If you have been looking for an MT4 Expert Advisor that favours controlled risk, clean execution, and forward-tested logic over flashy backtest curves, AI MEDUSA EA V2.95 for MetaTrader 4 deserves a careful look. Positioned as an AI-assisted, non-martingale, non-grid system, it is built to trade H1 with a portfolio mindset, managing entries and exits with firm stop losses, take profits, and an automatic breakeven safety net. The promise is simple: reduce unmanaged risk, keep position sizing disciplined, and let an external AI decision engine handle the conditions that are hard to compress into fixed rules.

What Makes AI MEDUSA Different

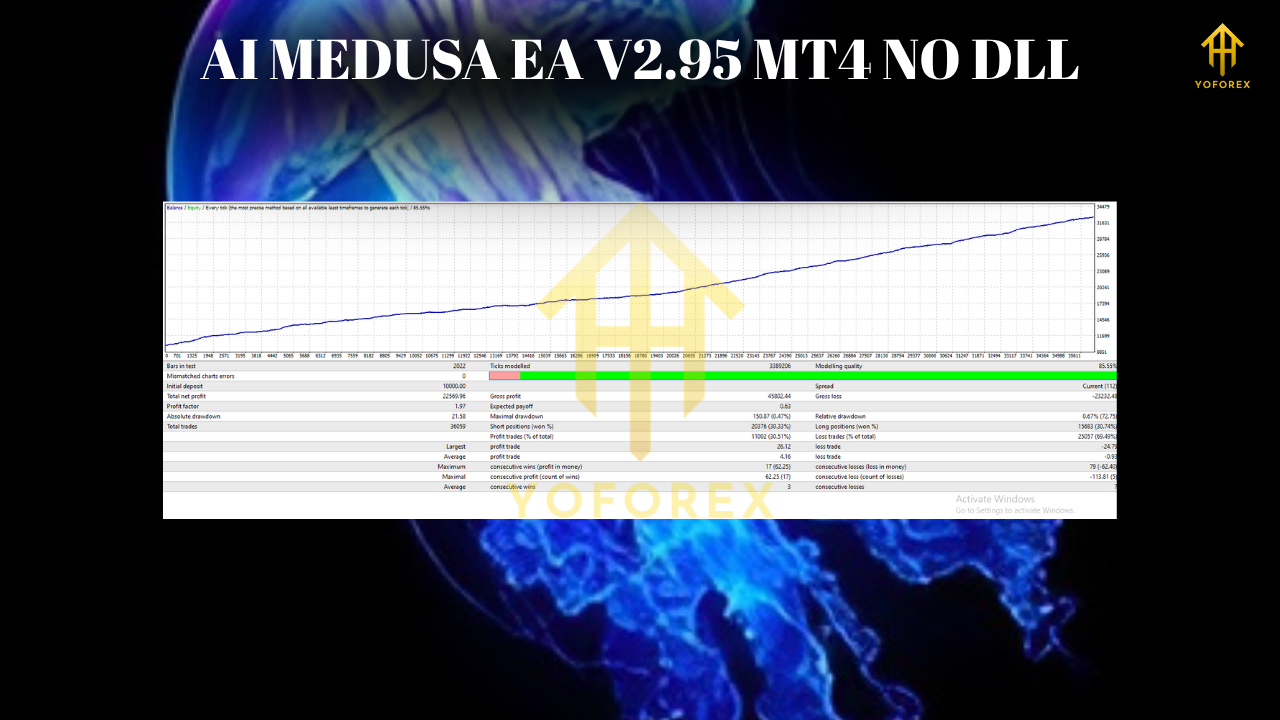

Many retail EAs lead with long historical tests and optimised parameters that rarely survive live conditions. AI MEDUSA takes the opposite approach: its logic depends on real-time signals and decisioning, which means the emphasis is on live performance, forward testing, and robust execution. For traders at YoForexEA.com who value durability over curve-fit charts, this design choice is pragmatic. The strategy’s core pillars are clear: trade on H1 for cleaner signals, diversify across major currency pairs, and anchor every trade with defined exits.

Strategy Philosophy: H1 Quality Over Intraday Noise

H1 is a thoughtful compromise between speed and reliability. It filters out much of the market’s intraday randomness while still producing a healthy number of opportunities across multiple symbols. AI MEDUSA leans on that balance. Instead of chasing micro-moves that rely on razor-thin spreads and hyper-fast reaction times, it looks for structured setups with observable follow-through, allowing risk controls to do their job.

Non-Martingale, Non-Grid by Design

Risk blow-ups typically come from doubling down. A grid or martingale sequence can look profitable for months, right up to the moment it is not. AI MEDUSA avoids both. Each trade stands on its own merit, with a pre-defined stop loss and a measured take profit. The automatic breakeven function is a practical reinforcement: once a position reaches a specified threshold, the EA can move the stop to protect equity, reducing the chance that a small win turns into a loss during retracements.

