AI-Powered Scalping for NASDAQ 100: Introducing AI Indices Scalper EA V1.0 MT4

In the dynamic world of trading, staying ahead often means leveraging the latest technologies. One such innovation is the AI Indices Scalper EA V1.0 MT4, an Expert Advisor designed for scalping the NASDAQ 100 index using artificial intelligence. This revolutionary tool combines advanced machine learning techniques with real-time market analysis to provide traders with a precision-driven approach to scalping.

Understanding the AI Indices Scalper EA V1.0 MT4

The AI Indices Scalper EA V1.0 MT4 represents the cutting-edge of trading technology, combining the power of artificial intelligence with the precision needed for successful scalping. Specifically designed for MetaTrader 4 (MT4), one of the most popular trading platforms for forex and CFD trading, this Expert Advisor (EA) automates the process of precision breakout scalping on the NASDAQ 100 index (symbol USTEC).

At its core, the AI Indices Scalper EA V1.0 MT4 leverages a Transformer-based neural architecture, a type of deep learning model that has proven highly effective in processing sequential data. Originally developed for natural language processing, Transformer models have been adapted for financial data analysis due to their ability to capture long-range dependencies and contextual information. This architecture forms the foundation of the EA's analytical capabilities, allowing it to process market data with remarkable depth and accuracy.

