CFF Guru Grid EA V1.0 MT4: Optimize Your Trading Strategy with Automated Grid Trading

The CFF Guru Grid EA V1.0 MT4 is an advanced Expert Advisor designed to automate the grid trading strategy. This EA enables traders to capture profits in fluctuating markets by placing multiple buy and sell orders at predefined intervals, making it a valuable tool for traders seeking to maximize their returns.

Recommended Settings for CFF Guru Grid EA V1.0 MT4

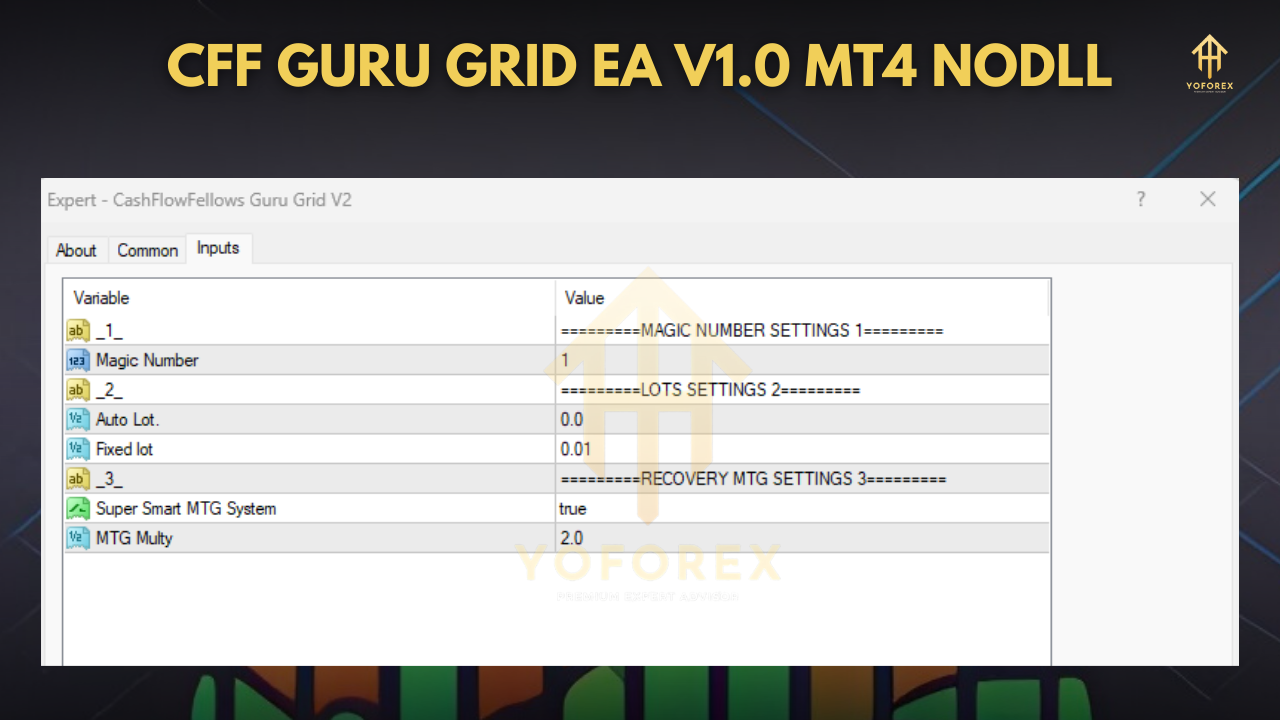

- Lot Size: The Lot Size parameter should be adjusted based on your account balance and risk tolerance. Beginners may prefer a smaller lot size to minimize risk, while more experienced traders can set a larger lot size to maximize potential profits.

- Grid Size: The Grid Size defines the spacing between each buy and sell order. A larger grid size reduces the number of trades, but each trade can capture a larger profit. Conversely, a smaller grid size leads to more frequent trades, capturing smaller price movements. Traders should choose the grid size according to their trading style and market volatility.

- Take Profit (TP): Setting a Take Profit level ensures that the EA closes trades once a predefined profit target is reached. This helps lock in profits and ensures that the trades are closed in a timely manner. The TP level can be adjusted based on the trader’s goals and market conditions.

- Stop Loss (SL): The Stop Loss level is essential for managing risk. Setting a proper SL will prevent significant losses if the market moves against the trade. It’s important to adjust the SL according to the volatility of the currency pair being traded.

- Maximum Open Orders: This setting limits the number of open orders at any given time, which helps manage the overall exposure to the market. Traders can adjust this parameter based on their risk management strategy and trading goals.

- Timeframe (H1, H4): The CFF Guru Grid EA is optimized for the H1 and H4 timeframes. The H1 timeframe captures short-term price movements, while the H4 timeframe is suitable for medium-term trends. Traders should choose the timeframe that aligns with their trading style and market analysis.

