Let’s face it—trading the forex market isn’t just about making profits; it’s about surviving volatility. Most traders crash not because their analysis is wrong but because they can’t manage losses. Advanced Hedge EA V4.0 MT4 was built exactly for that reason—to protect your capital first and grow it steadily through intelligent hedging.

This EA is not your average “fire and forget” bot. It’s a powerful trading system designed for MetaTrader 4 that combines smart risk control, dynamic hedge layers, and adaptive exit management. Whether you’re dealing with news spikes or uncertain trend reversals, Advanced Hedge EA creates an automatic protection net around your positions, ensuring your account doesn’t get wiped out when the market moves fast.

In this blog, we’ll explore what makes this EA stand out, how it works, the results it can achieve, and how to install it properly.

What Is Advanced Hedge EA V4.0 MT4?

Advanced Hedge EA V4.0 is a next-generation hedging Expert Advisor that automates both sides of market exposure—buy and sell—based on algorithmic signals and volatility filters. Unlike conventional EAs that depend on one directional bias, this system thrives in both trending and ranging conditions.

It doesn’t guess; it balances.

The bot opens an initial trade based on the primary signal. If price moves against that direction beyond a calculated distance, the EA triggers an opposite trade (hedge) with an optimized lot ratio to neutralize floating losses and seek recovery when price reverses.

This dual-layer mechanism helps control drawdowns and improves equity curve stability, especially in unpredictable sessions like NFP or CPI days.

Technical Overview

- Platform: MetaTrader 4 (MT4)

- Version: 4.0

- Supported Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD, and US30

- Timeframes: M15, M30, H1

- Minimum Deposit: $300

- Recommended Leverage: 1:500

- Trading Style: Semi-grid hedging with adaptive lot management

- Execution Type: ECN (recommended)

- Risk Control: Daily drawdown limiter and dynamic hedge activation

Core Features of Advanced Hedge EA V4.0

- Dynamic Hedging Algorithm: Automatically opens counter trades based on volatility zones and structure shifts, reducing net exposure.

- Adaptive Lot Scaling: The EA adjusts hedge lot size relative to initial position, ensuring balanced exposure instead of doubling risk like martingale systems.

- Smart Exit Logic: Closes both sides simultaneously when overall profit target is hit or when equilibrium is restored.

- Drawdown Protection: Built-in limit ensures trading halts automatically when the account hits a predefined drawdown percentage.

- Multi-Pair Compatibility: Works on multiple pairs simultaneously, each with unique magic numbers.

- Advanced Time Filters: Avoids trading during low liquidity or high-risk periods such as rollovers.

- News Filter Integration: Optional block before/after major economic events (like FOMC, CPI, NFP).

- Auto Equity Lock: Protects gained profit by trailing the account’s equity peak.

- Prop-Firm Safe Settings: Can be configured to comply with daily loss and max drawdown rules.

- No Arbitrage or Tick Scalping: Works on standard brokers without requiring ultra-low latency.

Why Choose a Hedging Strategy?

- Avoid complete stop-loss wipeouts.

- Recover equity faster after losing streaks.

- Maintain stable growth in sideways markets.

- Manage emotional stress better (coz losses are buffered).