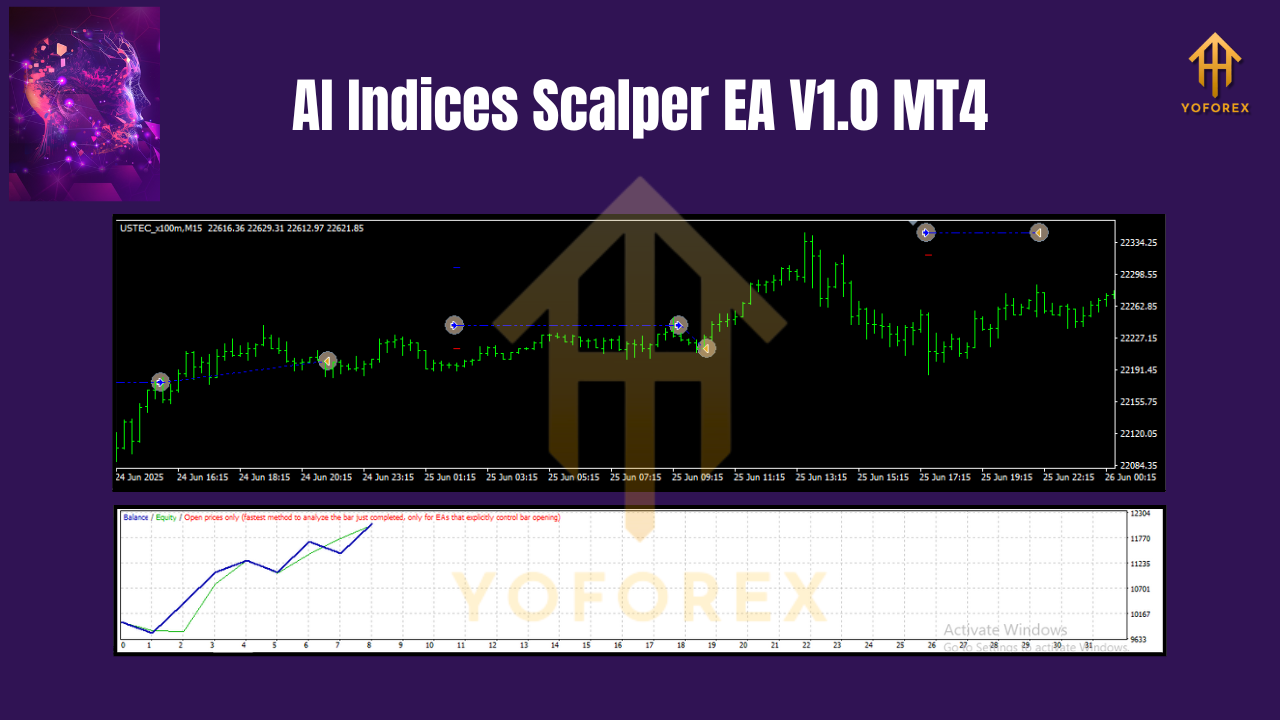

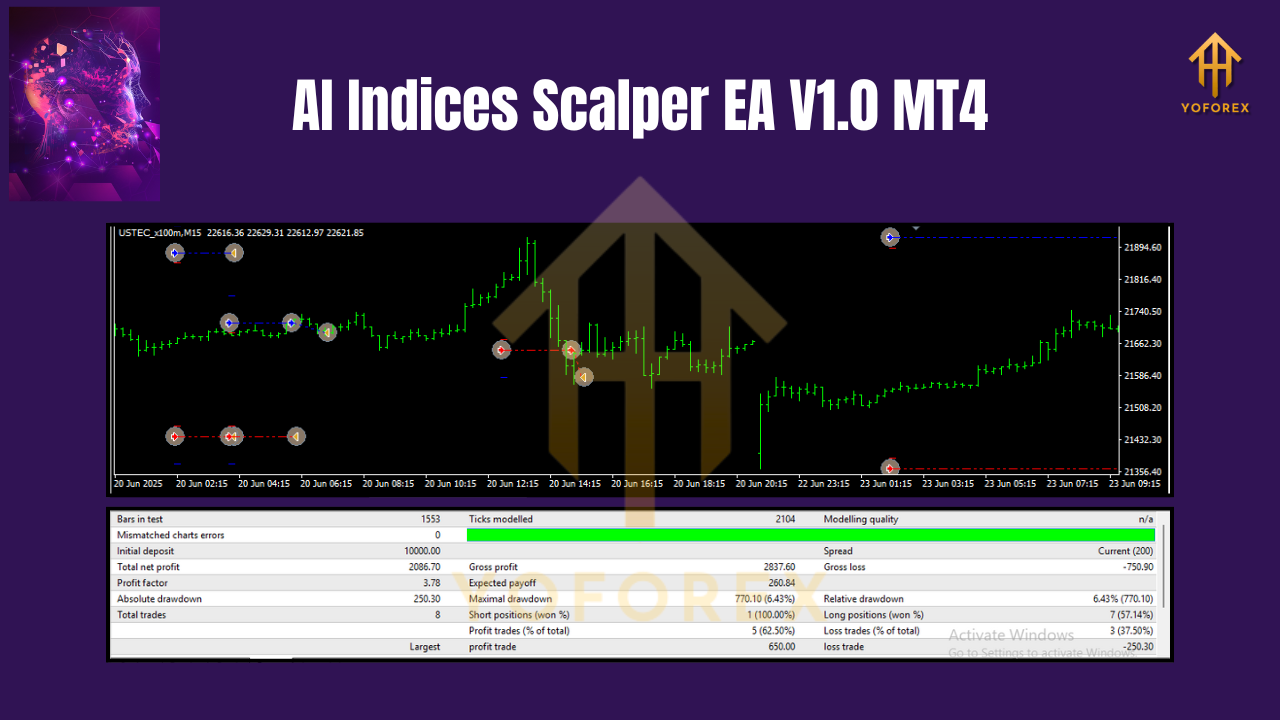

The EA operates on the M15 timeframe (15 minutes), making it particularly well-suited for identifying and executing on short-term price movements. This timeframe strikes a balance between immediate market reactions and longer-term trends, providing sufficient data for meaningful analysis without getting bogged down in microsecond fluctuations.

Key Features of the AI-Powered Trading System

The AI Indices Scalper EA V1.0 MT4 incorporates several advanced features that collectively enhance its scalping capabilities. Each component has been carefully designed to address specific aspects of the trading process, creating a comprehensive system that can identify, evaluate, and execute trading opportunities with exceptional precision.

