If you’ve been around discretionary trading for a minute, you’ve probably heard of the “Holy Grail” pullback concept—ride a strong trend and buy/sell the first clean pullback to a moving average. LBR Holy Grail EA V3.0 for MT4 packages that idea into a disciplined, rules-based Expert Advisor, combining an ADX/ADXR trend filter with a 20-EMA pullback and pragmatic exit logic. No guesswork, no chart babysitting—just a systematic way to harvest trend continuations while controlling drawdown.

Quick Specs

- Platform: MetaTrader 4 (MT4)

- Markets: EURUSD, GBPUSD, USDJPY, US30, XAUUSD (Gold) (test per broker)

- Timeframes: M15–H1 (popular), H4 for swing; M5 for advanced scalpers

- Method: ADX/ADXR trend strength filter + pullback to 20 EMA (configurable)

- Money Management: Fixed lots or balance/ATR-based; optional partial exits

- Account Types: Standard/ECN; hedging optional; FIFO users should check rules

- Skill Level: Beginner-friendly presets; advanced users can tweak deeply

What Makes This EA Different?

1) Trend Strength First, Trade Second

The EA reads ADX or ADXR to determine whether the market is “trending enough” to justify pullback entries. You set a minimum threshold (e.g., ADX ≥ 20–25). If momentum weakens, new entries pause—saving you from chop.

2) The Pullback Engine

When the trend is live, the EA waits for price to revert toward the 20 EMA (default) and prints a trigger once momentum re-aligns with the trend (e.g., close back above the EMA in an uptrend). You can require a micro pattern (engulfing/pin-like confirmation) for cleaner entries.

3) Smart Exits (Because Entries Are Only Half the Story)

Choose between fixed TP/SL, ATR-based dynamic stops, breakeven after x R, and partial take-profits (e.g., 50% at 1R, runner with a trailing stop behind the 20 EMA or swing structure). There’s also an optional time-based exit to flatten late Friday or ahead of news.

4) Equity Protection & Session Control

Cap daily drawdown, halt trading after n losses, and limit entries to high-liquidity sessions (London/NY). A spread/slippage filter avoids bad fills; a news pause (if you enable it) can stand down around red-label events.

5) No Forced Martingale or Grid

By default, the EA is one-shot per signal with optional scale-in rules (non-martingale) for advanced users. If you don’t enable them, it won’t stack.

Key Features (At a Glance)

- ADX/ADXR Trend Filter: Trade only when trend strength meets your threshold.

- EMA Pullback Logic: Default 20 EMA (configurable MA type/period).

- Confirmation Candle: Optional bar pattern or momentum re-alignment.

- Multi-Timeframe Bias (Optional): Align entries on M15 with H1 slope/EMA.

- ATR-Based Risk: Dynamic SL/TP adapts to volatility.

- Partial Close & Breakeven: Bank chips early; let the runner ride.

- Trailing Behind Structure/EMA: Keep gains during trend legs.

- Daily DD Guard & Trade Halt: Respect prop-firm style risk limits.

- Session/News/Spread Filters: Trade where execution quality is best.

- Clean On-Chart Panel: See trend status, ADX, open risk, and today’s P/L.

How the Strategy Flows (Step-by-Step)

Scan Trend: ADX/ADXR ≥ threshold (e.g., 22). Direction = EMA slope or higher-TF filter.

Wait for Pullback: Price retraces toward/through the 20 EMA without violating your max pullback depth (ATR-scaled).

Trigger: Candle closes back in trend direction (e.g., bullish close above EMA in an uptrend).

Order Placement:

SL: Below recent swing/ATR multiple.

TP: Fixed R targets or ATR bands; optional partial at 1R, runner trails.

Manage: Move to breakeven at 1R; trail behind EMA or swing lows/highs; flatten before news if enabled.

Recommended Presets (Start Here)

1) Conservative (EURUSD/GBPUSD, M15–H1)

- ADX Min: 25

- EMA Period: 20 (EMA type)

- SL: 1.5 × ATR(14)

- TP: 1.8–2.5R (partial 50% at 1R)

- Risk/Trade: 0.5%

- Session: London + first half of NY

- Daily DD Halt: 2–3%

2) Balanced (Majors + Gold, M15/H1)

- ADX Min: 22

- EMA Period: 20 (EMA)

- SL: 1.3 × ATR(14)

- TP: 2R target + trail behind EMA

- Risk/Trade: 0.75%

- News Pause: Medium/high impact

- Daily DD Halt: 3–4%

3) Aggressive (Advanced, M5–M15)

- ADX Min: 18–20

- EMA Period: 18–20

- SL: 1.0–1.2 × ATR(14)

- TP: 1.2–1.8R with tight trail

- Risk/Trade: 1% (max)

- Scale-in: Allowed on second pullback if ADX rising

Gold (XAUUSD) Tips:

Widen stops a touch (ATR-based), consider ADX ≥ 25, and prefer the London/NY overlap. Gold moves fast; don’t chase late entries.

