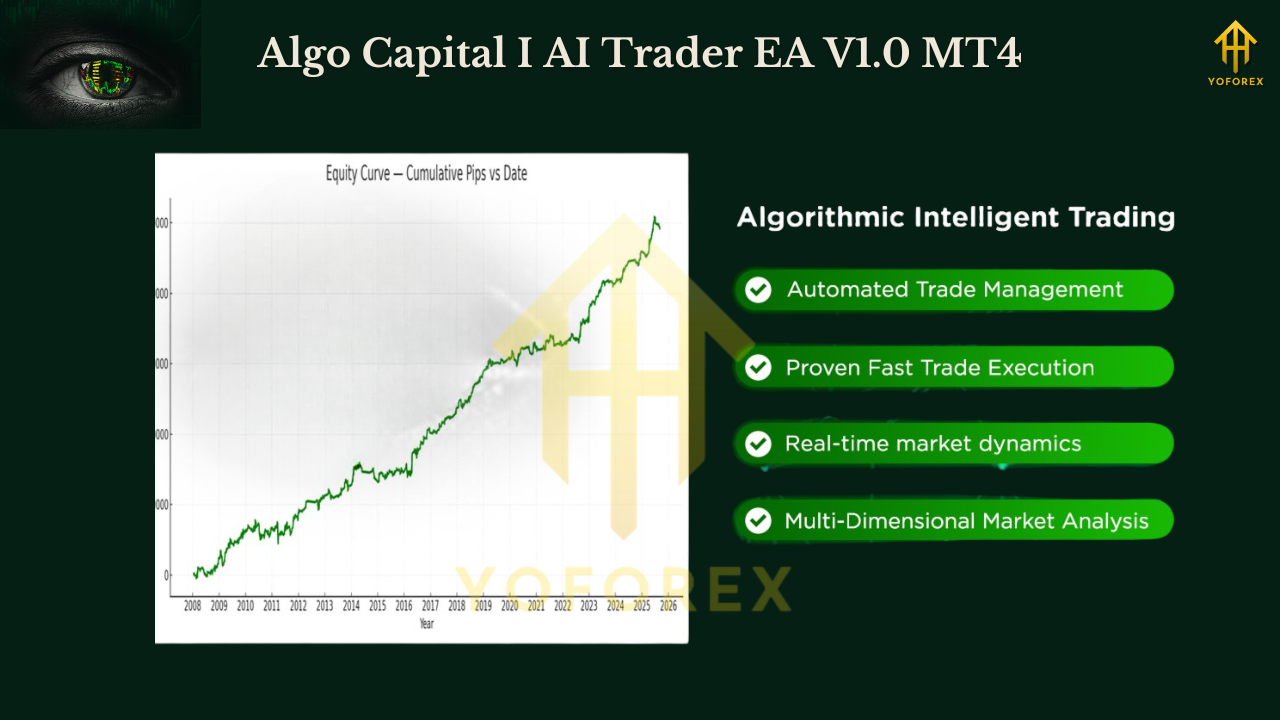

Algo Capital I AI Trader EA V1.0 MT4 — Institutional-Grade AI for Daily Chart Trading

Platform: MT4

Style: AI-driven Expert Advisor for forex majors & crosses

Supported Instruments:

AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY

Coming soon: Indices, Oil, Gold

Timeframe: Daily chart (D1)

Minimum Deposit: £5,000

Optimal Account Type: ECN / Raw Spread

Leverage Range: 1:30 – 1:1000

Max Base Lot Size: 0.1 (defined by the most expensive pair in base currency)

If you’re hunting for an AI-powered Expert Advisor designed for professional-grade trading on daily charts, Algo Capital I AI Trader EA V1.0 brings a long-horizon, rules-driven engine tailored for portfolio-level execution. Unlike fast-scalping robots, this EA is built to analyze longer cycles, hold structured trades, and enforce capital preservation on multi-pair baskets. It’s designed for traders who want to step closer to institutional flow management without hand-optimizing every input.

Why It Stands Out

1. Daily Chart Focus

Instead of chasing every tick, it locks onto higher timeframe signals where noise is reduced and trends are clearer. That means fewer trades, but more meaningful ones.

