STGFX – Complete Trading Indicator MT4: Trading Strategy Overview

The STGFX – Complete Trading Indicator is a powerful trading tool designed to assist in executing automated trades on the MetaTrader 4 (MT4) platform. It operates based on a detailed set of market conditions and is programmed to make precise decisions for entering and exiting trades. Below is a comprehensive guide to the minimum deposit, recommended time frame, currency pairs, and the trading strategy behind the EA.

1. Minimum Deposit

To get started with STGFX – Complete Trading Indicator MT4, you should consider the following factors for the minimum deposit:

| Account Type | Minimum Deposit | Recommended Leverage |

|---|---|---|

| Standard Account | $100 – $200 | 1:100 – 1:500 |

| Cent Account | $50 – $100 | 1:100 – 1:200 |

| ECN Account | $500 and above | 1:50 |

Note: The minimum deposit might vary depending on the broker’s policies. It’s important to have enough capital to allow for proper risk management and avoid margin calls.

2. Time Frame to Run

The STGFX indicator can be used effectively across different time frames, but to optimize its performance, it’s crucial to choose the correct time frame for your trading style.

| Time Frame | Recommended Use | Strategy Focus |

|---|---|---|

| M1 – M5 | Short-term scalping | Quick trades based on small price movements |

| M15 – M30 | Intraday trading with moderate risk tolerance | Suitable for trend-following strategies |