Suggested Pairs & Timeframes

- Pairs: EURUSD, GBPUSD, USDJPY for smooth behavior; add XAUUSD after calibration.

- Timeframes: M15/H1 is the sweet spot for most users; H4 for swings; M5 only if you know your feed well.

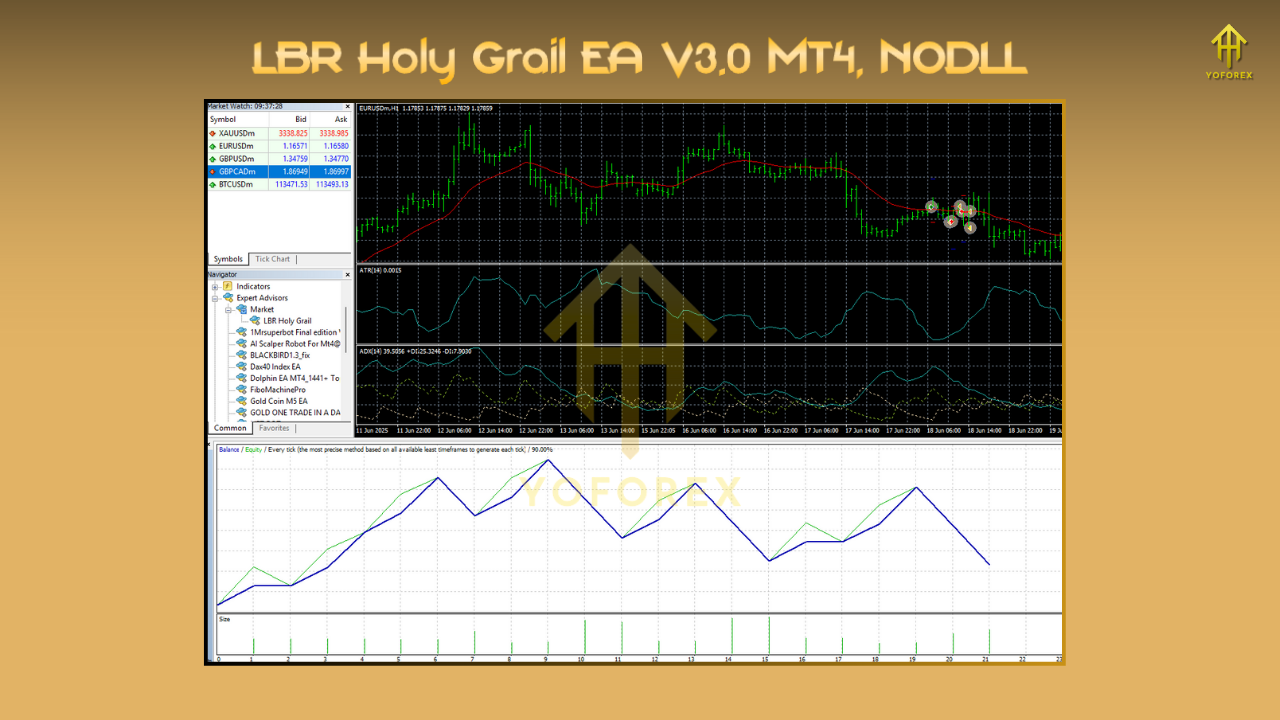

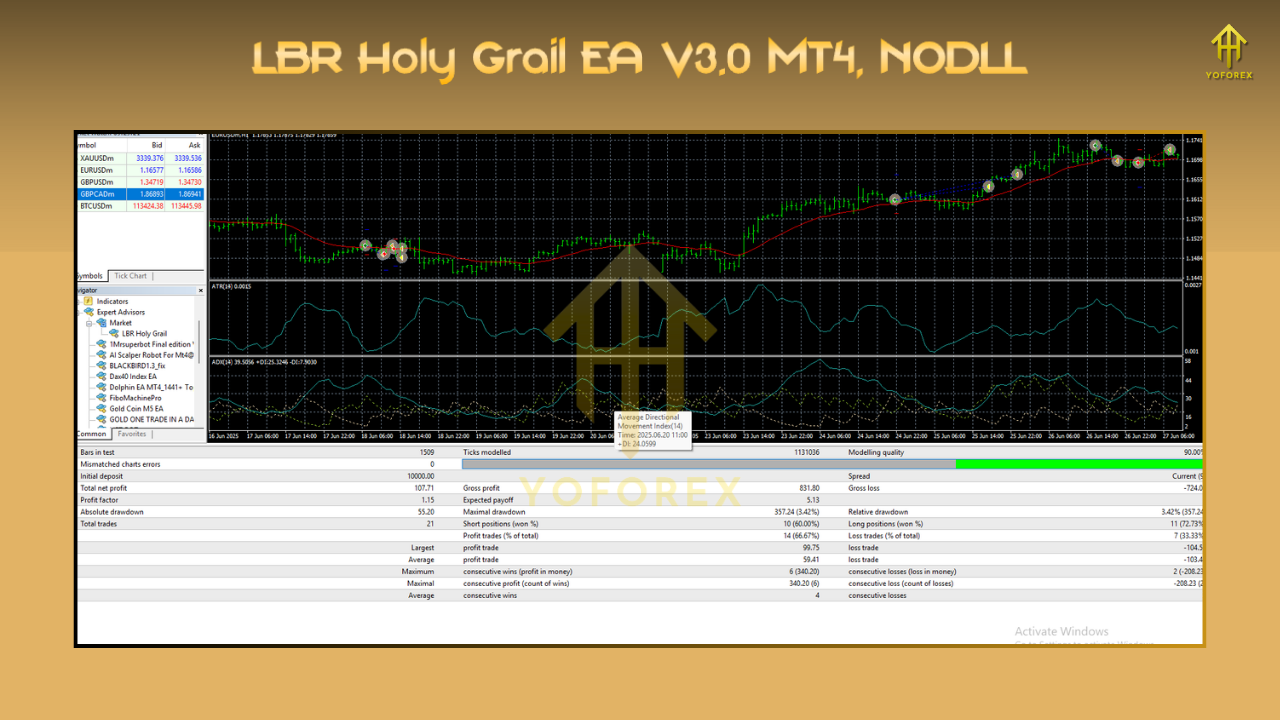

- Backtesting & Forward Testing Guide

- Modeling: Use high-quality tick data; set realistic spreads and commissions.

- Walk-Forward: Backtest last 2–3 years, then forward test live demo for 3–4 weeks.

- Metrics to Track: Win rate by session, avg R multiple, consecutive losses, and time-in-trade.

- Tuning: If you see many BE stops, loosen breakeven threshold or widen SL slightly with ATR. If late entries hurt R:R, tighten the trigger (e.g., require stronger close).

Installation (MT4)

- Download the EA file (

.ex4/.mq4). - MT4 → File → Open Data Folder → MQL4 → Experts → paste file.

- Restart MT4 or right-click Experts → Refresh.

- Attach LBR Holy Grail EA V3.0 to your chart.

- On Inputs, select your preset (Conservative/Balanced/Aggressive).

- Ensure AutoTrading is ON; enable notifications if you want mobile alerts.

Pro Tips for Cleaner Results

- Trade With Trend: Skip counter-trend dips in weak ADX; they’re range traps.

- Don’t Over-Optimize: Favor robust defaults across symbols over curve-fitting.

- Risk Small (always): 0.5–1% per trade, stop for the day after 2–3 losses.

- Journal: Note ADX reading at entry, distance from EMA, and session—patterns will jump out.

- Avoid News Landmines: A great setup can still slip on NFP/CPI; the news pause exists for a reason.

