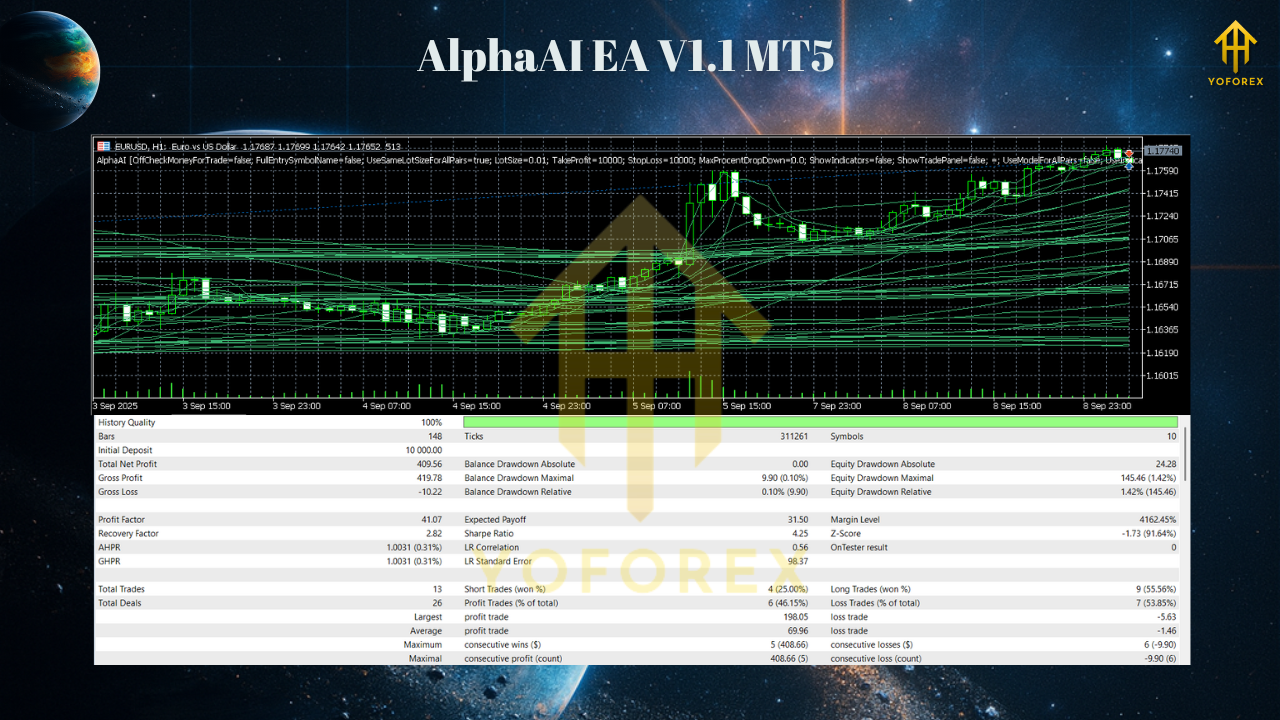

- Run backtest (12–24 months) → focus on drawdown, profit factor, average R/trade.

- Forward test on demo for 2–4 weeks before going live.

Best Practices

- Keep risk tiny until at least 30–50 trades are sampled.

- Journal weekly results: DD, win/loss %, R-multiple, equity curve.

- Expand slowly: after EURUSD/H1 validation, test one new pair (e.g., USDJPY or GBPUSD).

- Use a VPS for uninterrupted execution (low-latency recommended).

- Daily guardrails: set max loss (e.g., –2R/day) to protect against clusters of losing trades.

Pros & Cons

Pros

- AI-based adaptive filtering.

- Works out-of-box on EURUSD H1.

- No martingale/grid → risk transparent.

- Small-account and prop-firm friendly.

Cons

- Requires patience (H1 signals are fewer than scalpers).

- Needs forward validation on your broker.

- AI logic = less transparent than classic indicator-only EAs.

FAQ

Q: Can I use it on other pairs/timeframes right away?

A: It’s best to validate on EURUSD H1 first. Other pairs require extra optimization and testing.

Q: Is it safe for prop firms?

A: Yes, no martingale/grid, strict SL/TP, and risk % mode = prop safe.

Q: Do I need a VPS?

A: Strongly recommended. Keeps execution clean, especially during news events.

Final Thoughts

AlphaAI EA V1.1 MT5 is built for traders who want discipline and adaptability without endless tweaking. Start exactly as recommended: EURUSD, H1, small risk. Once you’re satisfied with results, scale cautiously to other pairs. The one-step-at-a-time workflow ensures you avoid overfitting and keep risk under control.

Risk Disclaimer: All trading involves risk. Backtest and forward-test before committing real capital.

Join our Telegram for the latest updates and support

Comments

Leave a Comment