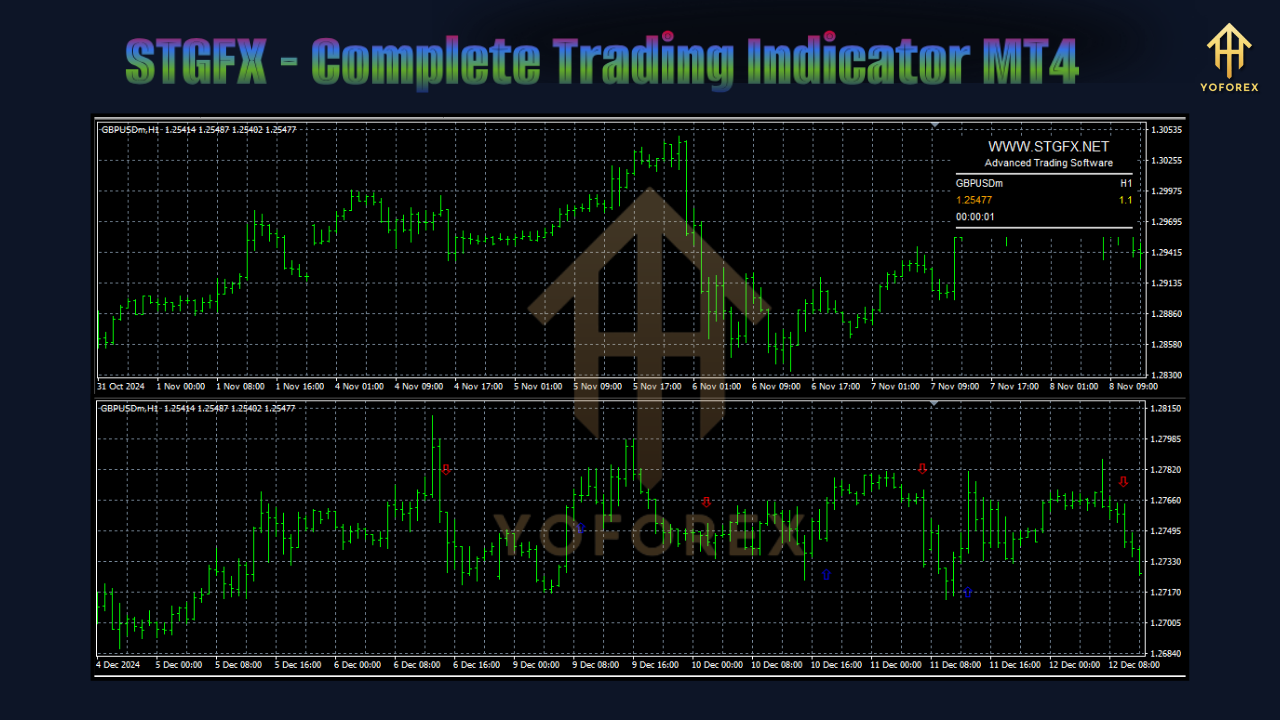

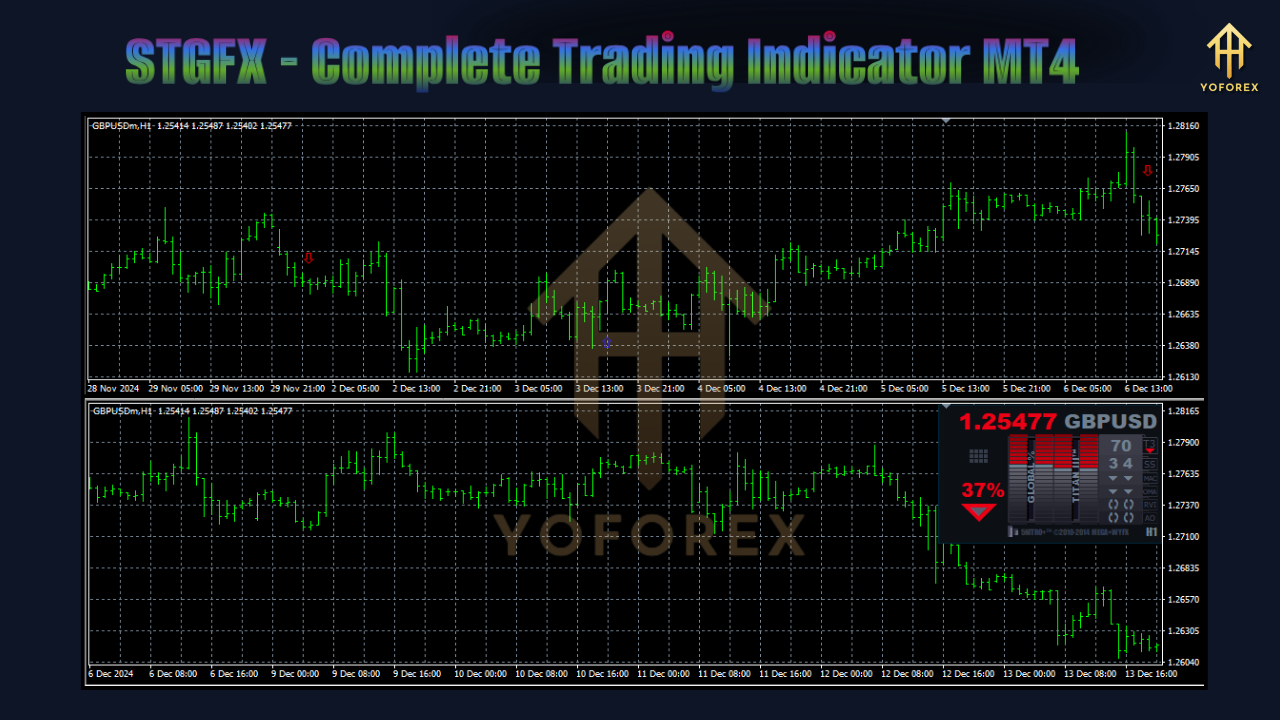

| H1 – H4 | Swing trading | Captures larger market moves with reduced noise |

| D1 | Long-term trading | Focuses on major trends and higher timeframe analysis |

Recommended Time Frame: The M15 (15-minute) and H1 (1-hour) time frames work well for most traders as they offer a balance between signal frequency and market noise.

3. Currency Pairs to Trade

STGFX works best with major currency pairs due to their liquidity and tighter spreads. The recommended currency pairs are:

| Currency Pair | Recommended for | Risk Level |

|---|---|---|

| EUR/USD | High liquidity and consistent movement | Low to Medium |

| GBP/USD | Volatile but high-potential moves | Medium to High |

| USD/JPY | Stable with good market behavior | Low to Medium |

| AUD/USD | Moderate volatility and favorable for scalping | Medium |

| USD/CHF | Stable price action, minimal risk | Low |

Best Pairs: EUR/USD and GBP/USD are typically favored for day trading due to their volatility and liquidity. However, USD/JPY can be a more stable option for conservative traders.

4. The Trading Strategy Behind STGFX – Complete Trading Indicator

The STGFX indicator relies on a combination of technical analysis and market sentiment to decide when to place a trade. Here’s a breakdown of how the EA makes trading decisions:

- Trend Detection: The EA uses trend-following algorithms to identify the overall market direction, utilizing tools like Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). When these indicators align, the EA confirms a strong trend and places a trade in that direction.