Cross-Market Intelligence

One of the most sophisticated aspects of the AI Indices Scalper EA V1.0 MT4 is its cross-market intelligence module. This feature analyzes real-time correlations between the VIX (volatility index), USD Index, and 10-year Treasury yields to place predictive limit orders. By understanding how these markets interact, the EA can make more informed decisions about potential trading opportunities.

The VIX, often referred to as the "fear index," measures the expected volatility of the S&P 500 index. A high VIX indicates heightened market uncertainty, which can significantly impact the NASDAQ 100 index. The USD Index represents the value of the US dollar against a basket of currencies, and changes in this index can influence the prices of commodities and stocks, including those in the NASDAQ 100. The 10-year Treasury yield serves as a benchmark for interest rates and can influence stock valuations, with higher yields potentially making stocks less attractive and leading to lower prices.

By monitoring these indicators simultaneously, the EA can better predict market movements and place orders in positions that are more likely to be filled at favorable prices. This cross-market analysis provides context that individual market data alone cannot offer, allowing the system to identify potential breakout points with greater accuracy.

Breakout Engine

The Breakout Engine represents the heart of the AI Indices Scalper EA V1.0 MT4's scalping strategy. This feature combines two powerful neural network architectures to identify and exploit market breakouts with exceptional precision.

The first component is a Convolutional Neural Network (CNN), which is used for detecting volume spikes. Volume is a critical indicator in market analysis, often preceding significant price movements. When trading volume increases dramatically within a short time frame, it can signal the beginning of a breakout or trend change. The CNN analyzes historical volume patterns to identify what constitutes an anomalous spike, distinguishing genuine breakout signals from random noise.

The second component is a Recurrent Neural Network (RNN), which forecasts price ranges, specifically focusing on 1.5 to 3% volatility bands. This narrow range allows the EA to identify when the market is likely to make a significant move while minimizing false signals. The RNN learns from historical price movements, identifying patterns that precede successful breakouts and using this knowledge to predict future opportunities.

Adaptive Meta-Learning

The Adaptive Meta-Learning feature is what allows the AI Indices Scalper EA V1.0 MT4 to continuously improve its performance over time. This component uses reinforcement learning to adjust stop-loss and take-profit ratios based on the EA's performance history. By learning from past trades, the system can refine its strategy to maximize profitability while minimizing risk exposure.

Reinforcement learning is a type of machine learning where an agent learns to make decisions by trial and error, receiving rewards or penalties based on the outcomes of those decisions. In the context of the AI Indices Scalper EA V1.0 MT4, the "rewards" come in the form of profitable trades, while "penalties" come from unprofitable ones. The system uses these outcomes to adjust its trading parameters, gradually optimizing its approach to maximize positive results.

What makes this feature particularly powerful is its ability to adapt to changing market conditions. Traditional trading systems often rely on fixed parameters that may become less effective as market dynamics evolve. The AI Indices Scalper EA V1.0 MT4, however, can adjust its strategy in real time, ensuring that it remains effective even in volatile or unpredictable market environments.

How the AI Indices Scalper EA V1.0 MT4 Works

The AI Indices Scalper EA V1.0 MT4 operates through a sophisticated multi-step process that transforms raw market data into actionable trading decisions. This process is designed to identify high-probability trading opportunities and execute trades with optimal timing and parameters.

The system begins by continuously analyzing market data across multiple timeframes and instruments. It monitors price movements, volume data, and other technical indicators to build a comprehensive view of current market conditions. This analysis is performed in real time, allowing the EA to respond to market changes as they occur.

When a potential breakout is detected, the EA activates its predictive analytics to determine the likelihood of a successful trade. This involves evaluating historical patterns, current market volatility, and cross-market correlations to assess the strength of the breakout signal. Only when the probability of success meets predefined thresholds does the EA proceed to place a trade.

