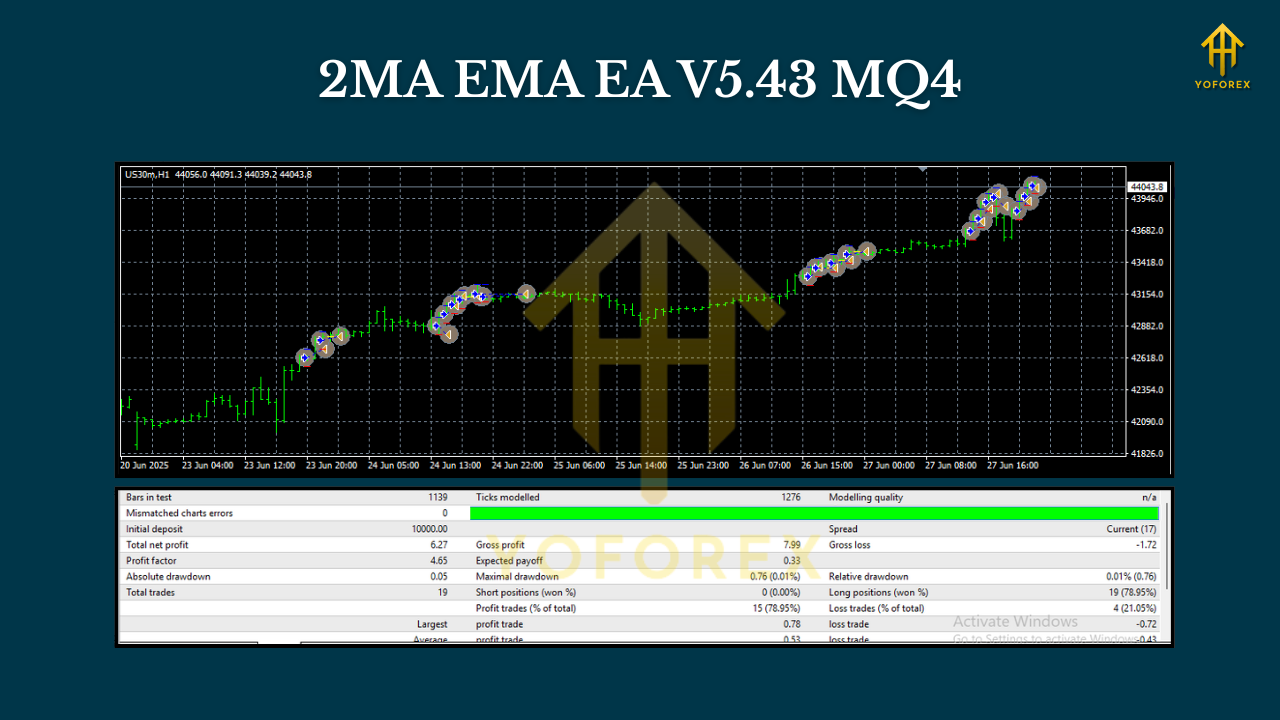

2MA EMA EA V5.43 MQ4: A Powerful Trading Solution for USDJPY and US30

The 2MA EMA EA V5.43 MQ4 is an advanced Expert Advisor designed for forex traders looking to optimize their trading strategies for USDJPY and US30 pairs. This EA employs the classic Exponential Moving Average (EMA) indicator combined with a dual moving average strategy, helping traders identify optimal trade entries and exits. With its ability to trade on H1 and H4 timeframes, this EA is ideal for traders who prefer a combination of both short-term and medium-term strategies.

How the 2MA EMA EA Works:

The core of the 2MA EMA EA V5.43 lies in its dual moving average system. By using two EMAs, the EA analyzes price movements with greater precision. The shorter EMA reacts faster to price changes, while the longer EMA offers a smoother view of the overall trend. When both EMAs align in a specific manner, it triggers trade signals—either buying or selling, depending on market conditions.

- Buy Signal: When the fast EMA crosses above the slow EMA, indicating a potential bullish trend.

- Sell Signal: When the fast EMA crosses below the slow EMA, signaling a possible bearish trend.

Key Features of the 2MA EMA EA V5.43:

- Dual EMA Strategy: Uses two Exponential Moving Averages for dynamic market analysis.

- Timeframe Flexibility: Compatible with both H1 (hourly) and H4 (four-hour) charts, allowing for diversified trading styles.

- Customizable Settings: Allows traders to adjust the periods for both EMAs and fine-tune the risk management parameters.

- User-Friendly Interface: Easy to set up and configure for both novice and experienced traders.

- Compatibility: Works seamlessly with MetaTrader 4 (MT4), making it accessible for traders using this popular platform.

Benefits of Using the 2MA EMA EA V5.43:

- Effective Trend Detection: The combination of fast and slow EMAs provides accurate trend signals, helping traders catch large moves in the market.

- Time Efficiency: Automates the trading process, saving time while maintaining consistency in trade execution.

- Reduced Emotional Trading: The EA removes the emotional aspect of trading by relying on objective, data-driven signals.

- Increased Profit Potential: By aligning trades with the prevailing market trends, this EA can help increase the chances of profitable trades.

Best Pairs for Trading with 2MA EMA EA V5.43:

- USDJPY: A highly liquid pair with a wide range of price action, ideal for traders looking to capitalize on both short-term and long-term trends.

- US30: The Dow Jones Industrial Average offers ample volatility, which is perfect for the dual EMA strategy. The EA can capitalize on the large price movements in this index.

How to Set Up the 2MA EMA EA V5.43:

- Download the EA: Ensure you have the MQ4 file for the 2MA EMA EA V5.43.

- Install the EA on MT4: Place the file in the

Expertsfolder in your MT4 directory. - Configure the Settings: Adjust the fast and slow EMA periods, set stop loss/take profit levels, and configure risk management settings as per your trading preferences.

- Start Trading: Once the setup is complete, run the EA on your preferred charts (USDJPY or US30) with the H1 or H4 timeframe.

Performance and Backtesting:

Before deploying any Expert Advisor in live markets, backtesting is essential. The 2MA EMA EA V5.43 provides a reliable performance in backtests, particularly for USDJPY and US30, making it a robust tool for traders looking to automate their strategies.

- USDJPY: The EA performs well due to the pair's liquidity and market efficiency.

- US30: The EA capitalizes on the strong trend movements of the US30 index, offering substantial profit opportunities.

Conclusion:

The 2MA EMA EA V5.43 MQ4 is a versatile and efficient tool that suits both new and experienced traders. With its clear and customizable trade signals, it simplifies decision-making while providing robust risk management. Whether you're trading USDJPY or US30, this Expert Advisor will ensure that you're always in sync with the market's trends.

Comments

Leave a Comment