PZ 123 Pattern Indicator V1: A Valuable Strategy Guide

The PZ 123 Pattern Indicator V1 is a powerful tool designed to identify 123 chart patterns (also known as ABCD patterns) on your trading charts. These patterns are essential for recognizing potential trend reversals and continuation points. In this guide, we’ll explore the recommended settings, timeframes, and currency pairs to maximize the effectiveness of this indicator.

Recommended Settings

- Indicator Name: PZ 123 Pattern Indicator V1

- Timeframes: H1 (1-hour chart) and M1 (1-minute chart)

- Currency Pairs: XAUUSD (Gold/US Dollar), EURUSD (Euro/US Dollar), GBPUSD (British Pound/US Dollar)

Strategy

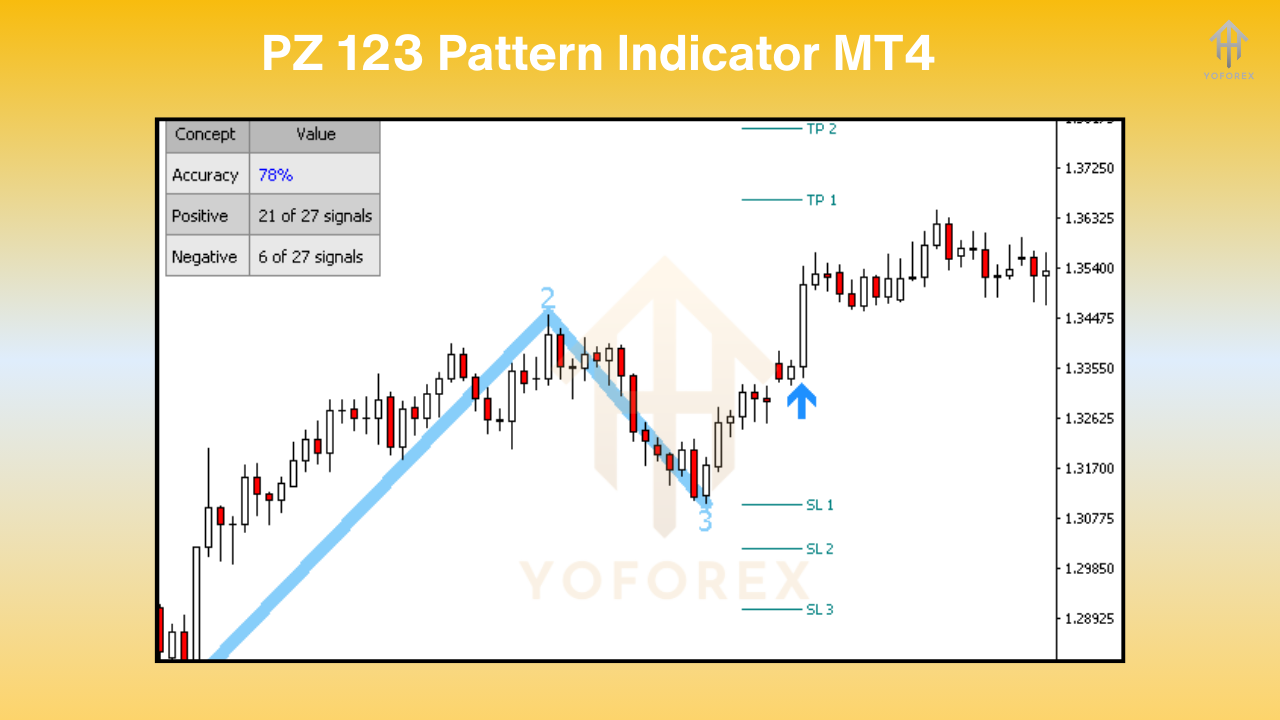

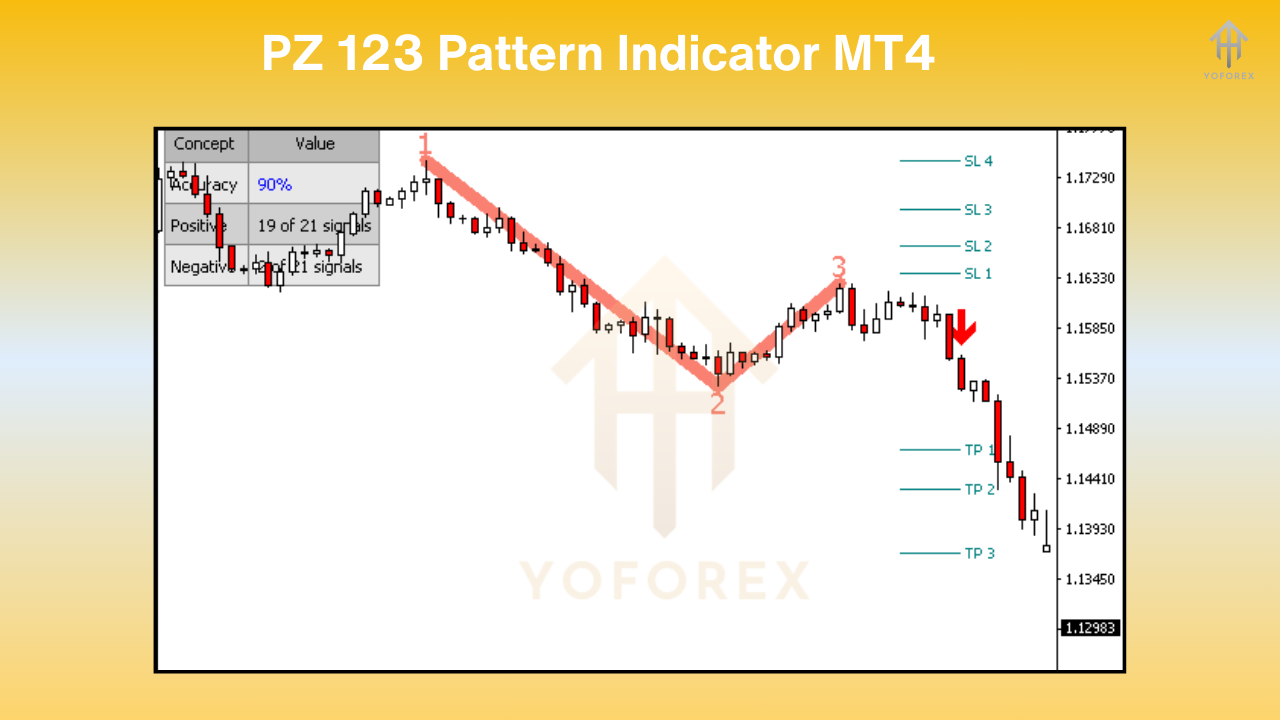

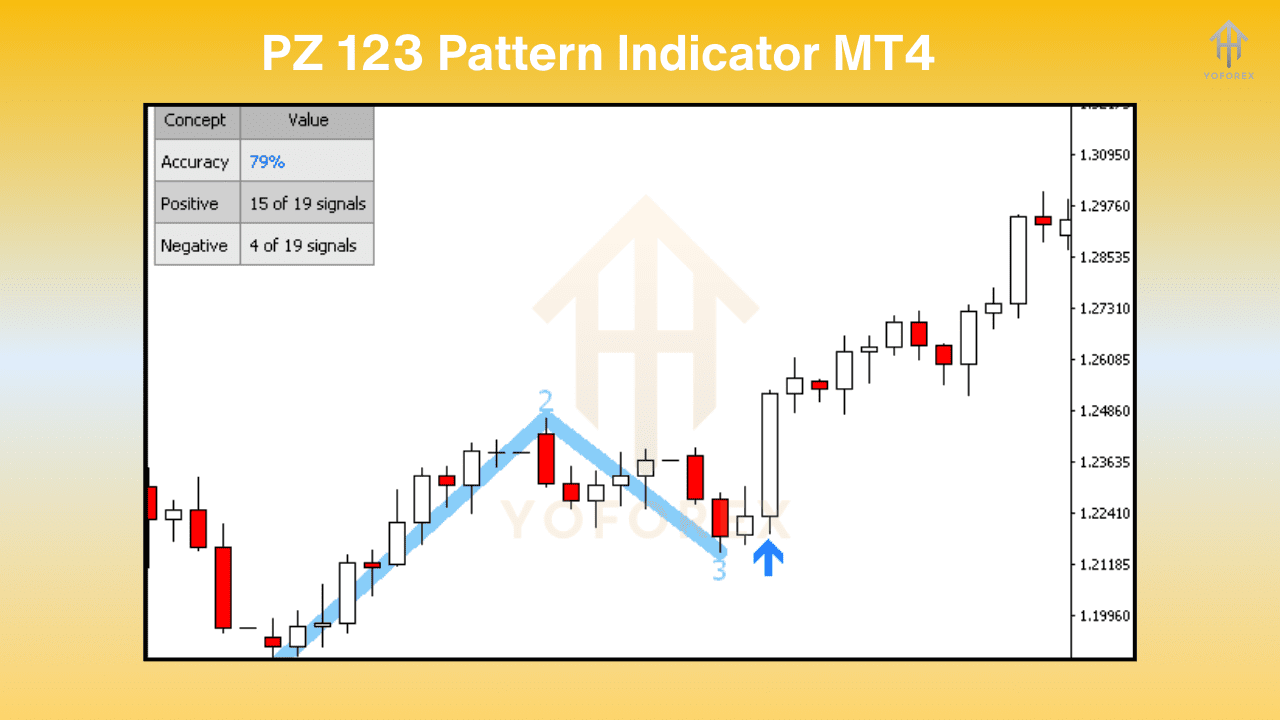

- Pattern Recognition:

- The indicator scans the price chart for 123 patterns.

- A 123 pattern consists of three consecutive price swings:

- 1st Swing (Leg): The initial move in the direction of the trend.

- 2nd Swing (Correction): A retracement against the trend.

- 3rd Swing (Resumption): The price resumes in the direction of the original trend.

- The indicator marks these patterns with visual cues (arrows or shapes) on the chart.

- Entry Conditions:

- Long Trade (Buy):

- Look for a bullish 123 pattern (higher lows).

- Wait for the price to break above the high of the 3rd swing (resumption).

- Enter a long position.

- Short Trade (Sell):

- Look for a bearish 123 pattern (lower highs).

- Wait for the price to break below the low of the 3rd swing (resumption).

- Enter a short position.

- Long Trade (Buy):

- Stop Loss and Take Profit:

- Set your stop loss below the low of the 2nd swing (correction) for long trades and above the high of the 2nd swing for short trades.

- Take profit can be set at the next significant support/resistance level or based on your risk-reward ratio.

- Risk Management:

- Use proper risk management techniques.

- Consider risking a small percentage of your account balance per trade (e.g., 1% or 2%).

- Trade Management:

- Monitor the trade and adjust the stop loss as the pr ice moves in your favor.

- Consider trailing your stop loss to lock in profits.

You Can Also Connect To Us With !!

Telegram Link – https://t.me/yoforexrobot

Download The Bot – https://yoforexea.com/index.php/product/pz-123-pattern-indicator-v1/

Our official Website – https://yoforexea.com/

There are no reviews yet.