The trade execution process is equally sophisticated. The EA uses predictive limit orders based on its analysis of cross-market intelligence, placing orders at prices that are likely to be filled quickly at favorable rates. It also calculates optimal stop-loss and take-profit levels based on its volatility forecasting and reinforcement learning algorithms, ensuring that each trade has favorable risk-reward characteristics.

After a trade is executed, the system monitors its performance and uses the outcomes to refine its strategy. Profitable trades reinforce the parameters that led to success, while unprofitable ones trigger adjustments to avoid similar mistakes in the future. This continuous learning process ensures that the EA adapts to changing market conditions and improves its performance over time.

Benefits of AI-Powered Scalping

The integration of artificial intelligence into trading systems, particularly for scalping strategies, offers numerous advantages over traditional manual approaches. The AI Indices Scalper EA V1.0 MT4 exemplifies these benefits, providing traders with a powerful tool for executing precision breakout scalping with enhanced accuracy and efficiency.

Precision and Accuracy

Perhaps the most significant advantage of AI-powered scalping is the level of precision and accuracy it can achieve. AI systems can analyze vast amounts of data with remarkable speed and accuracy, identifying patterns and relationships that might be missed by human traders. They can process information from multiple sources simultaneously, providing a more comprehensive view of market conditions than any individual could achieve.

This precision extends to trade execution as well. AI systems can place orders with pinpoint accuracy, ensuring that trades are entered and exited at optimal price levels. This level of precision is particularly valuable in scalping strategies, where small price movements can represent significant profit opportunities.

The ability to identify and exploit small market inefficiencies repeatedly is a key factor in the success of scalping strategies. AI systems like the AI Indices Scalper EA V1.0 MT4 are designed to identify these opportunities with high accuracy, maximizing profit potential while minimizing false signals.

Adaptability to Changing Markets

Another major advantage of AI-powered trading systems is their adaptability to changing market conditions. Traditional trading systems often rely on fixed parameters that may become less effective as market dynamics evolve. AI systems, however, can adjust their strategies in real time, ensuring that they remain effective even in volatile or unpredictable market environments.

The reinforcement learning component of the AI Indices Scalper EA V1.0 MT4 is particularly important in this regard. By learning from past trades and adjusting its strategy based on outcomes, the system can continuously improve its performance and adapt to new market realities. This self-learning capability is a significant advantage in today's rapidly evolving financial markets.

Additionally, the system's ability to process and interpret real-time data allows it to respond quickly to market changes as they occur. Whether it's a sudden news event, a shift in market sentiment, or a change in technical conditions, the AI can adjust its approach accordingly, maintaining its effectiveness in changing circumstances.

Emotional Discipline and Consistency

One of the most challenging aspects of manual trading is maintaining emotional discipline and consistency. Human traders can be influenced by fear, greed, and other psychological factors that lead to suboptimal decision-making. They may hesitate to take losses, let winning trades run too long, or make impulsive decisions based on short-term emotions.

AI systems like the AI Indices Scalper EA V1.0 MT4 operate without emotional bias, making decisions based purely on data and predefined parameters. This emotional discipline ensures consistent decision-making, regardless of market conditions or recent trading performance. The system will execute its strategy exactly as designed, without being influenced by the psychological pressures that often affect human traders.

This consistency is particularly valuable in scalping strategies, where maintaining discipline is crucial for long-term success. By eliminating emotional decision-making from the process, AI-powered systems can achieve more consistent results over time.

Time Efficiency and Scalability

AI-powered trading systems also offer significant time efficiency advantages. While a human trader might need to devote considerable time to market analysis and trade execution, an AI system can perform these tasks automatically in the background. This allows traders to focus on higher-level strategic decisions rather than getting bogged down in the details of individual trades.

Furthermore, AI systems are highly scalable, capable of monitoring and trading multiple markets or instruments simultaneously without any degradation in performance. This scalability makes them particularly valuable for traders who manage multiple accounts or trade across different asset classes.

The time efficiency and scalability of AI-powered systems like the AI Indices Scalper EA V1.0 MT4 allow traders to focus on value-added activities while letting the system handle the mechanical aspects of trading. This can lead to more effective use of time and potentially better overall results.