Multi-Pair Coverage From a Single Attachment

A key operational advantage is the portfolio mentality. Rather than running a different robot for every pair, you attach the EA to a recommended chart and allow it to detect and manage trades on a range of symbols. For traders who want diversified exposure without complex chart farms, this is a major convenience. Diversification is not a guarantee of profit, but it helps smooth equity curves by spreading risk across uncorrelated or partially correlated pairs.

Setup Walkthrough for MT4

- Install the EA in your Experts directory and restart MT4.

- Attach it to the recommended H1 chart.

- Verify that algorithmic trading is enabled and your broker permissions are set.

- Review money-management and risk parameters before the first live session.

- Keep a dedicated journal to track trade IDs, entry reasons, and exit performance, so you can evaluate behaviour across pairs.

Risk Management: The Heart of the System

AI MEDUSA ships with risk controls baked in. You still need to align them with your account size, leverage, and personal risk tolerance. Consider these practical guardrails:

- Define a per-trade risk cap as a percent of balance or equity.

- Enforce a daily loss limit to stop trading after a sequence of losses.

- Track maximum adverse excursion and maximum favourable excursion to understand whether stops and targets are positioned realistically for each pair.

- If you plan to trade many pairs simultaneously, reduce per-trade risk to keep aggregate exposure under control.

VPS, Latency, and Broker Conditions

Because the decision engine depends on live conditions, uptime and stable connectivity matter. Use a reliable VPS close to your broker’s servers to minimise latency and slippage. Prefer a broker with consistently tight spreads during active sessions, transparent commissions, and no artificial execution delays. Remember that the quality of fills can materially affect outcome distributions, especially when a breakeven or trailing action triggers near key levels.

Forward Testing Plan You Can Trust

Backtests can be informative, but are not the right yardstick for a system that leans on real-time decisioning. A better plan:

- Micro Live Account: Transition to a small live account to evaluate execution quality, slippage, and spread sensitivity under your broker.

- Gradual Scaling: If metrics are consistent, scale cautiously. Keep a monthly risk review that compares live performance with your demo baseline, and adjust symbol lists and position sizes accordingly.

Prop-Firm Readiness and Risk Rules

If your end goal is a prop firm evaluation, AI MEDUSA’s risk-first stance is well aligned with typical rules on daily loss and max drawdown. You will still need to tune parameters to each prop firm’s limits, including daily stop trading thresholds, maximum open trades, and maximum exposure per symbol. Always test your exact rule set on demo first, because prop evaluations penalise even brief breaches.

How the AI Layer Changes the Game

Classic rule-based EAs translate human logic into code. They tend to be stable but brittle: when market regimes shift, performance can break. AI-assisted decisioning offers flexibility by ingesting more contextual signals and adapting thresholds. The trade-off is that it becomes a live system, not a static one. That is why the best due diligence method is forward testing with strict risk controls and a willingness to pause when conditions become abnormal.

Managing Expectations

No EA wins all the time. Expect sequences of losses, flat periods, and occasional drawdowns. The real test is whether losses stay inside your planned envelope and whether recoveries are credible without ballooning risk. Judge the system across a meaningful sample size, and do not extrapolate early streaks, good or bad.

Practical Operating Tips

- Prefer sessions with stable liquidity and avoid periods of extreme widening spreads around major news, unless your plan explicitly includes them.

- Keep your MT4 updated and maintain your VPS regularly to prevent downtime during trades.

- Log infrastructure events such as internet interruptions, platform restarts, or broker maintenance windows; these details explain anomalies and help you fine-tune safeguards.

- Review your symbol universe quarterly. Some pairs may consistently underperform your expectations; rotate them out or reduce their weight.

Frequently Asked Questions

Can I run AI MEDUSA on a small account?

Yes, but size trades conservatively. If you enable multiple pairs, reduce per-position risk so that the total exposure remains within your comfort zone.

Is H1 mandatory?

H1 is recommended because it balances signal quality and frequency. Deviating from the recommended timeframe can change the trade profile and risk characteristics.

Do I need a VPS?

It is highly recommended. Stable connectivity and low latency are critical for an EA that relies on timely execution, protective stops, and breakeven adjustments.

What about news filters?

The safest approach for most users is to reduce risk or pause around high-impact releases unless you have tested behaviour specifically for news conditions.

Can I use it for evaluation accounts?

Yes, provided you configure risk parameters for the rules of your evaluation. Always validate on demo first to avoid accidental breaches.

Final Verdict

AI MEDUSA EA V2.95 MT4 is built for traders who want a disciplined, risk-aware approach guided by live decision-making rather than static optimisations. The H1 focus, non-martingale structure, and multi-pair coverage give it a robust architecture for day-to-week swings, while firm SL, TP, and breakeven logic keep downside in check. It is not a set-and-forget money machine, and it does not promise miracle streaks. It is a professional-leaning tool that rewards careful setup, reliable infrastructure, and a clear risk framework. If you prefer forward testing, transparent rules, and gradual scaling, MEDUSA’s design philosophy will fit your workflow.

Comments

Leave a Comment