2. Broad Instrument Coverage

Supports a wide basket of 28+ major/minor forex pairs — giving diversification and smoother equity curves. Expansion to indices, oil, and gold is on the roadmap.

3. AI-Driven Trade Selection

Embedded logic uses AI-trained filters to adapt across different instruments and volatility regimes. It’s designed to capture macro swings and structured reversals rather than scalp micro-fluctuations.

4. Institutional Risk Model

- Max base lot size = 0.1 (per most expensive pair) → ensures no pair blows up risk.

- Equity-based sizing → dynamically scales exposure relative to your capital.

- Daily timeframe + multi-pair mix → reduces correlation risk.

5. Broker-Safe Architecture

- Optimized for ECN/Raw spread accounts.

- Leverage-friendly: works from 1:30 (low institutional) to 1:1000 (retail).

- Safe handling of stop/limit orders; auto-adjusts for broker restrictions.

How It Works (Plain English)

- Scan the Basket

Every day, the EA reads the full set of supported forex pairs and evaluates structure, volatility, and trend proxies. - Signal Filtering (AI Layer)

Instead of pure technical triggers, it uses a trained model to decide if conditions match a high-probability regime (trend continuation, reversal exhaustion, or stand-aside). - Execution

Places trades with hard stops and pre-calculated take-profits, adapting per pair’s volatility. No martingale, no averaging down. - Risk Management

Equity protection via max lot 0.1, risk-% sizing, and optional global equity stop. - Portfolio-Level Behavior

Manages across multiple pairs at once. Some may be long, others short, smoothing PnL rather than relying on one pair.

Recommended Setup

- Timeframe: Attach to D1 charts only (each symbol separately).

- Account Size: Minimum £5,000 (or equivalent in base currency).

- Lot Sizing: Max 0.1 lot per most expensive pair; smaller for others.

- Account Type: ECN or Raw spread with tight commissions.

- Leverage: 1:30–1:1000, depending on regulation and broker.

- Execution: VPS recommended for stability across multiple charts.

Example Workflow

- Deposit £5,000+ into an ECN account.

- Attach EA to supported pairs on D1 charts.

- Start with risk-per-trade = 0.5%–1%.

- Track portfolio drawdown and pair-by-pair performance over at least 50–100 trades.

- Expand to indices/oil/gold when the update rolls out.

Strengths

- Diversification across 28+ forex pairs

- Daily chart = low noise, stronger structure

- AI layer reduces false positives

- Risk-first design with capped lot size

- Compatible with both retail and institutional brokers

Limitations

- Not a scalper → trade frequency is low; patience required.

- Requires larger starting capital (£5,000) compared to retail bots.

- Heavier VPS load if attached to all pairs (28 charts).

Best Practices

- Forward-test on demo first to see portfolio rhythm.

- Don’t override daily logic with intraday tinkering; this is a long-game EA.

- Treat as a portfolio manager: think in months, not hours.

- Use a low-latency VPS for uninterrupted basket execution.

FAQ

Does it use martingale or grid?

No. Strict lot caps and volatility-based stops are enforced.

What’s the minimum deposit?

£5,000 is required; smaller accounts won’t run properly under the lot model.

Can it run on M15/H1?

No. Designed strictly for D1 chart signals. Running lower TF breaks the system logic.

Does it handle indices and gold?

Not yet, but support is coming soon.

Is it prop-firm friendly?

Yes, provided the firm allows multi-pair EAs on D1 and supports EA trading.

Final Word

Algo Capital I AI Trader EA V1.0 (MT4) is for traders ready to move beyond scalper gimmicks and into portfolio-style, AI-driven daily trading. With a minimum of £5,000 and a focus on broad multi-pair exposure, it offers a systematic, risk-conscious approach that avoids over-optimization and short-term noise. Think of it less as a “bot” and more as an automated portfolio manager that hunts swings across the forex landscape.

Risk Disclaimer: Trading involves risk. Past performance does not guarantee future results. Always forward-test on demo and manage exposure responsibly.

Join our Telegram for the latest updates and support

Comments

Leave a Comment