- Signal Confirmation: The indicator waits for confirmation of a reversal or continuation signal, using factors such as:

- Support and resistance levels

- Candlestick patterns

- Volume analysis

- Entry Criteria: Once the trend direction and confirmation are clear, the EA places a buy or sell order. It often does this when:

- The price breaks through significant support/resistance levels

- RSI signals overbought or oversold conditions

- MACD shows momentum shifts

- Risk Management: The STGFX EA applies stop-loss and take-profit levels based on pre-defined percentage risk and recent market volatility. It will automatically adjust the position size and stops based on your risk settings.

- Trade Exit: The EA exits trades when:

- The price reaches a predetermined target (take-profit level)

- Market conditions suggest a trend reversal

- The price hits the stop-loss level, limiting the loss

5. Conclusion: How to Maximize Your Results

To get the best out of STGFX – Complete Trading Indicator MT4, it’s essential to:

- Choose the appropriate time frame for your trading style.

- Start with a minimum deposit suitable for your account type and leverage.

- Stick to major currency pairs that offer liquidity and lower spreads.

- Understand the trading strategy employed by the EA, which focuses on trend-following with risk management.

By following these steps, you can enhance the effectiveness of the STGFX indicator and make well-informed trading decisions that maximize your trading results.

Disclaimer: Trading involves risks, and past performance is not indicative of future results. Always conduct thorough research and seek professional advice before trading.📈🍀

Stay Updated:

For more support join our Telegram Channel : https://t.me/+eo74nsL9xXI1YTFl

Additional Resources:

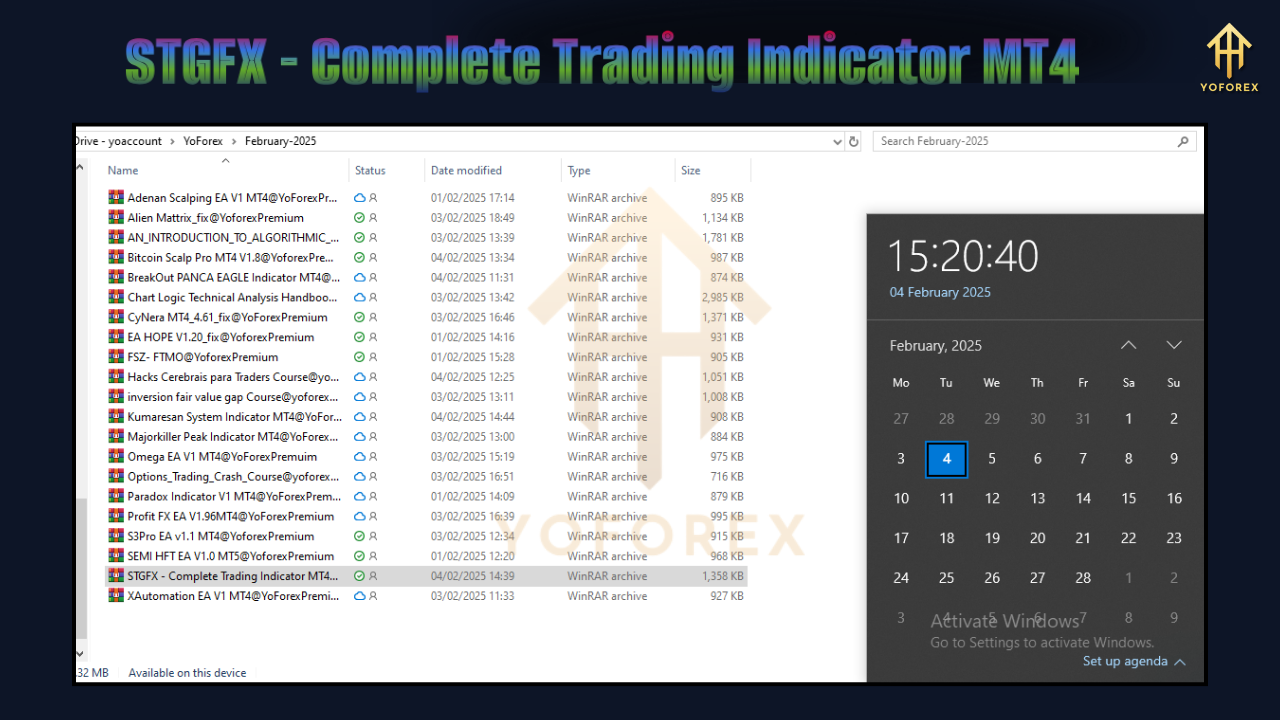

Instant Download: https://yoforexea.com/product/stgfx-complete-trading-indicator/

You can also download from other websites:

https://www.fxcracked.org/product/stgfx-complete-trading-indc/

https://www.forexfactory.cc/product/stgfx-complete-trading-indicator/

There are no reviews yet.