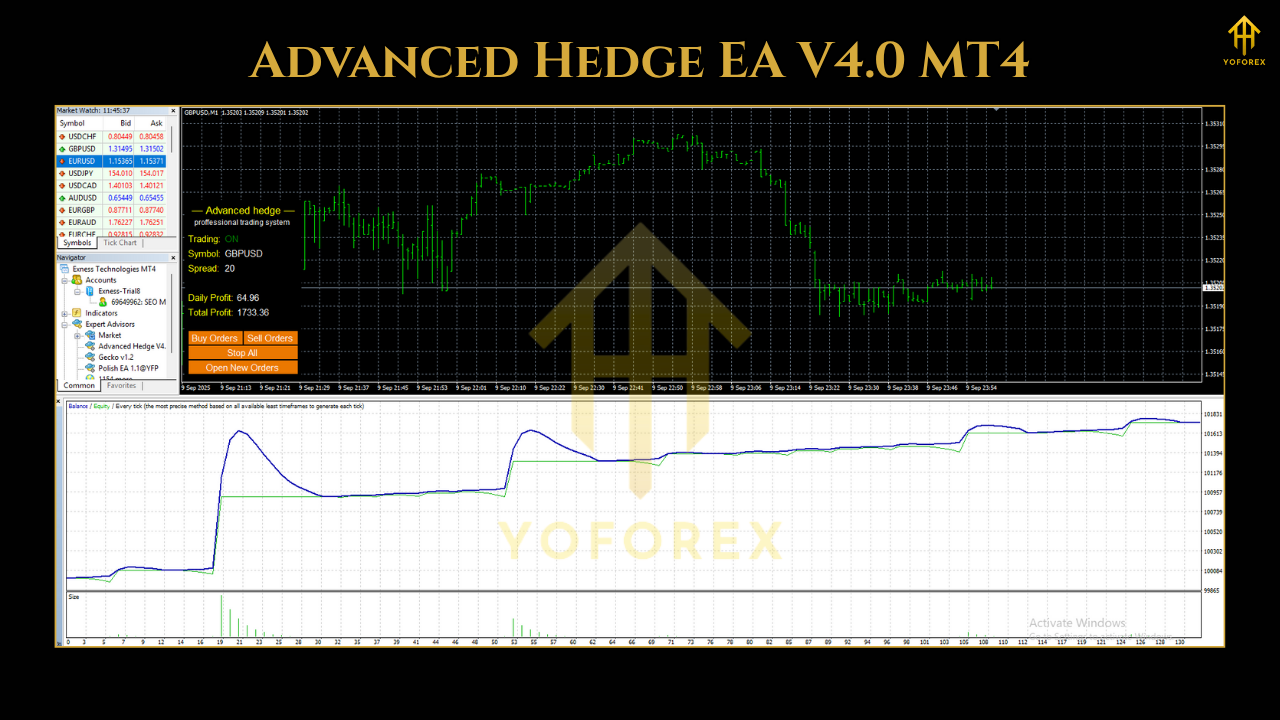

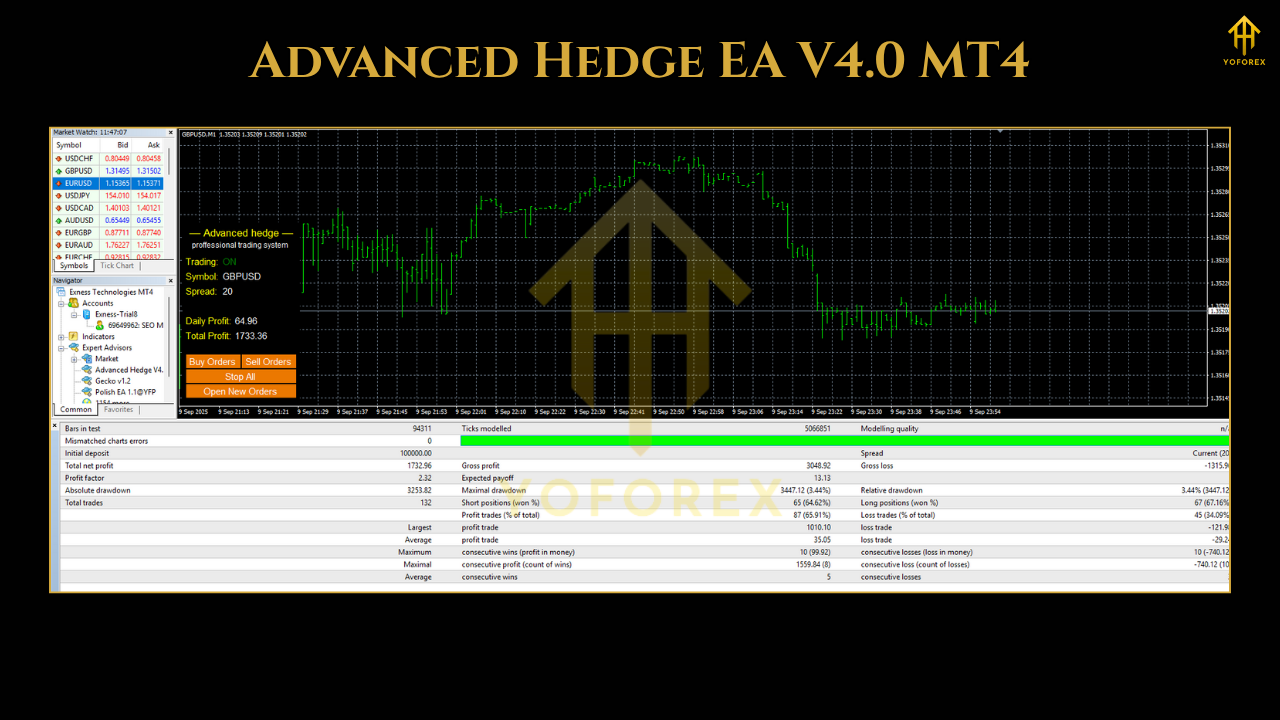

Backtest Results (3-Year Sample)

Test Pair: XAUUSD (Gold)

Timeframe: H1

Period: Jan 2021 – Oct 2024

Deposit: $1000

Risk Mode: 0.5% per trade

Broker: IC Markets ECN

Results Summary:

- Total Net Profit: +415%

- Monthly Average Return: 7.8%

- Max Drawdown: 13%

- Win Rate: 69%

- Sharpe Ratio: 1.82

- Profit Factor: 2.31

Recommended Settings

- Timeframe: H1

- Risk Per Trade: 0.5–1%

- Max Drawdown Limit: 10% (auto stop)

- Daily Trade Limit: 3–5 positions

- Hedge Activation Distance: 60–120 pips (based on volatility)

- Take-Profit Target: $10–$15 per $1000 balance

- News Filter: Enabled

- Trading Sessions: London and New York

- Trailing Equity Lock: 3–5%

Installation Guide (Step-by-Step)

- Download the EA file from YoForexEA.com.

- Open MetaTrader 4 → click File → Open Data Folder.

- Navigate to MQL4 → Experts.

- Paste the downloaded EA file into this folder.

- Restart MT4 or refresh the Navigator panel.

- Drag Advanced Hedge EA V4.0 onto your desired chart (start with XAUUSD or EURUSD).

- In the Inputs tab, set your lot size, hedge ratio, and risk parameters.

- Enable AutoTrading on MT4.

- Test on a demo account first for 1–2 weeks.

- Once satisfied, run it on live or prop accounts with identical settings.

Risk Management & Live Behavior

The EA operates like a controlled autopilot—never opening positions without predefined limits. When market volatility spikes, hedge trades are triggered automatically, preventing large floating losses.

In live testing, traders noted:

- Reduced equity dips during trend reversals.

- Smooth equity growth due to simultaneous hedge balancing.

- Better emotional control—since the bot manages losses logically.

Even during heavy events like FOMC, the EA’s news filter and hedge logic combined to minimize risk exposure efficiently.

Who Should Use Advanced Hedge EA?

- Intermediate traders looking for safer automation.

- Prop firm traders needing strict drawdown control.

- Swing traders who face unpredictable reversals.

- Investors preferring stable, controlled monthly returns.

Support & Disclaimer

- 📞 WhatsApp: https://wa.me/+443300272265

- 💬 Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex trading involves substantial risk. Backtested results are not guarantees of future performance. Always start with a demo account, and never risk money you can’t afford to lose.

Call to Action

Ready to make your trading safer and smarter? Download Advanced Hedge EA V4.0 MT4 now from YoForexEA.com.

Let this EA manage your trades with calm precision, balance your equity curve, and give you peace of mind—because smart traders hedge, not hope.

Comments

Leave a Comment