Implementing the AI Indices Scalper EA V1.0 MT4 in Your Trading Strategy

The AI Indices Scalper EA V1.0 MT4 is designed to be user-friendly and compatible with the MetaTrader 4 platform, one of the most popular trading platforms for forex and CFD trading. To start using this powerful tool, traders need to follow a few simple steps to set it up and configure it for their trading strategy.

First, the EA must be installed on the trader's MetaTrader 4 account. This typically involves downloading the EA file and adding it to the MetaTrader 4 platform through the appropriate menu options. The exact installation process may vary slightly depending on the specific version of MetaTrader 4 being used and the source from which the EA is obtained.

Once installed, the next step is to configure the necessary parameters. The primary parameters to set are the symbol (USTEC for NASDAQ 100) and the timeframe (M15). These settings ensure that the EA is trading the correct market with the appropriate time horizon. Traders may also need to specify account-specific details such as leverage, lot size, and risk parameters, depending on how the EA is designed.

After configuration, the EA will begin analyzing the market and executing trades automatically based on its AI algorithms. The system will continuously monitor price movements, volume data, and cross-market correlations, placing trades when high-probability opportunities are identified.

The Future of AI in Trading: Implications and Outlook

The integration of artificial intelligence into trading systems, exemplified by tools like the AI Indices Scalper EA V1.0 MT4, represents a significant evolution in how financial markets are approached. As AI technology continues to advance, its impact on trading is likely to grow, leading to new possibilities and challenges for traders at all levels.

Evolution of Trading Technology

The journey from traditional, emotion-driven trading to AI-powered systems like the AI Indices Scalper EA V1.0 MT4 represents a natural progression in trading technology. Early trading systems relied heavily on human intuition and experience, with limited analytical tools. As technology advanced, traders gained access to more sophisticated charting tools, technical indicators, and backtesting capabilities. Today, AI systems are taking this evolution further, automating not just the analysis but also the decision-making process.

This evolution has democratized trading in many ways, making advanced analytical capabilities available to traders who might not have the time, resources, or expertise to perform this analysis manually. At the same time, it has raised questions about the role of human judgment in trading decisions and the potential for overreliance on automated systems.

Balancing Automation and Human Oversight

As AI systems like the AI Indices Scalper EA V1.0 MT4 become more sophisticated, one of the key challenges is striking the right balance between automation and human oversight. While automation can provide speed, precision, and emotional discipline, it also removes the human element that can account for unpredictable events or unique market conditions.

The most effective approach is likely to be a hybrid model, where AI systems handle routine tasks like data analysis and trade execution, while human traders provide strategic direction and make critical decisions in exceptional circumstances. This balance allows for the efficiency and precision of automation while retaining the flexibility and judgment that only humans can provide.

For traders using the AI Indices Scalper EA V1.0 MT4, this means monitoring the system's performance, understanding its underlying logic, and being prepared to intervene when appropriate. It also means continuously evaluating the system's effectiveness and making adjustments based on changing market conditions and trading objectives.

Conclusion: Revolutionizing Scalping with AI

The AI Indices Scalper EA V1.0 MT4 represents a significant advancement in trading technology, particularly for scalping strategies on the NASDAQ 100 index. By leveraging advanced AI techniques, including Transformer-based neural architectures, convolutional and recurrent neural networks, and reinforcement learning, this Expert Advisor offers a sophisticated approach to identifying and exploiting market breakouts with precision and consistency.

The system's multi-faceted approach, incorporating cross-market intelligence, a dedicated Breakout Engine, and adaptive meta-learning capabilities, creates a comprehensive solution for precision breakout scalping. Its ability to analyze real-time correlations between different market indicators, detect volume spikes indicative of breakouts, and adjust its strategy based on performance history makes it well-suited for the fast-paced world of scalping.

Join our Telegram for the latest updates and support

Comments

Leave a Comment