Pros & Cons

- Clear logic: trend filter + EMA pullback

- Non-martingale core; risk tools built-in

- Session, spread, and news controls for execution quality

- Works on majors; adaptable to gold with care

- Presets make it fast to deploy

- ADX lag: You’ll miss the very first push (by design)

- Over-tight stops can get nicked; ATR sizing helps

- Not a “set-and-forget forever” bot—review weekly and tune lightly

FAQs

Does the EA use martingale or grid?

No by default. You can enable measured scale-ins (non-martingale) if you understand the risk.

What’s a good minimum deposit?

For majors with conservative risk, $300–$500 is workable; for gold, $1,000+ is safer. Leverage 1:100–1:500, quality ECN spreads.

Is it prop-firm friendly?

Yes, if hedging isn’t required. Respect daily DD limits—use the daily halt feature.

Best timeframe to start?

M15 or H1 on EURUSD/GBPUSD. Once comfortable, extend to USDJPY and XAUUSD.

Do I need a VPS?

Strongly recommended to maintain connectivity and tight execution 24/5.

Risk Disclaimer

Forex/CFD trading carries significant risk. Past performance does not guarantee future results. Always test on a demo account, use strict risk controls, and only trade funds you can afford to lose.

Call to Action

If you love the logic of trend + pullback but want robot-level consistency, LBR Holy Grail EA V3.0 MT4 is a sharp addition to your toolkit. Start with the Conservative preset on a demo for 2–4 weeks, review your stats, then scale carefully. Consistency first; size comes later.

Comments

Leave a Comment