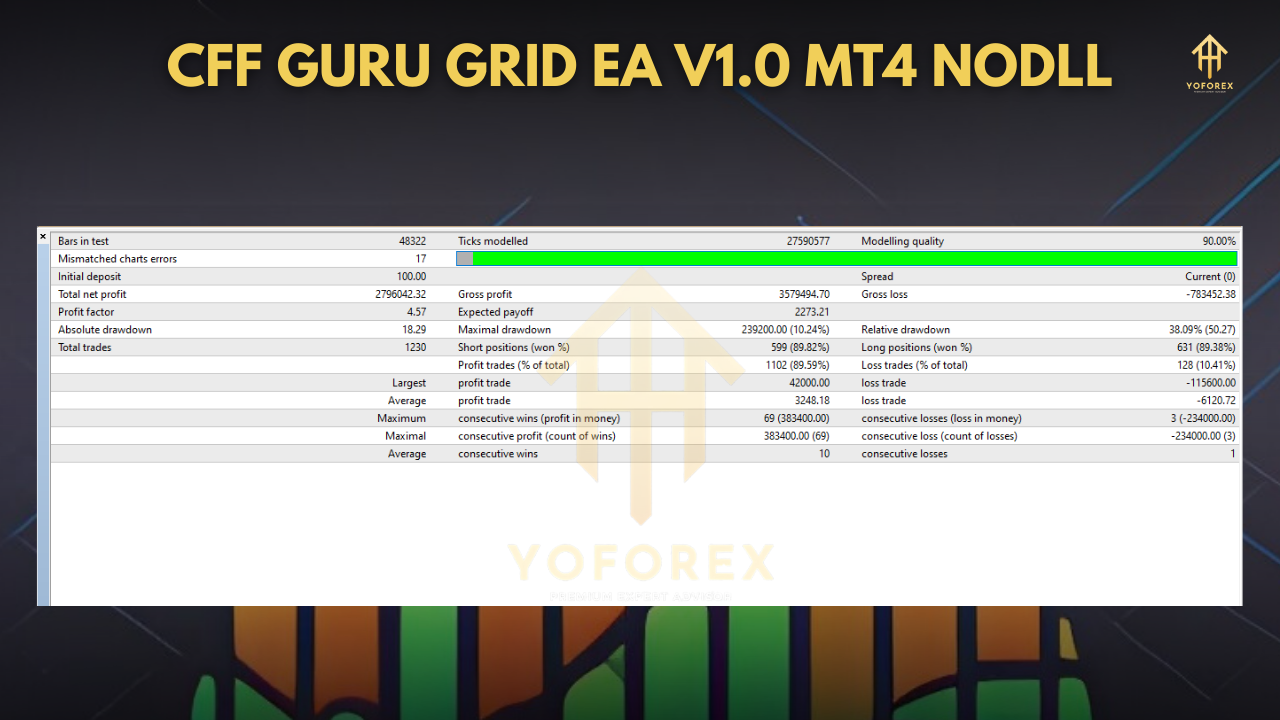

- Minimum Deposit: $100 – $300

Key Features of CFF Guru Grid EA V1.0 MT4

- Automated Grid Trading: The EA automates the grid trading strategy, opening buy and sell orders at predefined price intervals. This allows the EA to capitalize on both upward and downward market movements, ensuring that traders can benefit from price fluctuations.

- Customizable Risk Settings: With settings such as Lot Size, Grid Size, Stop Loss, and Take Profit, traders have full control over their risk management. These customizable features help ensure that the EA operates within the trader’s risk tolerance and objectives.

- Multi-Currency Pair Compatibility: The EA is optimized for popular currency pairs such as XAUUSD, EURUSD, and GBPUSD. However, it can be applied to other currency pairs with low spreads, offering traders flexibility in selecting the most suitable instruments.

- Timeframe Optimization: The CFF Guru Grid EA works on both the H1 and H4 timeframes. This flexibility allows traders to adapt the EA to different market conditions, whether they are looking to capture short-term moves or longer-term trends.

- Risk Management Tools: Built-in risk management features, such as adjustable Stop Loss, Take Profit, and Maximum Open Orders, ensure that the EA remains within safe trading parameters, minimizing potential drawdowns and maximizing the probability of success.

- Scalability: The CFF Guru Grid EA can be easily scaled according to the trader’s account size. By adjusting the Lot Size and Grid Size, traders can adapt the EA to different account balances and trading styles.

How CFF Guru Grid EA V1.0 MT4 Works

- Grid Formation: The EA begins by opening an initial buy or sell order at the current market price. It then places additional buy and sell orders at predefined intervals, creating a grid-like structure. The grid size determines the distance between each order.

- Order Execution: When the price moves in either direction, the EA opens new orders in the same direction. If the price reverses, the EA opens orders in the opposite direction. This allows the EA to profit from both market trends and reversals.

- Risk Management: The Stop Loss and Take Profit levels are set for each order. If the market moves in favor of the trade, the EA will lock in profits at the Take Profit level. If the market moves against the trade, the EA will close the position at the Stop Loss level to limit potential losses.

- Maximum Open Orders: The Maximum Open Orders setting limits the number of open positions at any given time, ensuring that the EA does not overexpose the account to market risk.

Strategy: A Balanced Grid Trading Approach

- Trending Markets: In trending markets, the EA opens orders in the direction of the prevailing trend. By using grid intervals, the EA ensures that even if the market retraces, it can still capture profits when the trend resumes.

- Range-Bound Markets: In range-bound markets, the EA places buy and sell orders at key support and resistance levels. When the price reaches these levels, the EA executes trades, capturing profits from price reversals.

- Risk Control: The EA includes built-in risk management tools that allow traders to limit losses and protect profits. The Stop Loss and Take Profit levels help ensure that the trades are closed within a predefined range, reducing the risk of significant drawdowns.

Join Our Telegram

You Can visit other Websites & Download this Bot

https://www.fxcracked.org/product/cff-guru-grid-ea-v1-0/

https://www.forexfactory.cc/product/cff-guru-grid-ea-v1-0/

https://yoforexea.com/product/cff-guru-grid-ea-v1-0/

https://www.yoforex.org/product/cff-guru-grid-ea-v1-0/

There are no reviews yet.